Roblox Short Sellers Retreat After 100% Stock Run

(Bloomberg) -- The stunning rally in Roblox Corp. has forced short sellers to pull back as upbeat investors pile into its stock amid an uptick in users of its video-game platform.

Most Read from Bloomberg

Biden to Unveil Long-Awaited Student Debt Relief Measures on Wednesday

Covid Incubation Gets Shorter With Each New Variant, Study Shows

Apple’s New iPhone 14 to Show India Closing Tech Gap With China

Roblox has almost doubled since mid-May, snapping a six-month losing streak. That’s fueled a retreat by bears who had bet against the stock. Shorts have been reducing their Roblox positions recently, buying 876,000 shares, worth $42 million, over the past 30 days, according to S3 Partners.

While plenty of technology stocks have posted big gains in the market rebound of the past couple of months, Roblox stands out because the company was a poster child of the metaverse frenzy that gripped Wall Street in late 2021. The stock collapsed as investors fled risky assets this year, but now it’s outperforming peers, beating all members of the tech-heavy Nasdaq 100 Index since the benchmark bottomed in June.

That volatility is probably here to stay for a while: Short sellers are still betting that the money-losing company will struggle to build a profitable business any time soon, while backers such as growth-stock guru Cathie Wood’s Ark Investment Management see it as a big player in the metaverse, digital worlds where users can socialize, play games and conduct business.

“There’s obviously a type of war between the long term and the short term,” Gal Munda, an analyst at Wolfe Research, said by phone. He initiated coverage on the stock Wednesday with the equivalent of a hold rating, saying Roblox’s pandemic-driven growth is cooling off and the metaverse is still at least five years away for the company.

Roblox’s platform is aimed at preteens and teenagers, who play games for free on the site. The company earns revenue when users buy Robux, a virtual currency with which they make in-game purchases. But it aims to build a virtual world that features events such as a 50,000-person virtual concert with simulated audio and video.

The company last week reported bookings in the second quarter that missed analyst estimates, yet analysts seized on a rebound in July. At least 14 brokers, including Morgan Stanley, Citigroup Inc. and JPMorgan Chase & Co. raised their stock price targets after the results.

“The market believes that the Q2 miss was a near-term hiccup,” said Tejas Dessai, an analyst at Global X, a manager of exchange-traded funds that counts Roblox as the biggest holding in its video-game and esports ETF. The quarter “had plenty of bright spots,” he said.

While Roblox shares are still down 55% for the year, investors like Wood have continued to pile in. Her ARK Innovation ETF has steadily increased its position, buying about 147,000 shares this month.

That’s added pressure on short sellers, who borrow shares and sell them, hoping to buy them back at a lower price to profit from the difference. When the stock rises, they close out their positions to cap their losses.

“If Roblox’s stock price gets reinvigorated and pushes past March highs, we may see the rally continue in earnest and squeeze even more shorts out of their trades,” according to Ihor Dusaniwsky, managing director of predictive analytics at S3 Partners.

The majority of analysts covering the stock remain bullish on Roblox’s long-term prospects, too, with 15 analysts giving it a buy rating, nine at hold and two saying sell. The San Mateo, California-based company, which went public in March 2021 at $45 a share, is trading around that level on Thursday.

The bearish case is that Roblox may never again see the kind of growth it enjoyed when much of the world was locked down, and the metaverse may turn out to be a fad that fails to live up to the hopes of its boosters. And in the short term, the US may be headed for recession, which would lead to a pullback in consumer spending generally.

“The excitement around the Roblox metaverse will continue to be muted until new technological progress is made,” Munda wrote in his report this week.

Tech Chart of the Day

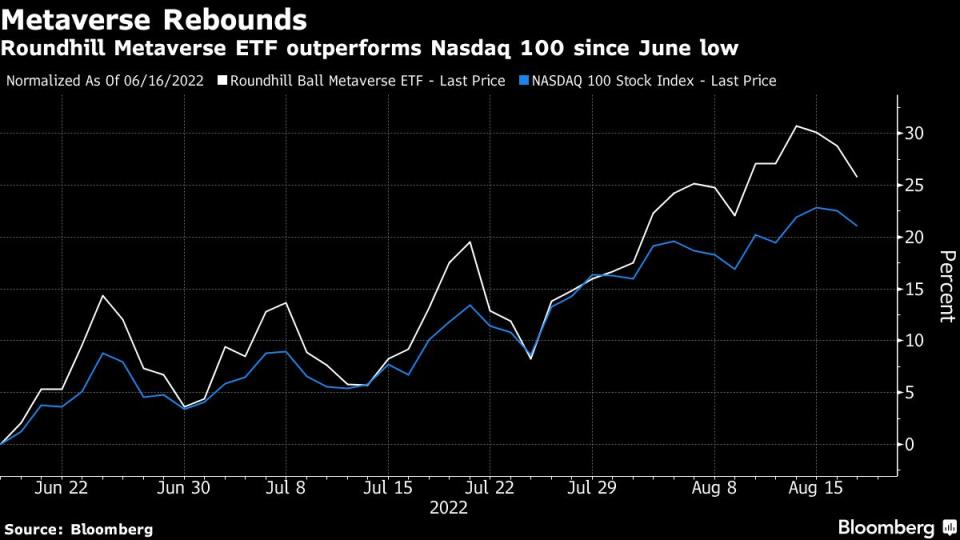

Only four out of the 44 components in the Roundhill Ball Metaverse ETF are down since its June 16 low, with Cloudfare Inc., Roblox and Coinbase Global Inc. leading the pack. The group is up 26% in the period, outperforming the Nasdaq 100’s 21% rise.

Top Tech Stories

China lashed out at a $52 billion program to expand American chipmaking, saying the landmark blueprint contains elements that violate fair market principles and targets Beijing’s own efforts to build a semiconductor industry.

Cisco Systems Inc., the biggest maker of machines that run the internet and corporate computer networks, gave a bullish forecast for quarterly sales as chip supply shortages ease and it’s able to fill more orders.

Renesas Electronics Corp. is exploring the sale of a US unit with military applications, which could fetch as much as $1 billion, according to people familiar with the matter.

Abu Dhabi-based artificial intelligence firm G42, backed by a key member of the oil-rich emirate’s ruling family, is setting up a $10 billion fund with a focus on technology investments in emerging markets.

Singapore’s biggest mobile apps, Grab Holdings Ltd., Delivery Hero SE’s Foodpanda and Deliveroo Plc, have set aside their rivalry to form an unlikely partnership, hoping to strengthen their influence with the local government as it considers laws that could transform the gig economy.

Apple Inc. is aiming to hold a launch event on Sept. 7 to unveil the iPhone 14 line, according to people with knowledge of the matter, rolling out the latest version of a product that generates more than half its sales.

(Adds stock moves)

Most Read from Bloomberg Businessweek

SoftBank’s Epic Losses Reveal Masayoshi Son’s Broken Business Model

Elon Musk’s Many Korean Fans Have Built a $15 Billion Tesla Stake

The $80 Billion IRS Infusion Means More Audits—in 2026 or 2027

A ‘Tsunami of Shutoffs’: 20 Million US Homes Are Behind on Energy Bills

©2022 Bloomberg L.P.

Yahoo Finance

Yahoo Finance