Rolls-Royce loses £5.4bn in first six months of 2020

Engine maker Rolls-Royce (RR.L) fell to a multi-billion pound loss in the first half of the year, the company said on Thursday.

The manufacturing giant made a pre-tax loss of £5.4bn ($7bn) in the six months to the end of June, hit by £1.1bn in write-offs and impairments, a £2.6bn loss on foreign exchange hedging contracts, and restructuring costs of £366m.

Rolls-Royce made an underlying operating loss of £1.7bn, compared to a profit of £203m in 2019. Revenue slumped 24% to £5.5bn.

READ MORE: Rolls-Royce closes factory as jobs cull continues

“The COVID-19 pandemic has significantly affected our 2020 performance, with an unprecedented impact on the civil aviation sector with flights grounded across the world,” chief executive Warren East said in a statement.

The company warned that the “timing and shape of industry recovery remains uncertain.”

Alongside results, Rolls-Royce announced its chief finance officer would also be leaving the business. Stephen Daintith is taking up the CFO role at Ocado. He will remain with Rolls-Royce for now “to support an orderly transition”.

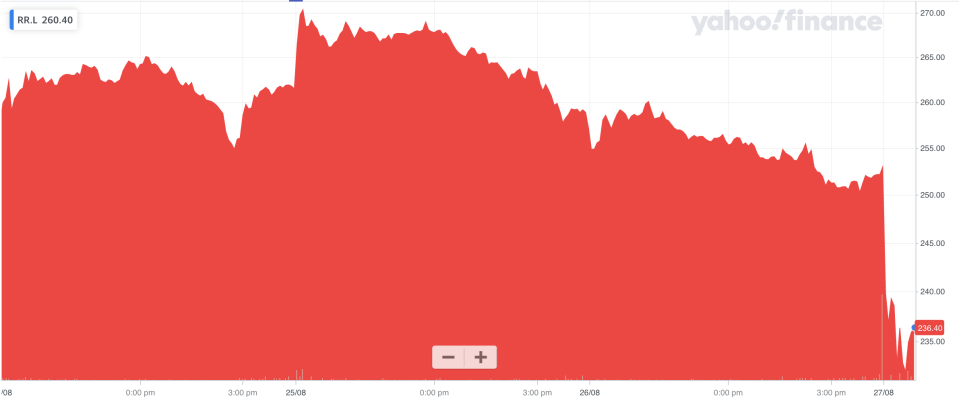

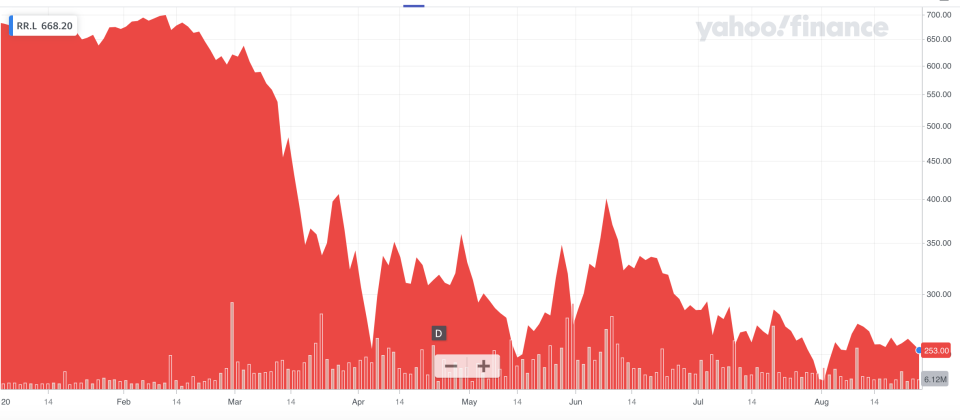

Shares slumped 6.5% in early trade in London.

Rolls-Royce’s revenue has been battered by global air travel bans in the first half of 2020, which have led to collapsing demand for its aircraft engines and for services to its engines already in use. In an update in July, the company said engine flying hours fell 50% in the first six months of the year. Its civil aerospace division lost £1.8bn in the first half of 2020.

READ MORE: Rolls-Royce job cuts a 'body blow' to town where turbojets born

The high fixed costs of Rolls-Royce’s factories have left the company burning cash at an alarmingly fast rate. Rolls-Royce saw cash outflows of £2.8bn in the first six months of the year and it expects to burn through £4bn across 2020.

Rolls-Royce’s chief executive Warren East has been pursuing an aggressive cost cutting strategy in response, aimed at saving over £1bn a year. The company announced plans to cut 9,000 of its 52,000 staff in May and the closure of one of its factories in Nottinghamshire was announced on Wednesday. Rolls-Royce said 4,000 staff members have now left the business since the restructure was annouced.

“These actions will significantly reduce our cost base, which combined with recovery in Power Systems and continued resilience in Defence, will help us to deliver significantly improved returns as the world recovers from the pandemic,” East said.

Rolls-Royce also announced plans to raise £2bn by selling off assets, including its Spanish engine and turbine business ITP Aero.

“All disposals are subject to finding the right buyer and the right price,” East told journalists.

The interim results come “against a backdrop of concerns about its precarious financial position,” Micheal Hewson, chief market analyst at CMC Markets, said ahead of the figures.

Rolls-Royce had net debt of £1.7bn by the end of June, compared to positive cash holdings of £1.4bn at the end of 2019. The company said it expects debt to rise to £3.5bn by the end of this year.

Rolls-Royce had £6.1bn of liquidity in cash and credit facilities at the end of June and the company has since agreed a further £2bn undrawn term loan.

The business said this should give it enough cash to operate for the next 18 months, provided there is no COVID-19 second wave and “a gradual recovery” in air travel begins.

However, in “a severe but plausible downside scenario” the company would only have runway for 12 months and would be forced to raise additional cash. This “could be achieved through some combination of debt, equity and the proceeds from business disposals,” the company said.

“While our actions have helped to secure the Group’s immediate future, we recognise the material uncertainties resulting from COVID-19 and the need to rebuild our balance sheet for the longer term,” East said.

He added Rolls-Royce was also “continuing to assess additional options to strengthen our balance sheet”.

Shares in the company have collapsed over 60% since the start of the year, including a one-day drop of 10% in July after it warned revenue for the next seven years would be lower than forecast due to the pandemic.

Adding to the company’s woes, Rolls-Royce recently disclosed wear and tear on the blades of some of its older Trent XWB engines. The issue evoked memories of the long-running problems with the company’s Trent 1000 engines, which it spent billions of dollars resolving.

Earlier this month activist investor ValueAct, which was once Rolls-Royce’s biggest investor, sold its entire stake in the business after five years as a shareholder.

Listen to the latest podcast from Yahoo Finance UK

Yahoo Finance

Yahoo Finance