Is Rottneros AB (publ) (STO:RROS) A Smart Pick For Income Investors?

Is Rottneros AB (publ) (STO:RROS) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

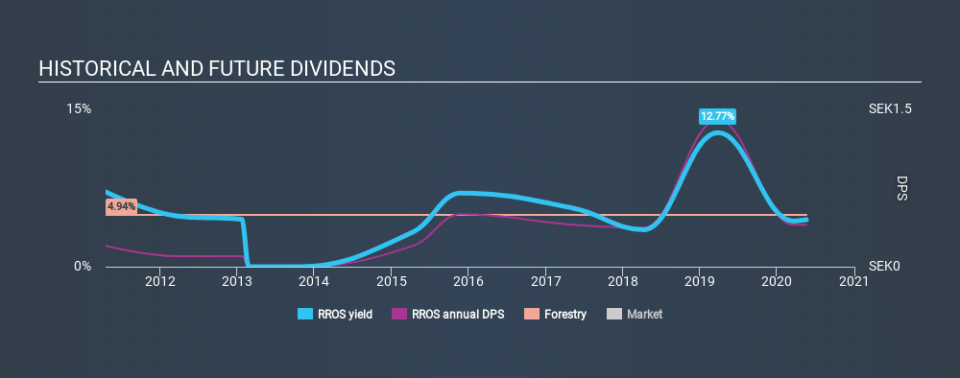

In this case, Rottneros likely looks attractive to dividend investors, given its 4.5% dividend yield and nine-year payment history. It sure looks interesting on these metrics - but there's always more to the story . When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Explore this interactive chart for our latest analysis on Rottneros!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 52% of Rottneros's profits were paid out as dividends in the last 12 months. This is a fairly normal payout ratio among most businesses. It allows a higher dividend to be paid to shareholders, but does limit the capital retained in the business - which could be good or bad.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Rottneros's cash payout ratio last year was 22%. Cash flows are typically lumpy, but this looks like an appropriately conservative payout. It's positive to see that Rottneros's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Consider getting our latest analysis on Rottneros's financial position here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Looking at the last decade of data, we can see that Rottneros paid its first dividend at least nine years ago. It's good to see that Rottneros has been paying a dividend for a number of years. However, the dividend has been cut at least once in the past, and we're concerned that what has been cut once, could be cut again. During the past nine-year period, the first annual payment was kr0.20 in 2011, compared to kr0.40 last year. Dividends per share have grown at approximately 8.0% per year over this time. Rottneros's dividend payments have fluctuated, so it hasn't grown 8.0% every year, but the CAGR is a useful rule of thumb for approximating the historical growth.

A reasonable rate of dividend growth is good to see, but we're wary that the dividend history is not as solid as we'd like, having been cut at least once.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. Over the past five years, it looks as though Rottneros's EPS have declined at around 2.4% a year. A modest decline in earnings per share is not great to see, but it doesn't automatically make a dividend unsustainable. Still, we'd vastly prefer to see EPS growth when researching dividend stocks.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. First, we think Rottneros has an acceptable payout ratio and its dividend is well covered by cashflow. Earnings per share are down, and Rottneros's dividend has been cut at least once in the past, which is disappointing. While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than Rottneros out there.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come accross 3 warning signs for Rottneros you should be aware of, and 1 of them is a bit unpleasant.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance