Roche (RHHBY) Reports Upbeat Data on Columvi From STARGLO Study

Roche RHHBY announced positive results from the late-stage STARGLO on the blood cancer drug Columvi (glofitamab).

The STARGLO study is a phase III, multicentre, open-label, randomized study evaluating the efficacy and safety of Columvi, in combination with gemcitabine plus oxaliplatin (GemOx), versus MabThera/Rituxan (rituximab), in combination with GemOx (R-GemOx), in patients with relapsed or refractory (R/R) diffuse large B-cell lymphoma (DLBCL) who have received at least one prior line of therapy and who are not candidates for autologous stem cell transplant, or who have received two or more prior lines of therapy.

This study is intended as a confirmatory study to convert Columvi’s accelerated approval in the United States and conditional marketing authorization in the EU to full approvals for patients with R/R DLBCL after two or more lines of systemic therapy.

The study met its primary endpoint of overall survival with a 41% reduction in the risk of death in R/R DLBCL patients treated with Columvi plus GemOx.

Median OS was not reached with the Columvi regimen versus nine months for R-GemOx. The safety of the combination appeared consistent with the known safety profiles of the individual drugs.

The Columvi combination also achieved its key secondary endpoints with a 63% reduction in risk of disease worsening or death compared to R-GemOx.

A follow-up analysis was conducted after all patients had completed therapy (median follow-up of 20.7 months), which showed continued benefit in both primary and secondary endpoints.

However, adverse event rates were higher with the Columvi combination versus R-GemOx. Roche stated that a higher median number of cycles was received with the Columvi combination.

Results from STARGLO are the first to show the potential of a CD20xCD3 bispecific antibody to make a difference in second or later-line DLBCL in people who are ineligible for transplant and have limited options.

Roche will submit the results from the STARGLO study to global health authorities, including the FDA and the European Medicines Agency.

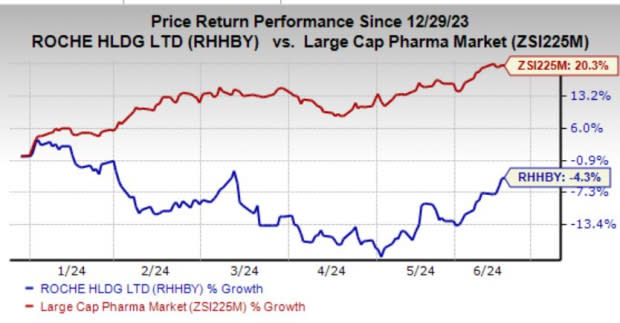

Roche’s shares have lost 4.3% year to date against the industry’s growth of 20.3%.

Image Source: Zacks Investment Research

Per Roche, this Columvi combination could provide a much-needed off-the-shelf treatment option for people with transplant-ineligible R/R DLBCL.

Columvi is also being evaluated in other aggressive, hard-to-treat lymphomas. The FDA recently granted the Breakthrough Therapy Designation to Columvi for the treatment of adult patients with relapsed or refractory mantle cell lymphoma who have received at least two prior therapies based on results from the phase I/II NP30179 study.

Columvi is part of Roche’s broad and industry-leading CD20xCD3 T-cell-engaging bispecific antibody clinical development program that also includes Lunsumio (mosunetuzumab).

Approval of new drugs and label expansion of the existing ones should bode well for Roche in this scenario.

Drugs like Vabysmo, Ocrevus, Hemlibra and Polivy fuel Roche’s top line as the company looks to fill up the dent in revenues caused by a decline in COVID-19-related sales. Competition from biosimilars for established drugs like Avastin, MabThera/Rituxan and Herceptin continues to hurt sales.

Zacks Rank & Stocks to Consider

Roche currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the healthcare sector are Ligand Pharmaceuticals LGND, ALX Oncology Holdings ALXO and Minerva Neurosciences, Inc. NERV, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for Ligand’s 2024 earnings per share (EPS) has increased 16 cents to $4.71. During the same time frame, the consensus estimate for 2025 EPS has increased 70 cents to $5.90. Year to date, shares of LGND have risen 12.1%.

Ligand beat on earnings in each of the trailing four quarters, delivering an average surprise of 56.02%.

In the past 60 days, the Zacks Consensus Estimate for ALX Oncology’s 2024 loss per share has narrowed from $3.33 to $2.89. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.85 to $2.73.

ALX Oncology beat on earnings in two of the trailing four quarters and missed the mark in the other two, delivering an average negative surprise of 8.83%.

In the past 60 days, estimates for Minerva Neurosciences’ 2024 loss per share have narrowed from $3.57 to $1.89. Loss per share estimate for 2025 has narrowed from $4.54 to $3.60 during the same time frame.

NERV’s earnings beat estimates in one of the trailing four quarters and missed the same in the other three, the average negative surprise being 54.43%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Minerva Neurosciences, Inc (NERV) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance