Royal Gold (RGLD) Provides Update on Operations for Q4

Royal Gold, Inc. RGLD has issued an update for fourth-quarter fiscal 2021 (ended Jun 30, 2021) operations. During the quarter, RGLD Gold AG — the fully-owned subsidiary of Royal Gold — sold 63,500 gold equivalent ounces (GEOs) comprising 50,500 gold ounces, 319,000 silver ounces and 1,500 tons of copper related to its streaming agreements. Stream sales during the fiscal fourth quarter were in line with the previous guided range of 60,000 to 65,000 GEOs.

The average realized price of gold was $1,801 per ounce in the quarter, down 1.5% sequentially. Average realized price of silver stood at $26.45 per ounce, flat compared with the prior quarter. Average realized copper prices were $9,584 per ton, up from the previous quarter’s $8,575 per ton. The company ended the fiscal fourth quarter with 38,000 gold equivalent ounces in inventory, including 27,000 ounces of gold, 485,000 silver ounces and 800 tons of copper.

During the fiscal fourth quarter, cost of sales came in at around $388 per gold equivalent ounce compared with the fiscal third-quarter figure of $410 per gold equivalent ounce. The cost of sales is based on the quarterly average silver-gold ratio of roughly 68 to 1, and copper-gold ratio of around 0.19 tons per ounce.

The Zacks Consensus Estimate for fiscal fourth-quarter earnings is pegged at 90 cents, suggesting an increase of 69.8% from the prior-year reported figure. The Zacks Consensus Estimate for quarterly revenues is pinned at $158.9 million, indicating year-over-year growth of 32.4%.

Royal Gold is focused on allocating its solid cash flow to dividends, debt reduction and investments in new businesses. As of Mar 31, 2021, the company had $850 million available and $150 million outstanding under the revolving credit facility.

Royal Gold is a precious metals stream and royalty company engaged in the acquisition and management of precious metal streams, royalties and similar production-based interests. As of Jun 30, 2021, the company owned interests on 187 properties on five continents, including interests on 41 producing mines and 17 development stage projects.

The company will benefit from higher metal prices this year. Silver and copper are gaining on pick-up in industrial activity. Copper prices look strong on robust demand in China. Gold continues to be the most significant revenue driver for Royal Gold and accounted for 68% of total revenues during the fiscal third quarter. After declining below $1,700 an ounce earlier this year, gold prices have picked up lately and are currently trading above $1,800 per ounce on concerns over the new Delta COVID-19 variant. However, this volatility in gold prices is a concern.

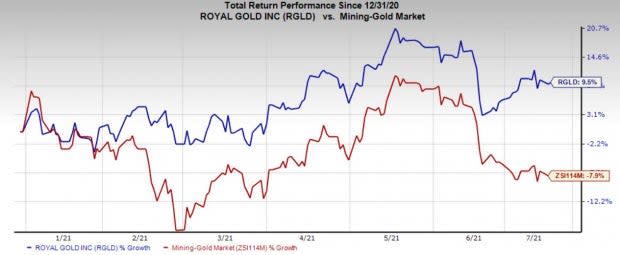

Price Performance

Royal Gold’s shares have gained 9.5% so far this year, as against the industry’s loss of 7.9%.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Royal Gold currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other top-ranked stocks in the basic materials space include Commercial Metals Company CMC, Nucor Corporation NUE and Cabot Corporation CBT, each flaunts a Zacks Rank #1, at present.

Commercial Metals has a projected earnings growth rate of 21.9% for fiscal 2021. The company’s shares have rallied around 51.9% in a year’s time.

Nucor has a projected earnings growth rate of 259.9% for the current year. The company’s shares have soared around 130% over the past year.

Cabot has an expected earnings growth rate of around 126% for the current fiscal year. The company’s shares have surged 60% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

Royal Gold, Inc. (RGLD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance