Rolls-Royce eyes mini-nuke project in Finland as UK drags its feet

Rolls-Royce could build mini-nuclear reactors in Sweden and Finland under plans being explored by Helsinki's national energy company.

Finnish government-owned utility Fortnum has signed an early stage deal with Rolls-Royce’s nuclear power business to explore uses of its small modular reactors (SMRs) in the two Nordic countries.

Shares in Rolls-Royce jumped over 6pc in London on the news, amid a broader market rally.

The early stage deal comes as Rolls-Royce awaits a UK government decision on whether to buy the reactors, which are smaller and cheaper than full scale plants. Rolls-Royce’s 470MW units cost £1.8bn each.

As well as the Finns, the Czech government is also considering purchasing the technology as part of efforts to decarbonise energy systems.

Despite international interest, Rolls-Royce has warned that deals may collapse unless Britain signals it backs the technology by placing its own orders.

£210m of UK taxpayer funding has already been committed to Rolls-Royce's SMRs but Chancellor Jeremy Hunt recently confirmed that a competitive tender would be run on the projects.

Fortnum is currently assessing a number of nuclear proposals, including new full-size power stations and modular variants that are factory-built and thus theoretically cheaper. An investment decision on chosen projects will be made at a later stage, it said.

Laurent Leveugle, Fortum’s head of newbuild feasibility study, said: “We are especially interested in learning more about Rolls-Royce SMR’s delivery model considering Rolls-Royce’s historical industrial experience.”

Dozens of companies around the world are at various stages in designing mini-nuclear power generators, which range in power from a seventh to less than 1pc of the power of a full-size station.

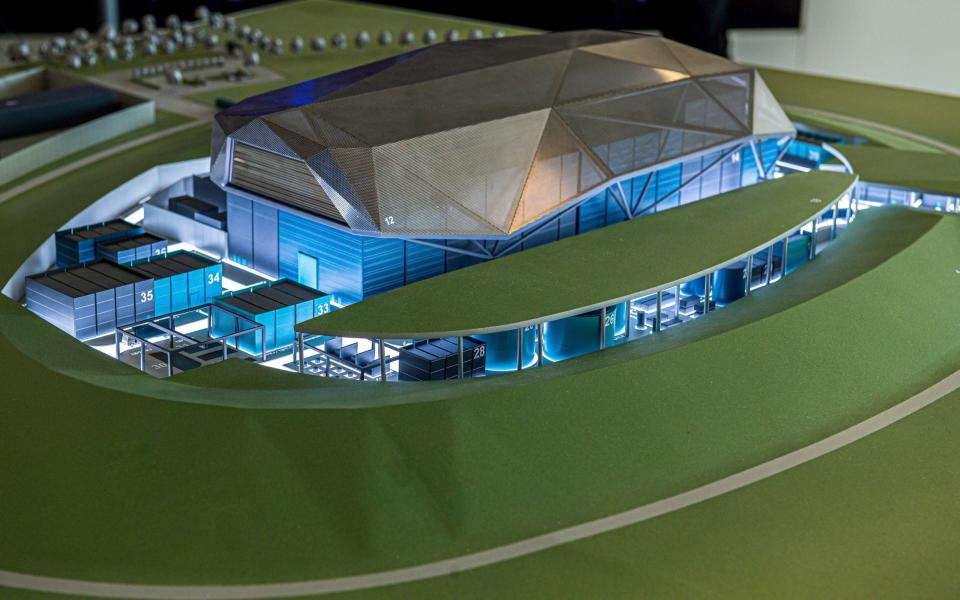

Earlier this week, rival SMR designer Last Energy, which is based in the US, said it signed a deal to sell 24 of its power plants to UK customers. Its £100m modular units, which are two-thirds the size of a football pitch, can output 20MW of electricity, enough to power 40,000 homes. They will be deployed in 2026 with no government funding required.

For heavy energy users with 24-hour operations like steel mills and data centres, nuclear power is attractive because it consistently provides power, compared to wind and solar generation.

Alan Woods of Rolls-Royce SMR said: "The importance of energy security has increased dramatically, and we see our unique approach to nuclear new build - focusing on delivery capability and cost-effectiveness - as the best solution to providing low-carbon energy for generations to come.

"We look forward to working with Fortum during their feasibility study."

In December, GE Hitachi stole a lead on other developers when its BWRX-300 small modular reactor was chosen by Ontario Power Generation in Canada to deploy a reactor by as early as 2028.

Yahoo Finance

Yahoo Finance