RPM International (RPM) Gains From MAP 2025 Amid Currency Risks

RPM International Inc. RPM is benefiting from the implementation of MAP 2025 operational improvement initiative, increased infrastructure spending, and acquisitions and divestitures.

Recently, RPM reported third-quarter fiscal 2023 (ended Feb 28, 2023) results, wherein its earnings and sales surpassed the Zacks Consensus Estimate by 23.3% and 3.5%, respectively. The growth was backed by the abovementioned tailwinds.

However, this manufacturer and marketer of high-performance coatings, sealants and specialty chemicals is facing headwinds in the form of intense inflation, foreign exchange risks and adverse weather situations.

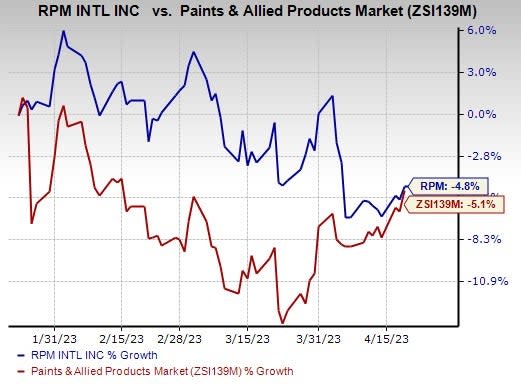

Image Source: Zacks Investment Research

Shares of RPM have declined 4.8% in the past three months compared with the Zacks Paints and Related Products industry’s decline of 5.1%. Earnings estimates for 2023 and 2024 have moved south to $4.27 per share from $4.37 and $4.62 per share from $4.79, respectively, over the past 30 days. This depicts analysts' concern over the company’s growth prospects.

What’s Working in Favor of RPM?

RPM International unveiled the MAP 2025 operational improvement initiative in August 2022. The main motto of this initiative is to accelerate growth, maximize operational efficiencies and generate superior value for its customers, associates and shareholders. By the end of May 2025, RPM expects to achieve $8.5 billion of annual revenues, 42% gross margin and 16% adjusted EBIT margin. Owing to MAP 2025, third-quarter fiscal 2023 net sales and adjusted EBIT increased 5.7% and 4.2%, respectively, year over year. For fiscal 2023, our model predicts gross margin and adjusted EBITDA margin to increase 130 basis points (bps) and 60 bps, year over year, respectively.

Meanwhile, the company has been gaining from solid demand arising from infrastructure and reshoring projects. RPM International witnessed the strongest revenue growth in the third quarter of fiscal 2023 from its businesses providing engineered solutions to infrastructure and reshoring projects. North America and Latin America sales grew 8% and 7.3%, respectively, year over year, attributable to strong infrastructure and reshoring-related spending. Consolidated net sales for the quarter increased 5.7% year over year. For fiscal 2023, we expect net sales to increase 7.6% year over year.

Also, acquisitions and divestitures have been a crucial part of RPM’s growth strategy. In the first nine months of fiscal 2023, the company completed six small acquisitions and the divestiture of Guardian Protection Products, Inc. for proceeds of approximately $49.2 million. In the third quarter of fiscal 2023, acquisitions, net of divestitures, contributed 0.7% to sales.

Headwinds

RPM International’s business has been witnessing higher costs and expenses related to restructuring, acquisitions, labor, distribution and freight. RPM incurred $4.2 million and $2.3 million of restructuring and other charges during third-quarter fiscal 2023, respectively. It also witnessed rapidly escalating material costs and increasing pension non-service costs. Over the past year, inflation in the labor market has resulted in higher labor costs in factories and distribution centers, which impacted the organizational cost structure as a whole.

Every segment of RPM faced unfavorable foreign exchange translation, especially in Europe, which impacted growth. In third-quarter fiscal 2023, currency headwinds reduced net sales by 2.3%.

Also, adverse weather conditions affected sales of paint, coatings, roofing, construction products and related products, especially in extreme cold and rainy weather. RPM International’s fiscal third quarter (December through February) witnesses weaker sales and net income compared with other quarters. The inconsistency in weather conditions impacts productivity adversely.

Zacks Rank & Key Picks

RPM currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Here are some top-ranked stocks that investors may consider from the Zacks Construction sector.

Altair Engineering Inc. ALTR currently sports a Zacks Rank #1. ALTR delivered a trailing four-quarter earnings surprise of 135.8%, on average. Shares of the company have gained 52.9% in the past six months.

The Zacks Consensus Estimate for ALTR’s 2023 sales and EPS indicates growth of 7.8% and 11.2%, respectively, from the previous year’s reported levels.

CRH plc CRH currently sports a Zacks Rank #1. Shares of CRH have gained 47.2% in the past six months. The long-term earnings growth rate is anticipated to be 10.2%.

The Zacks Consensus Estimate for CRH’s 2023 sales and EPS indicates growth of 6% and 13.2%, respectively, from the previous year’s reported levels.

Quanta Services, Inc. PWR currently carries a Zacks Rank #1. PWR has a trailing four-quarter earnings surprise of 4.7%, on average. Shares of the company have gained 24.4% in the past six months.

The Zacks Consensus Estimate for PWR’s 2023 sales and EPS indicates growth of 8.8% and 10.3%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quanta Services, Inc. (PWR) : Free Stock Analysis Report

Altair Engineering Inc. (ALTR) : Free Stock Analysis Report

RPM International Inc. (RPM) : Free Stock Analysis Report

CRH PLC (CRH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance