Rexnord (RXN) Q2 Earnings Surpass Estimates, Revenues Miss

Rexnord Corporation RXN reported better-than-expected earnings for the second quarter of fiscal 2020 (ended Sep 30, 2019). It pulled off a positive earnings surprise of 8.5%.

This machinery company’s adjusted earnings were 51 cents per share, surpassing the Zacks Consensus Estimate of 47 cents. Also, the bottom line jumped 10.9% from the year-ago quarter number of 46 cents on benefits from buyouts and margin improvement.

Inside the Headlines

In the reported quarter, Rexnord’s net sales were $521.3 million, decreasing 0.7% year over year. The improvement was driven by 1% contribution from net positive impact of acquisitions/divestitures, partially offset by 2% adverse impact of foreign currency translation. The company’s net sales lagged the Zacks Consensus Estimate of $526 million by 0.9%.

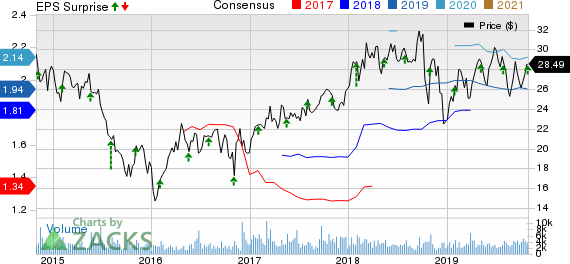

Rexnord Corporation Price, Consensus and EPS Surprise

Rexnord Corporation price-consensus-eps-surprise-chart | Rexnord Corporation Quote

The company reports results under two segments — Process & Motion Control, and Water Management. The quarterly segmental results are briefly discussed below:

Revenues from Process & Motion Control totaled $337 million, decreasing 3% year over year. It represented 64.6% of net sales. Core sales fell 2% due to weak demand across some of its industrial process end markets and the impact of the company’s ongoing product line simplification actions. The acquisition of Centa Power added 1% to sales growth while unfavorable movements in foreign currencies negatively impacted results by 2%.

Water Management revenues, representing 35.4% of net sales, were $184.3 million, up 5% year over year. Core sales in the quarter grew 4% backed by demand growth in building construction markets in North America. However, product line simplification actions played spoilsport in the quarter.

Margin Profile

In the reported quarter, Rexnord’s cost of sales decreased 2.6% year over year to $313.1 million. It represented 60.1% of net sales compared with 61.3% recorded in the year-ago quarter. Gross margin increased 120 basis points (bps) to 39.9%. Selling, general and administrative expenses of $108.8 million decreased 0.7% and represented 20.9% of net sales compared with 20.9% a year ago.

Adjusted earnings before interest, tax, depreciation and amortization (EBITDA) were $118.2 million, up 2.6% year over year. Adjusted EBITDA margin was 22.7%, up roughly 80 bps. For Process & Motion Control, adjusted EBITDA margin increased 70 bps to 23% while that for Water Management expanded 30 bps to 27.4%.

Adjusted tax rate in the quarter was 25.6%, down from 27% in the year-ago quarter.

Balance Sheet and Cash Flow

Exiting the fiscal second quarter, Rexnord had cash and cash equivalents of $319.8 million, reflecting a 9.3% increase from $292.5 million in the last reported quarter. Long-term debt increased 1% to $1,249.3 million from calendar year 2018 end. Notably, the company repaid $5.4 million of debt in the first six months of fiscal 2020.

In the first six months of fiscal 2020, it generated net cash of $86.3 million from operating activities, reflecting 14.9% year-over-year growth. It decreased the capital investment for purchasing property, plant and equipment by 25% from the previous year to $13.2 million. Free cash flow was $73.1 million, increasing 27.1% from the year-ago figure.

Outlook

For fiscal 2020, Process & Motion Control is likely to benefit from strengthening demand in global process industries and global commercial aerospace end markets. The industrial distribution business in the United States and Canada will probably grow as well.

Sales in Water Management are likely to gain from a solid product portfolio and healthy demand from non-residential construction markets of the United States and Canada, especially from institutional clients.

For fiscal 2020, the company maintained its projections, with core sales expected to grow in low-single digit. Product line simplification initiatives are predicted to have an adverse impact of 150-200 bps on sales.

Adjusted EBITDA guidance is expected to be in the range of $460-$467 million compared with $460-$475 million guided earlier. Net income from continuing operations is likely to be $184-$189 million compared with the previously estimated $181-$191 million. The effective tax rate is expected to be roughly 26%.

Capital expenditure is anticipated to be below 2.5% of sales. Free cash will exceed net income. Interest expenses are predicted to be approximately $62 million, down from the previously stated $65 million.

Zacks Rank & Key Picks

Rexnord currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same space are Cimpress N.V CMPR, Brady Corporation BRC and Dover Corporation DOV. While Cimpress sports a Zacks Rank #1 (Strong Buy), Brady and Dover carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cimpress’ earnings surprise in the last reported quarter was a positive 137.04%.

Brady delivered average positive earnings surprise of 9.68% in the trailing four quarters.

Dover pulled off average positive earnings surprise of 6.70% in the trailing four quarters.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Rexnord Corporation (RXN) : Free Stock Analysis Report

Dover Corporation (DOV) : Free Stock Analysis Report

Cimpress N.V (CMPR) : Free Stock Analysis Report

Brady Corporation (BRC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance