RPC lines up asset sales amid investor pressure to generate cash

Plastic packaging firm RPC Group is to sell its food packaging business for $95m (£74.5m) and is lining up further asset sales after facing increasing pressure from investors to raise more cash.

Northamptonshire-based RPC, Europe’s biggest plastics packager with revenues of £3.9bn, has grown rapidly in recent years by buying other companies in order to move into new markets.

In 2017, it spent around £900m on acquisitions, including £511m for Letica.

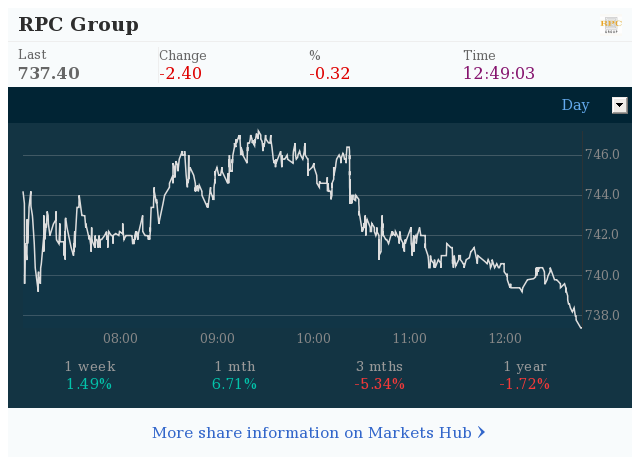

But a slump in free cash flow this year caused its shares to fall as much as 17pc in June, and in July the company’s chairman Jamie Pike revealed that disagreements among its investors was preventing it from pursuing growth opportunities.

The FTSE 250 firm, which supplies plastic products including screw caps, bottle tops, asthma inhalers and coffee capsules, said it would prioritise generating cash by selling divisions it considers non-core.

RPC is selling Letica’s food-service packaging business to Graphic Packaging debt free, but it will settle a $7.5m earn-out payable to former shareholders of Letica under the sale.

Michigan-based Letica Foodservice – a non-core asset for RPC – produces cups, cartons and trays used by fast food restaurants and coffee shops. It was bought by RPC last year in order to give the company “more footprint” in the US.

RPC also said that it was preparing to sell its non-core spirits closures business at Bridge of Allan in Scotland and that the business was being "marketed to interested parties", while its underperforming European injection moulding automotive business in The Netherlands and Estonia is also being offloaded.

The company also recently purchased Cambridgeshire-based PLASgran, a recycler of rigid plastics, in a deal said to be worth £34.5m.

Shares in RPC were up 0.86pc to 771.6p during the morning’s trading.

Yahoo Finance

Yahoo Finance