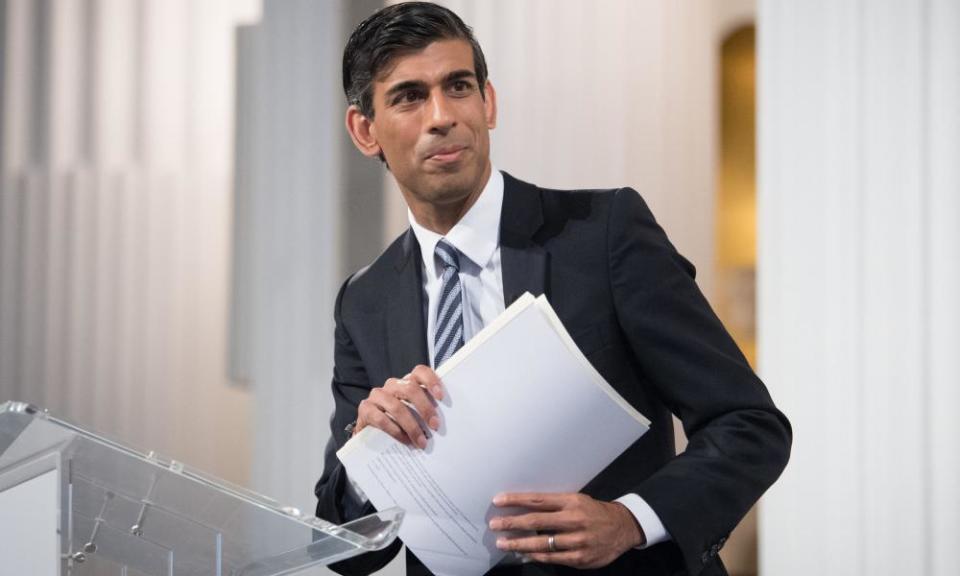

Rishi Sunak has been running the economy on autopilot but needs to change course

England is on the move. Despite rising infections and the race between coronavirus vaccines and variants back in full swing, there has been a distinct shift in tone from ministers over the past week about the English exit from pandemic restrictions.

For several weeks the government has been watching and waiting, poring over Covid-19 data in the hope the link between infections, hospitalisations and deaths has been broken by the vaccination programme. So far, the news is encouraging despite rising concern as the Delta variant drives a fresh wave in the pandemic.

For the economy it has been a similar story, with Rishi Sunak maintaining a watching brief to gauge how businesses and households responded to the easing of lockdown this spring before weighing up how best to respond. So far, the chancellor has bet that the end of lockdown restrictions will allow him to scale back emergency Covid economic support.

In a pre-programmed fiscal tightening, furlough is being scaled back and tax breaks brought to an end. But how wise is it to run the economy on autopilot as the ground of the pandemic shifts? With measures last updated in March, there is a danger Sunak could find forecasts for a post-pandemic boom in consumer spending turn out to be far more muted in reality.

At the heart of the issue here is a contradiction. Four months ago when Boris Johnson set out his roadmap for exiting lockdown, expectations were for vaccinations to bring an end to the crisis once and for all, in a return to normality. However, ministers now believe the public must “learn to live with Covid” and exercise more personal responsibility.

For now, the government still appears to be betting that looser restrictions will prove just the tonic for struggling businesses, as emergency support is cut back. Though business leaders are pushing for a more relaxed approach, there are plenty of reasons why life without masks is not the only ingredient for an economy unleashed.

The signs are already emerging. After a springtime resurgence in the economy, activity has slowed over recent weeks.

Credit and debit card spending data collected by the Bank of England shows a steady decline in spending from a peak in early May, with a drop of 12% in aggregate transactions. Overall, spending is still 93% of its February 2020 levels.

Further growth in infections will put the recovery on the back foot, regardless of whether restrictions are relaxed

Whether this is a reflection of increased consumer caution as rising Covid-19 infections return, it is too early to tell. Life continues to go on, and the easing of lockdown restrictions could provide a further welcome boost for businesses.

But it is a reminder that forecasts for a sustained explosion of summertime consumption were a false prophecy. Further growth in infections will put the recovery on the back foot, regardless of whether restrictions are relaxed.

Research from the International Monetary Fund suggests most of the economic impact from the first wave of Covid-19 last year was caused by voluntary physical distancing, as people chose not to go out to restaurants, pubs and shops when the chance of catching the disease was particularly high.

There are lessons here from Sweden, which has used relatively light-touch Covid restrictions and relied more on personal discretion. While Sweden’s economy suffered less than most of its peers, the country’s 2020 recession was still among the most severe in its modern history.

Back in April last year, academics found consumer spending fell by only four percentage points less in Sweden than in Denmark despite much tougher restrictions for its near neighbour.

Vaccines may alter this story, if confidence is maintained that there are few dangers from leaving home to head down the shops, to the pub or on holiday. But at present much caution still remains. According to early snapshots of activity in June, visits to high streets, shopping centres and retail parks are falling once more in the north of England – where Covid-19 infection rates are higher – in a potential sign of growing consumer caution.

Higher rates of infection mean more people are requiring to self-isolate to limit the spread of the disease, with almost half a million people instructed to quarantine by the NHS Covid-19 app or test-and-trace staff last week. With rising infections, this figure could increase steadily higher still.

Johnson is, however, expected to move the goalposts for isolation rules this week, according to Sunday newspapers, with plans to end the requirement for people to scan a QR code when entering a pub, bar, restaurant or other venue. But a smooth transition is unlikely if infection rates keep rising.

Hospitality firms could find themselves not technically being limited by government restrictions but still being forced into closure if too many staff members become sick or need to self-isolate, at a time when many are already struggling with a nationwide shortage of workers.

Meanwhile, there is no specific government support available for businesses, at a time when furlough is being scaled back and will be removed entirely by the end of September.

While pandemic controls are expected to be relaxed, the story is quite different for international measures, where countries across Europe are increasingly stepping up border controls and using travel bans to limit the spread of Covid variants. This will maintain the pressure on company supply chains while travel companies will have yet another summer holiday season to forget.

In the hard yards that will make up the end of the pandemic, and if the country must learn to live with Covid-19, Britain’s economy is unlikely to find itself in a comparable position to pre-crisis normality.

Given these developments, betting that the removal of restrictions alone will boost the British economy back to full health is not an action plan. Sunak’s watch-and-wait approach from No 11 will need to be jettisoned soon.

Yahoo Finance

Yahoo Finance