Rogers Corp (ROG) Q1 2024 Earnings: Surpasses Revenue Forecasts, Misses EPS Expectations

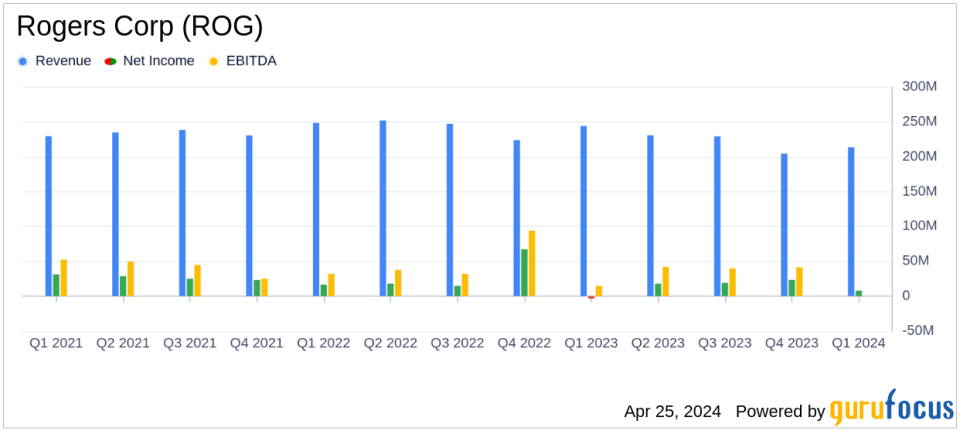

Revenue: Reported $213.4 million, surpassing the estimate of $210.0 million.

Net Income: Achieved $7.8 million, falling short of the estimated $15.5 million.

Earnings Per Share (EPS): Recorded at $0.42, below the estimated $0.55.

Free Cash Flow: Generated $18.7 million, indicating strong cash management.

Gross Margin: Decreased to 32.0% from 32.9% in the previous quarter, reflecting a less favorable product mix.

Adjusted EBITDA: Stood at $28.3 million, with a margin of 13.3%, demonstrating operational efficiency.

Operating Activities: Net cash provided by operating activities was $28.1 million, showing robust operational cash flow.

Rogers Corporation (NYSE:ROG) disclosed its financial outcomes for the first quarter of 2024 on April 25, highlighting a mix of surpassing revenue forecasts while falling short on earnings per share (EPS) expectations. The detailed earnings can be explored through Rogers Corp's 8-K filing. This quarter's performance underscores the company's resilience and strategic adaptability in a fluctuating economic landscape.

Rogers Corporation, a global leader in engineered materials crucial for power, protection, and connectivity applications, operates through segments like Advanced Electronics Solutions and Elastomeric Material Solutions. The company's products are pivotal in various high-tech sectors, including aerospace, automotive, and renewable energy, with significant operations across the United States, China, and Germany.

Financial Performance Overview

For Q1 2024, Rogers Corp reported net sales of $213.4 million, a slight decrease from $243.8 million in the same quarter last year but a notable improvement from $204.6 million in Q4 2023. This performance exceeded the midpoint of the company's guidance, with a significant contribution from the aerospace and defense sectors. However, the reported EPS of $0.42 missed the analyst estimate of $0.55.

Operational Highlights and Challenges

The company's gross margin slightly declined to 32.0% from 32.7% year-over-year, influenced by an unfavorable product mix despite higher sales volumes. Selling, general and administrative expenses saw a reduction, dropping to $47.5 million from $60.1 million in Q1 2023, reflecting decreased professional service fees and compensation costs.

Despite these gains, the GAAP operating margin reduced to 5.5% from a near break-even point last year, primarily due to lower other operating income and a high base effect from a one-time insurance recovery in 2021. Adjusted operating margin, however, showed improvement, rising to 7.5% from 6.3% in the previous quarter.

Strategic Moves and Future Outlook

Colin Gouveia, President and CEO of Rogers Corp, commented on the quarter's results:

"We are encouraged by the improving demand that we saw in the first quarter, which resulted in sales near the top end of our guidance expectations. Aerospace and defense sales were strong in the first quarter and after a prolonged downturn, the outlook for the general industrial market is improving with lower customer inventory levels and positive order trends."

The company anticipates Q2 2024 net sales to be between $210 million and $220 million, with projected EPS ranging from $0.34 to $0.54. This guidance reflects cautious optimism, balancing expected market improvements against ongoing inventory challenges in some sectors.

Conclusion

Rogers Corp's Q1 2024 results demonstrate a robust strategic positioning to leverage market recoveries, particularly in aerospace and defense. However, the EPS shortfall highlights ongoing challenges and the need for continued operational efficiency improvements. Investors and stakeholders will likely watch closely how Rogers navigates the evolving market dynamics in subsequent quarters.

Explore the complete 8-K earnings release (here) from Rogers Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance