RLI Q1 Earnings and Revenues Surpass Estimates, Rise Y/Y

RLI Corp.’s RLI first-quarter 2021 operating earnings of 87 cents per share beat the Zacks Consensus Estimate by 17.6%. Also, the bottom line increased 31.8% from the prior-year quarter.

RLI witnessed improved premiums from Casualty, Surety and Property segments along with improving combined ratio in the reported quarter.

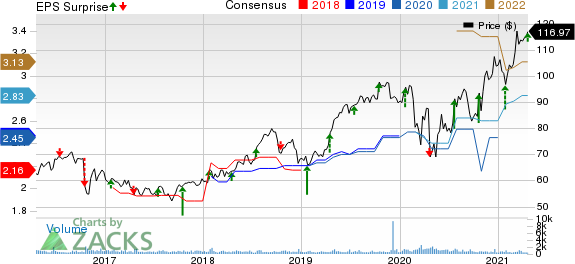

RLI Corp. Price, Consensus and EPS Surprise

RLI Corp. price-consensus-eps-surprise-chart | RLI Corp. Quote

Operational Performance

Operating revenues for the reported quarter totaled $245 million, up 5.2% year over year. This upside can be attributed to higher net premiums earned. Moreover, the top line beat the Zacks Consensus Estimate by 1.2%.

Gross premiums written increased 20% year over year to $294.9 million. This uptick can be attributed to solid performance of Casualty (up 18.6%), Surety (up 5.3%) and Property segments (up 31.4%).

Net investment income decreased nearly 7.6% year over year to $16.4 million.

Total expenses increased 0.9% year over year to $203.9 million, primarily due to increased insurance operating expenses, policy acquisition costs and interest expense on debt.

The company reported underwriting income of $29.9 million, which increased 73.8% from the year-ago period due to solid performance of Casualty segment, partially offset by poor performance of the Property and Surety segments.

Combined ratio improved 510 basis points (bps) year over year to 86.9%.

Financial Update

The company exited the first quarter with total investments and cash of $2.9 billion, up 1.4% from 2020 end.

Book value was $25.55 per share as of Mar 31, 2021, up 1.6% from the figure as of Dec 31, 2020.

Long-term debt was $149.5 million, up 0.03% from 2020 end.

Statutory surplus increased 5.9% to $1.2 billion as of Mar 31, 2021 from the number as of Dec 31, 2020.

Return on equity was 29.5%, reflecting an increase of 2010 basis points year over year.

Net cash flow provided by operations was $60.3 million in the quarter under review compared to net cash flow used in operations of $5.8 million in the year-ago period.

Dividend Update

On Mar 21, the company paid out a cash dividend of 24 cents per share. Dividends totaled $495 million in the last five years. RLI has paid and increased regular dividends for 45 consecutive years.

Zacks Rank

RLI currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Some Other Insurers

The Progressive Corporation’s PGR first-quarter 2021 earnings per share of $1.72 missed the Zacks Consensus Estimate of $1.78.

The Travelers Companies’ TRV first-quarter 2021 earnings per share of $2.73 beat the Zacks Consensus Estimate of $2.44.

W.R. Berkley Corporation’s WRB first-quarter 2021 earnings per share of $1.08 beat the Zacks Consensus Estimate by 21.3%.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

W.R. Berkley Corporation (WRB) : Free Stock Analysis Report

RLI Corp. (RLI) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance