Revvity (RVTY) Q1 Earnings and Revenues Surpass Estimates

Revvity, Inc. RVTY reported first-quarter 2024 adjusted earnings per share (EPS) of 98 cents, which beat the Zacks Consensus Estimate of 94 cents by 4.3%. However, the bottom line declined 2.9% from the year-ago quarter’s level.

GAAP EPS from continuing operations was 23 cents compared with 20 cents in the prior-year period. However, GAAP EPS was 21 cents, which includes a loss of 2 cents per share from discontinued operations.

Price Performance

RVTY’s shares have gained 23.7% in the past six months compared with the industry's growth of 17.9%. The S&P 500 Index has increased 23.1% in the same period.

Image Source: Zacks Investment Research

Revenue Details

Based in Waltham, MA, this leading MedTech company reported revenues of $649.9 million, down 4% year over year and 3% organically. However, the top line beat the Zacks Consensus Estimate by 0.4%.

Segmental Details

Revvity reports under two operating segments — Life Sciences and Diagnostics.

Life Sciences

Revenues from this segment totaled $303 million, indicating a decrease of 7.8% from the year-ago quarter’s level. Organically, the segment witnessed a decline of 8%.

Adjusted operating income amounted to $101.7 million, down 21.5% from that recorded in the prior-year quarter.

Diagnostics

This segment’s revenues totaled $347.1 million, up 0.1% on a year-over-year basis. Organically, the top line increased 1%.

Adjusted operating income amounted to $75.4 million, up 1.3% from the year-ago quarter’s figure.

Margin Analysis

Selling, general and administrative expenses totaled $260.6 million, up 4.8% year over year. Research and development expenses amounted to $50.4 million, down 11.2% from the year-ago quarter’s reported number.

Adjusted operating income declined 12.4% to $165.8 million from the year-ago quarter’s level. Adjusted operating margin, as a percentage of revenues, was 25.5%, contracting 250 basis points.

Financial Update

The company exited the first quarter of 2024 with cash and cash equivalents of $1.70 billion compared with $1.60 billion in the prior quarter.

Net cash provided by operating activities, including discontinued operations, totaled $147.6 million compared with net cash provided by operating activities of $63.5 million in the year-ago quarter.

2024 Guidance

Revvity updated its earnings and revenue guidance for 2024.

For 2024, the company expects its adjusted EPS in the range of $4.55-$4.75. Revenues are anticipated to be in the band of $2.76-$2.82 billion. The Zacks Consensus Estimate for EPS and sales is pegged at $4.65 per share and $2.82 billion, respectively.

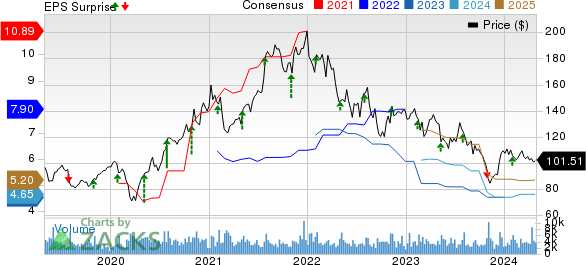

Revvity Inc. Price, Consensus and EPS Surprise

Revvity Inc. price-consensus-eps-surprise-chart | Revvity Inc. Quote

Zacks Rank & Stocks to Consider

RVTY carries a Zacks Rank #4 (Sell) at present.

Some better-ranked stocks in the broader medical space are Align Technologies, Inc. ALGN, Becton, Dickinson and Company BDX, popularly known as BD, and Ecolab Inc. ECL.

Align Technologies, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 9.4%. ALGN’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 5.9%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ALGN’s shares have lost 2.2% compared with the industry’s 3.4% rise in the past year.

BD, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 9.4%. BDX’s earnings surpassed estimates in three of the trailing four quarters and broke even once, with the average being 4.6%.

BD has lost 11.1% against the industry’s 4.9% rise in the past year.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.3%. ECL’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 1.7%.

Ecolab’s shares have rallied 33.8% against the industry’s 9.3% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Revvity Inc. (RVTY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance