Rio Tinto pledges to weather ‘volatility’ as it unveils bumper payout for investors

Metal prices are likely to remain volatile for the rest of year, the boss of mining group Rio Tinto has warned, while promising investors the company can keep delivering healthy returns.

The FTSE 100 miner has benefitted from a recovery in the price of iron ore, the steelmaking ingredient that makes up the bulk of its earnings and which it mines in vast quantities in Western Australia, for sale largely to China.

Jean-Sébastien ‘J-S’ Jacques, chief executive, said “underlying demand” from China remained strong but it was hard to know if structural changes to the country’s steel industry would affect prices.

“There will be some volatility, I have no doubt,” he said. “But do I worry about volatility? No. Whatever is thrown at you, you should be able to make cash and make returns to shareholders. We have a strong portfolio of assets and a strong balance sheet.”

Unveiling its results for the first half of year, Rio rewarded investors with payouts totalling $2.5bn (£1.9bn), including an interim dividend of 110 US cents per share, equivalent to $2bn - a record for the company.

The Anglo Australian miner will also double its current $500m share buyback scheme, so that it will have acquired $1bn of its own shares by the end of 2017.

The payouts draw a definitive line under the two-year downturn that blighted the mining industry between 2014 and 2015.

Mr Jacques admitted Rio had benefitted from higher prices, but also pointed to a scheme to save $2bn in costs, which it has completed six months ahead of schedule.

This helped Rio pay down net debt by $2bn, to $7.6bn, in the six months to June 30. Pre-tax profits jumped 57pc to $4.96bn, while revenue climbed nearly 20pc to $19.3bn.

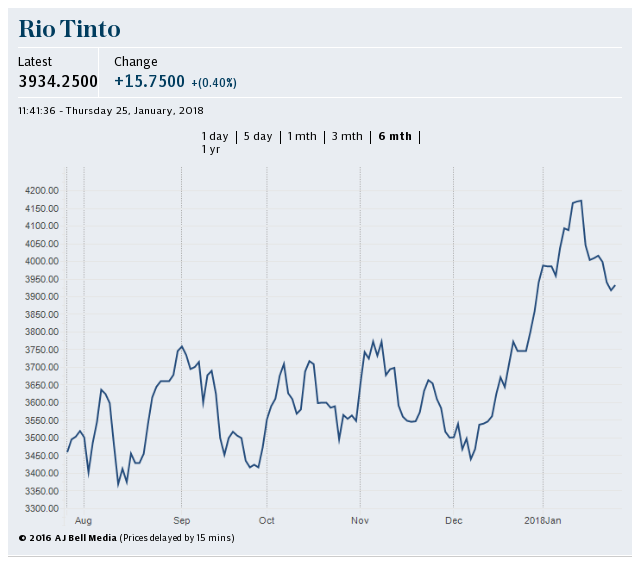

However Rio’s shares in London were down 3pc to £33.93 in afternoon trade after its earnings before interest, tax, depreciation and amortisation - a figure closely watched by analysts - fell slightly short of expectations at $9bn.

Mr Jacques said: “I don’t believe it’s a miss at all”, citing a handful of one-off setbacks that had dented the first-half performance, such as a strike at a copper mine in Chile that Rio co-owns with BHP Billiton.

The chief executive denied that Rio was returning cash to shareholders in lieu of better ideas, pointing out it has projects under way to expand its production of copper, iron ore and bauxite, used in aluminium.

“For us there is plenty of growth [ahead] but it’s all about delivery. We would rather progress fewer projects but do them in the right way than pursue lots of projects and deliver them in an average way,” Mr Jacques said.

Rio investors could be in line for another cash bonanza later this year, once the company banks cash from the $2.7bn sale of its coal mines in Australia to Yancoal. The Chinese-backed company announced earlier this week it had begun an equity raise to fund the transaction, which Rio hopes will complete in September.

Paul Gait, an analyst at Bernstein with a 'buy' recommendation on the stock, said: "Rio is a cash machine."

Yahoo Finance

Yahoo Finance