Risks To Shareholder Returns Are Elevated At These Prices For Pressure Technologies plc (LON:PRES)

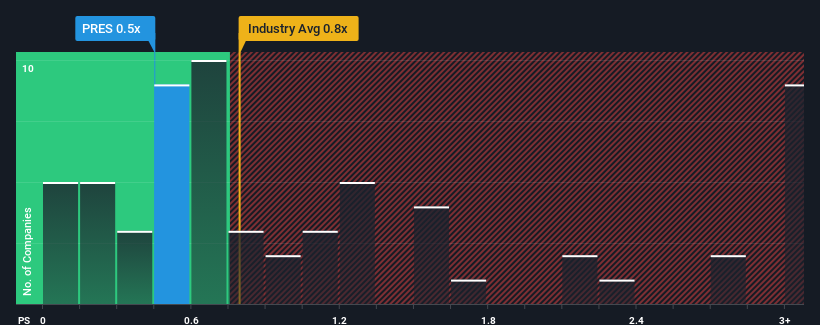

With a median price-to-sales (or "P/S") ratio of close to 0.7x in the Energy Services industry in the United Kingdom, you could be forgiven for feeling indifferent about Pressure Technologies plc's (LON:PRES) P/S ratio of 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Pressure Technologies

How Has Pressure Technologies Performed Recently?

With revenue growth that's superior to most other companies of late, Pressure Technologies has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Pressure Technologies' future stacks up against the industry? In that case, our free report is a great place to start.

What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Pressure Technologies' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 44% gain to the company's top line. The latest three year period has also seen a 5.4% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 7.9% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 18%, which is noticeably more attractive.

With this in mind, we find it intriguing that Pressure Technologies' P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given that Pressure Technologies' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 3 warning signs for Pressure Technologies that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance