RTX Secures a $678M Contract to Aid AN/SPY-6(V) Family of Radars

RTX Corp.’s RTX business unit, Missiles and Defense, recently clinched a modification deal involving the AN/SPY-6(V) family of radars. The award has been provided by the Naval Sea Systems Command, Washington, D.C.

Details of the Deal

Valued at $677.7 million, the contract is estimated to be completed by September 2028. The latest modification should enable RTX to exercise options for hardware production of the AN/SPY-6(V) family of radars.

A major portion of the work related to this deal will be executed in Andover, MA.

What’s Favoring RTX?

With the rapid escalation of geopolitical tensions globally in recent times, nations across the board have been significantly boosting their defense arsenal. Since radars constitute a vital part of this arsenal, escalation in defense spending has been benefiting radar manufacturing companies like RTX, in the form of solid order flows for radar production and associated upgrades. The latest contract win is a bright example of that.

To this end, it is imperative to mention that RTX’s SPY-6 is the U.S. Navy family of radars that performs air and missile defense on seven classes of ships.

These radars can defend against ballistic missiles, cruise missiles, hypersonic missiles, hostile aircraft and surface ships simultaneously. The solid demand for this product can be gauged from the fact that SPY-6 radar arrays are being integrated into the U.S. Navy’s newest ships, including DDG 51 Flight III destroyers, frigates, aircraft carriers and amphibious warships.

Growth Prospects

The demand for military radar systems has expanded manifold in recent times, driven by factors like the rise in defense spending of emerging economies, increase in regional tensions and inter-country conflicts that have boosted threats from missiles and aircraft. This has set the stage for ample growth opportunities for the military radar market.

The Markets and Markets firm projects the global military radar market to witness a CAGR of 4.7% during 2023-2027. Such growth projections bode well for prominent radar manufacturers like RTX.

Notably, RTX’s product portfolio consists of varied radars like integrated air and missile defense radars, ballistic missile radars, surveillance radars as well as air dominance radars. Radars like AN-TPY-2, APG-79 and APG-82 are some of the company’s combat-proven products that enjoy solid demand in the global military radar market, apart from AN/SPY-6.

Opportunities for Peers

RTX apart, other defense contractors that are major radar manufacturers and thus expected to benefit from the growth opportunities offered by the global military radar market are discussed below:

Lockheed Martin LMT: Its radars are the choice of more than 45 nations on six continents. The company’s product portfolio includes various radar systems like AN/APY-9 radar, airborne ground surveillance radar systems, AN/TPQ-53 radar systems, SPY-7, the long-range discrimination radar, FPS-117 and a few more.

Lockheed boasts a long-term earnings growth rate of 4.10%. The Zacks Consensus Estimate for its 2024 earnings implies an improvement of 3.2% from the 2023 reported figure.

L3Harris Technologies LHX: The company manufactures combat-proven radars like SPS-48, land-based surveillance radar, AN/APY-11 Multimode radar, Tactical Air Surveillance radar, AN/SPS-48G Long range 3D surveillance radar and many more. Notably, its Vigilant family of software-defined, radar electronic support measures solutions is essential for survival and dominance in the electromagnetic threat environment of the modern battlefield.

L3Harris boasts a long-term earnings growth rate of 9.2%. The Zacks Consensus Estimate for its 2024 earnings implies an improvement of 9.4% from the 2023 reported figure.

Northrop Grumman NOC: As a pioneer in Active Electronically Scanned Array (AESA) radars, NOC has been at the forefront of AESA innovations for more than 60 years. Its broad portfolio of products also includes radars like AN/APG-83 scalable agile beam radar, AN/ASQ-236 Dragon’s eye radar pod as well as AN/APG-81 and AN/APG-71 for F-35 and F-22 jets, respectively.

Northrop boasts a long-term earnings growth rate of 8.7%. The Zacks Consensus Estimate for its 2024 sales implies an improvement of 4.6% from the 2023 reported figure.

Price Performance

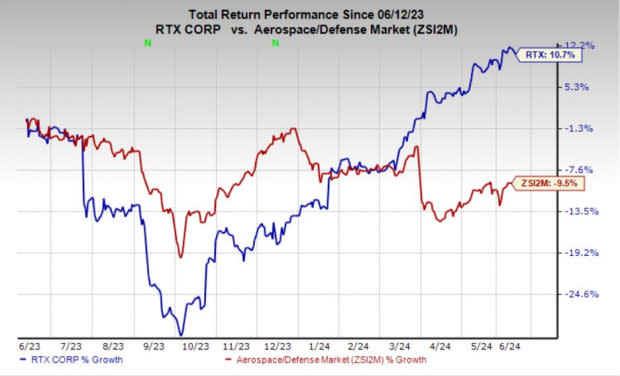

The company’s shares have risen 10.7% in the past year against the industry’s decline of 9.5%.

Image Source: Zacks Investment Research

Zacks Rank

RTX currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

L3Harris Technologies Inc (LHX) : Free Stock Analysis Report

RTX Corporation (RTX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance