Rollins (ROL) Gains 24% in 6 Months: What's Behind the Rally?

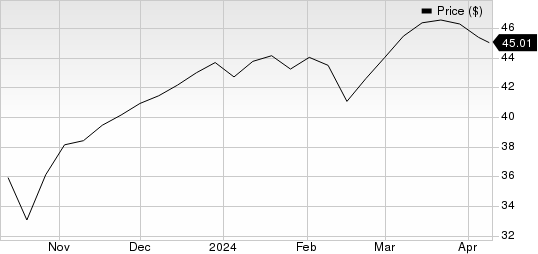

Rollins, Inc. ROL has had an impressive run over the past six months. The stock has gained 24%, outperforming the 21% growth of the industry it belongs to and the 19% rise of the Zacks S&P 500 composite.

Strong Demand and Consistent Dividends are Significant Advantages

Commitment to shareholder returns makes Rollins a reliable way for investors to compound wealth over the long term.The company paid dividends of $264.3 million, $211.6 million and $208.7 million in 2023, 2022 and 2021, respectively.

The demand environment for this leading pest and termite control services provider is currently in good shape across all its business lines. Revenues increased 14% year over year in the third quarter of 2023. Business lines — residential, commercial and termite — registered 17.7%, 10.6% and 13.4% growth, respectively.

Rollins, Inc. Price

Rollins, Inc. price | Rollins, Inc. Quote

Rollins has developed its operating platform in a way that increases cross-selling opportunities and cost efficiency and facilitates swift customer service delivery. The company’s real-time service tracking and customer Internet communication technologies have increased its competitive advantage.

Its proprietary Branch Operating Support System facilitates service tracking and payment processing for technicians and provides virtual route management tools to increase route efficiency across the network, enabling cost reduction and increasing customer retention through quick response service.

Zacks Rank and Stocks to Consider

Rollins currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are AppLovin APP and DocuSign DOCU.

AppLovin flaunts a Zacks Rank #1 (Strong Buy) at present. APP has a long-term earnings growth expectation of 20%. You can see the complete list of today’s Zacks #1 Rank stocks here.

APP delivered a trailing four-quarter earnings surprise of 26.5%, on average.

DocuSign currently carries a Zacks Rank of 2 (Buy). DOCU has a long-term earnings growth expectation of 13.3%.

DOCU delivered a trailing four-quarter earnings surprise of 23.7%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Rollins, Inc. (ROL) : Free Stock Analysis Report

AppLovin Corporation (APP) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance