RingCentral Expands Client Base: Should Investors Buy the Stock?

RingCentral RNG shares have declined 18.3% year to date compared with the Zacks Computer & Technology sector’s rise of 12.6%. The underperformance can be attributed to the challenging macroeconomic conditions, unfavorable forex and stiff competition.

However, RingCentral’s expanding partner base is expected to boost its prospects. It recently partnered with Zayo, a major communications infrastructure provider, to launch Zayo UC+ with RingCentral.

This new offering integrates RingCentral’s AI-driven, cloud-based Unified Communications as a Service (UCaaS) solution with Zayo’s extensive network infrastructure, delivering an all-in-one platform for voice, video, messaging and contact center services.

Designed to enhance workforce productivity and elevate customer experiences, Zayo UC+ with RingCentral provides secure, customizable workflows and actionable AI-powered capabilities, supporting seamless communication across multiple channels.

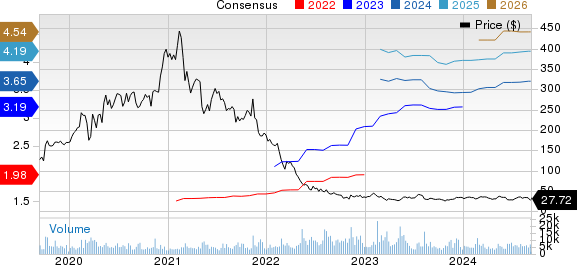

Ringcentral, Inc. Price and Consensus

Ringcentral, Inc. price-consensus-chart | Ringcentral, Inc. Quote

However, does RNG’s strong portfolio make it worth buying despite a weak price performance? Let’s analyze the fundamental drivers, or lack of any.

RNG’s Prospects Ride on Strong AI Prowess

RNG’s focus on adding AI-supported features to its platforms is a key catalyst. It is constantly riding on solid demand for UCaaS and contact center software-as-a-service (SaaS) solutions.

Strong momentum across the enterprise segment is an upside. In the second quarter of 2024, RingCentral saw continued strength in its UCaaS business. Enterprise business grew double-digit on a year-over-year basis. RNG closed roughly 20 deals with more than $1 million total contract value (TCV). The average TCV of large deals grew 30% year over year.

RingCentral is benefiting from an expanding partner base that includes the likes of Cox Communications, Vodafone VOD, ServiceNow NOW and Microsoft MSFT.

RNG announced an expanded strategic partnership with Vodafone Business to offer Vodafone Business Contact Center with RingCentral, powered by RingCX, extending to 30 markets by early 2025.

In the second quarter, RingCentral’s AI-powered contact center, RingCX, secured a top 25 U.S. county as a client and added more than 300 new features, including integrations with ServiceNow, HubSpot and Microsoft Teams.

RingCentral’s increasing international presence is noteworthy. Its solutions are getting adopted in the Europe and Asia Pacific region.

RNG’s Q3 Guidance Positive

RingCentral’s robust portfolio and expanding partner base are contributing to its growth prospects continuously, driving top-line growth.

For the third quarter of 2024, RingCentral expects revenues between $600.5 million and $603.5 million, indicating year-over-year growth of 8%.

The Zacks Consensus Estimate for third-quarter 2024 revenues is currently pegged at $601.9 million, suggesting 7.84% growth over the figure reported in the year-ago quarter.

The consensus mark for earnings is currently pegged at 92 cents, unchanged over the past 30 days, indicating 17.95% year-over-year growth.

Here’s What Investors Should do With RNG Stock

RingCentral is an attractive stock for investors looking for growth due to its initiatives to leverage. It has a Growth Score of A.

With a Valuation Score of A, the stock appears to be undervalued at present. The forward 12-month Price/Sales ratio for RNG stands at 1.12, significantly below the industry average of 3.08.

RingCentral currently carries Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Vodafone Group PLC (VOD) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

Ringcentral, Inc. (RNG) : Free Stock Analysis Report