Inside Rolls-Royce’s extraordinary British revival

Just weeks into his new job running Rolls-Royce, Tufan Erginbilgiç gathered nervous staff for a meeting at the engineering giant’s headquarters in Derby.

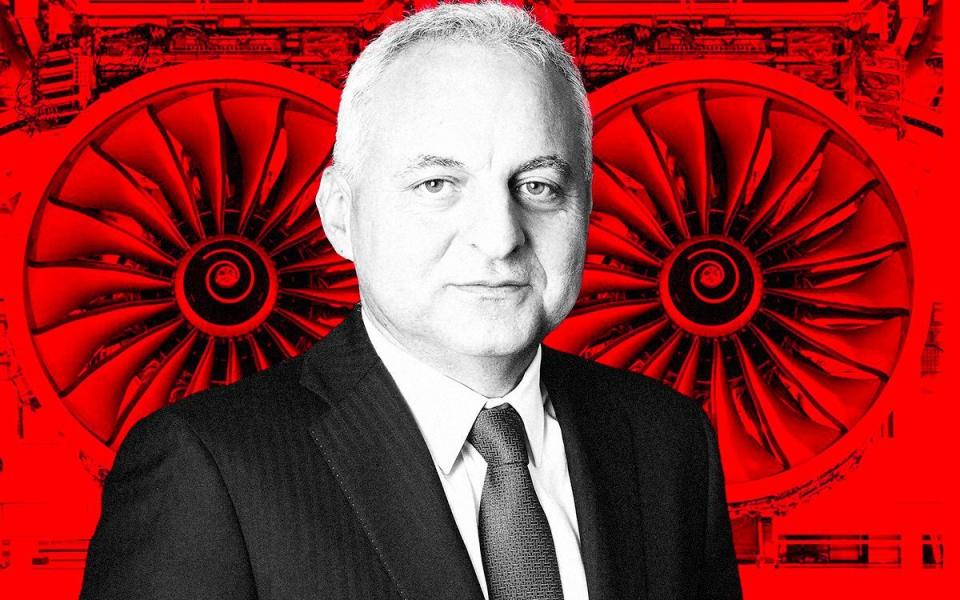

The meticulous Turkish executive had spent the past month studying the FTSE 100 company from all angles and talking to investors who were long past fed up.

Now, he had a characteristically blunt verdict for its 42,000 employees: Rolls was a “burning platform” – and they were all standing on it.

“Given everything I know, this is our last chance,” he warned.

It was a shock and awe tactic that divided opinions, with some critics branding it a “Gerald Ratner approach”, the British jewellery magnate who called his own company’s products “total c---”.

At the company’s annual general meeting a few months later, one angry shareholder berated Erginbilgiç for “destabilising” the business.

Erginbilgiç was unrepentant – and remains so.

“What I was doing with that description was telling people that, actually, they were living in a fake world,” he tells the Telegraph (although he concedes his “burning platform” comment was only ever meant to be heard internally).

“The company effectively was at a point where we couldn’t do anything we wanted to do. And what we could do, frankly, wasn’t a lot.

“I thank everybody who contributed to the history of Rolls-Royce. But we need to talk about some facts here.”

Just over a year on, things look starkly different.

Erginbilgiç, known as “Turbo Tufan” by analysts, is now hailed in the City as a conquering hero – the man who finally got the unwieldy Rolls-Royce machine firing on all cylinders.

The company’s blockbuster annual results in February seemed to confirm as much, with Rolls reporting a doubling of profit margins and record free cash flows.

Rolls’s share price has risen 350pc under Erginbilgiç and the company’s prized “investment grade” status has been restored by credit rating agencies. (A stepping stone, perhaps, towards the return of the dividend following a four-year absence.)

With just over a week to go until 2024’s AGM, Erginbilgiç is unlikely to get the same difficult reception that he did at last year’s meeting.

Both inside the company and externally, the startling turnaround has been credited to the sheer force of Erginbilgiç’s personality and the culture changes he has rammed through since taking control.

“When Tufan arrived he was pretty much unknown,” recalls one analyst. “The first introduction most of us had was when he made the ‘burning platform’ comments.

“And at that point you have to sit up straight, because you realise something is about to change.”

Phil Townley, director of future programmes at Rolls-Royce’s defence campus in Bristol, says: “Tufan demands certain standards and you can see everyone is lifting their game.

“It’s just re-energised people.”

A second analyst adds: “It’s always hard to tell whether people are responding out of inspiration or fear, but there’s no doubt that he has galvanised the workforce.”

While it is best known for making engines for passenger jets, Rolls also makes turbines for fighter jets and warships, nuclear reactors for UK submarines and diesel-burning engines used to power electricity generators, trains and yachts.

It is developing a new generation of small modular reactors – mini-nuclear power stations – that the Government hopes will play a pivotal role in net zero.

The company, worth £36.8bn, is a prized national asset: a central pillar of both Britain’s industrial base and national security. The significance of its revival goes beyond simply the impact on its staff and investors.

However, while few dispute that things have improved under Erginbilgiç, some critics claim he is being given too much credit for the turnaround.

Sir John Rose, who was boss of Rolls from 1996 to 2011, claimed that celebrations of Erginbilgiç’s genius were wildly premature.

“The biggest impact on [2023’s] results is not the new chief executive ... but the actions of his predecessor Warren East, the strong US dollar, the recovery in flying and the strong performance of diesels and defence,” the veteran industrialist sniffed in a letter to a newspaper.

Rolls makes money from the “flying hours” its passenger jet engines notch up. A recovery in the international aviation market – spurred by China’s post-Covid reopening in late 2022 – has therefore had a big impact, completely independent of anything Erginbilgiç has done.

Perhaps unsurprisingly, Erginbilgiç bristles at suggestions he is coasting on the success of others.

“This is my third transformation, right?” the 64-year-old points out. “And what I have seen in all three is the same: after a while, the leadership stops talking about results, so people don’t know whether the company is in a good shape or a bad shape.

“All they know is they delivered their plan and they are getting a bonus, so they think ‘we’re doing well’.”

Erginbilgiç (pronounced “air-gin-bil-gitch”) is a dual Turkish-British citizen who studied engineering and then business administration at university in Istanbul.

He spent much of his career in the oil industry and earned his spurs at BP from 1997 to 2020, rising through the ranks to take charge of the “downstream” business focused on refining, chemicals and petrol stations.

There, the married father-of-two gained a reputation as a ruthless and efficient operator, and at one point worked directly under ex-BP chief executive Tony Hayward as chief of staff.

Hayward, who succeeded Lord Browne in 2007 but resigned in 2010 over the Deepwater Horizon oil spill, has described Erginbilgiç as “one of the very best executives I’ve ever worked with”.

Erginbilgiç ended up leaving BP after missing out on the chief executive role to Bernard Looney in 2020. Instead, he moved into private equity as an adviser at Global Infrastructure Partners.

His appointment as chief executive of Rolls in July 2022, made under chairman Dame Anita Frew, was something of a surprise.

Erginbilgiç has said he was partly attracted to the role by the company’s 119-year history, which famously includes building Merlin engines for Spitfire and Hurricane fighter planes during the Second World War.

However, Rolls had just survived a near-death experience when he arrived. The coronavirus pandemic shut down the aviation market overnight and forced the company to raise billions of pounds in emergency funds from investors.

Even before that the engineering giant had been trying the City’s patience. It had been stuck in turnaround mode – with few tangible results – for the best part of a decade.

Erginbilgiç’s predecessor East – the cool-headed former boss of Cambridge-based chip designer Arm Holdings – was meant to rejuvenate Rolls.

“Warren was brought in to modernise the company. He was supposed to be this kind of technology figure,” explains one senior figure within the company.

Instead, he spent most of his tenure putting out fires, not least the aftermath of a major corruption scandal and problems with the company’s Trent 1000 engines that cost more than £2bn in compensation paid out to airlines.

By the time East departed, Rolls was leaner, having shed around 10,000 staff during the pandemic, but was still viewed as a fixer-upper.

Chief among its problems was the huge difference in profitability between the company and its main competitors, such as General Electric and Pratt & Whitney.

It made less money despite the commanding position Rolls had built supplying engines to widebody planes and smaller business jets.

In widebody – industry jargon for double-aisle planes, including jumbo jets – the company has a market share of almost 40pc, acting as the sole engine supplier for the Airbus A350 and the A330neo and competing with GE to supply engines for the Boeing 787 Dreamliner.

However, Rolls’ civil aviation business, which brings in just under half the group’s revenues, was barely managing a 5pc profit margin – compared to the 20pc enjoyed by some rivals. (Rolls quit the narrow-body market, which is focused on smaller planes such as the Boeing 737, in 2012.)

There were also problems at the company’s Germany-based power systems division, which brought in one quarter of Rolls’ revenues. Erginbilgiç later said he was shocked that revenues had been allowed to go up while margins tumbled, remarking – perhaps rashly – that it had been “grossly mismanaged”.

He also came to the view that Rolls was investing money ineffectively, with its poor record on returns stretching back to before the pandemic.

He tells the Telegraph: “There was no strategy for resource allocation. And it was very decentralised. Everybody came up with whatever [budget] they thought they should spend.

“Now, we have a new process. Anything that doesn’t align with the strategy, we don’t even consider.”

Erginbilgiç has been ruthless in his efforts to knock the business into shape.

He axed back-office roles in human resources, finance and procurement to break the “siloed” fiefdoms of the company’s three main divisions. These functions are now centralised and the businesses must compete for capital.

At the same time, he pooled engineering expertise into one group-wide department, replaced half of the top 100 executives and slashed the company’s supply chain costs.

Most crucially, however, Erginbilgiç dared to do something previous management teams had shied away from: he asked Rolls’ customers for more money.

“Rolls just haven’t wanted to because the received wisdom was that you’d lose market share,” explains an analyst who speaks to Erginbilgiç regularly.

Erginbilgiç, with his direct approach, was less cautious.

“He knows what he wants and when he walks into a room he’ll let you know what that is and how he’s going to get there. He’s just a very tough, hard man,” the analyst adds.

“Warren East, he’s a very nice man on a personal level and I like him a lot, but he’s not a hard man.”

Erginbilgiç was previously described by former BP colleagues as incredibly smart but lacking in “emotional intelligence”.

Rolls’s chief executive now heads an investment committee that vets every new major deal that the company does, and he has successfully renegotiated what were loss-making contracts.

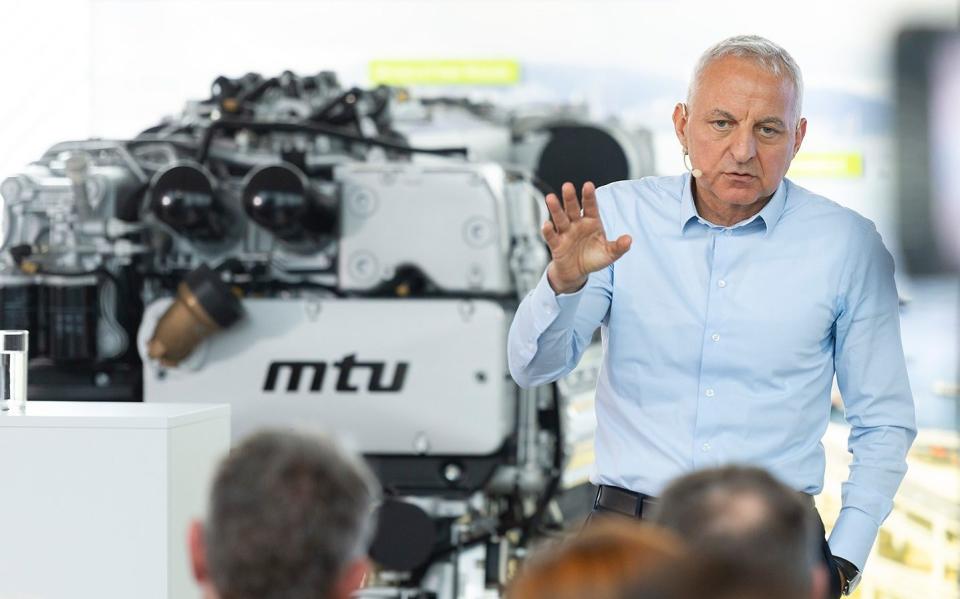

Simon Burr, who was last year elevated to the role of group director for engineering, technology and safety, describes his boss as “extremely focused and direct”.

“Tufan’s focused on objectives, on accountability and doing what we say we are going to do,” he says. “And frankly, I’m very comfortable with that.”

It is this focus on pricing and performance that Erginbilgiç argues has been central to Rolls’s turnaround – not just a revival in air travel.

“I know everybody is focused on civil aviation,” he says. “But we did it across all the divisions. It is not a coincidence that power systems had its best profit delivery [ever] last year.

“When people say ‘Tufan, you are benefiting from flying hours’ – well, power systems doesn’t work that way.”

Be that as it may, the recovery in aviation has certainly helped.

In Erginbilgiç’s first year in charge, the international flying market recovered from 62pc of its pre-pandemic levels to 89pc following the reopening of China.

Erginbilgiç counters that Rolls has already achieved record cash flows without getting back to 100pc of previous traffic.

That said, the chief executive admits the turnaround is far from complete.

“I’m not suggesting we are done, because it’s only been one year and this is a big organisation,” he stresses.

The company has promised profits of between £2.5bn and £2.8bn, on an operating margin of 13pc-15pc, by 2027. That will involve getting margins in civil aviation from 10pc today to 15pc-17pc.

Erginbilgiç has also ordered a £1bn upgrade programme for the company’s Trent 1000, 7000 and XWB engines as part of efforts to reduce their time in maintenance.

It follows complaints about the durability of the XWB in the hotter, dustier conditions of the Middle East, an issue Emirates publicly blamed for its decision to hold off on ordering up to 50 Airbus A350 jets in November.

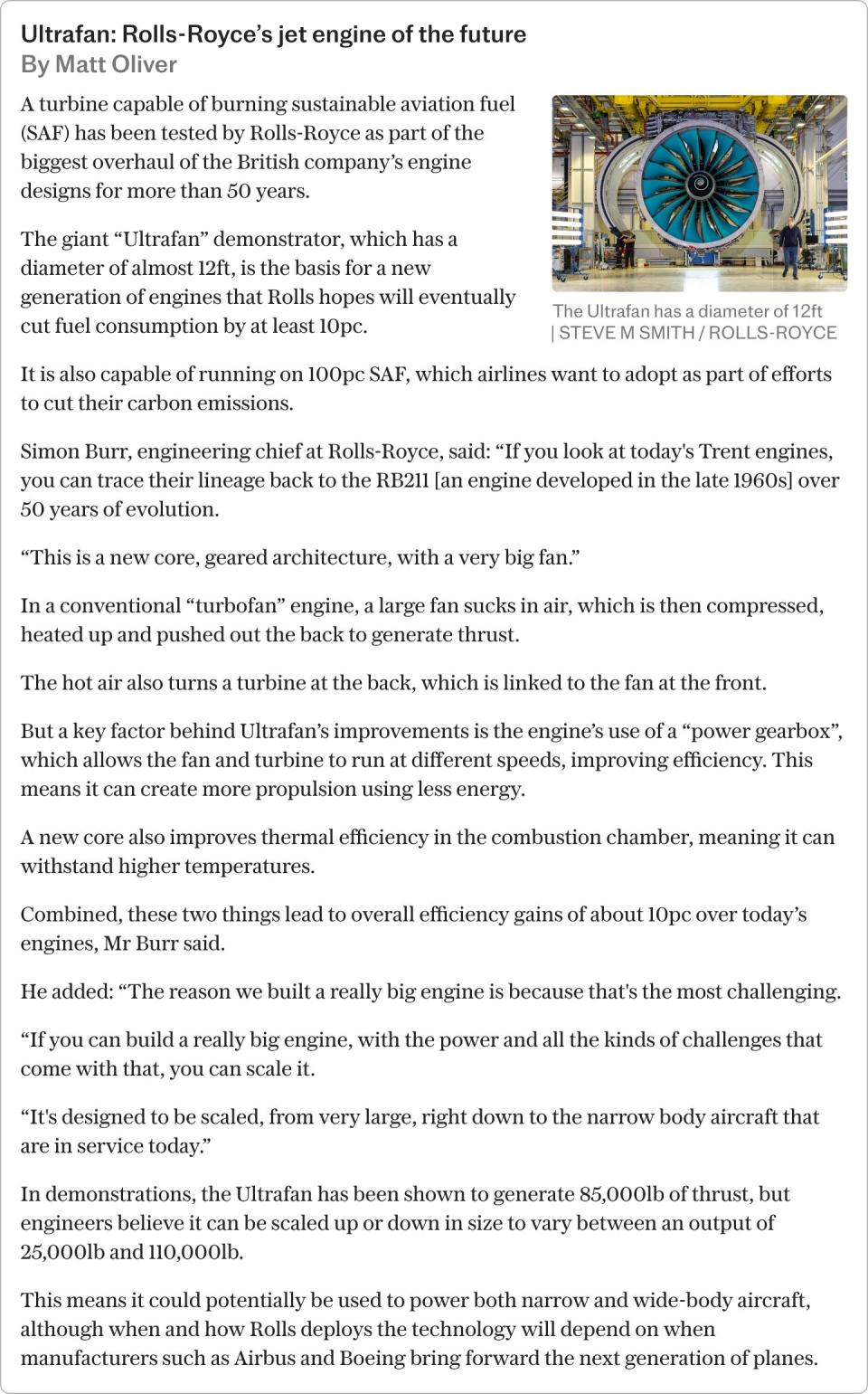

In response, Rolls is borrowing technologies from its experimental Ultrafan turbine to double the XWB-97’s “time on wing” in harsh conditions by 2028.

Round-the-clock trials are underway at the company’s giant test chamber in Derby, where technicians are literally passing huge quantities of sand through the upgraded turbine to prove its mettle.

“In three years, we are going to get our products to the ultimate level of competitiveness,” Erginbilgiç says.

“That means, with all my engines, I’m going to get more flying hours and fewer shop visits.”

Focus means avoiding distractions and Rolls is also seeking to jettison its electric air taxi business to raise cash.

Although Erginbilgiç has talked up the company’s embryonic venture for nuclear small modular reactors (SMRs), he has also warned it cannot continue indefinitely without hard orders from the Government.

Another executive said the SMR business will run out of cash by the end of 2024, with the Government’s long-delayed SMR competition not set to conclude until this summer. It sets the stage for a crisis, should any further hold ups occur.

For his part, Erginbilgiç insists SMRs – and the even smaller “micro reactors” Rolls is working on – represent a real strength.

“Nuclear capability in Rolls-Royce is so distinctive,” he says. “If we do not become market leaders in this space, then we didn’t run the business well.”

Erginbilgiç’s impressive opening salvo has bought him valuable credibility in the City.

Talk of “burning platforms” is long gone. Instead, Erginbilgiç is talking up the prospects for future growth. The company is set to get a huge boost in defence from schemes such as the Aukus nuclear submarine programme and development of the Tempest fighter jet.

“If you step back, and think about the future we are creating for Rolls-Royce, the next phase will show our midterm targets are only a milestone.”

Rolls-Royce’s resident “hard man” adds: “The future is a lot better.”

Yahoo Finance

Yahoo Finance