Ruane Cunniff's Strategic Moves in Q1 2024: Spotlight on Taiwan Semiconductor

Insights into the Investment Shifts of a Market Veteran

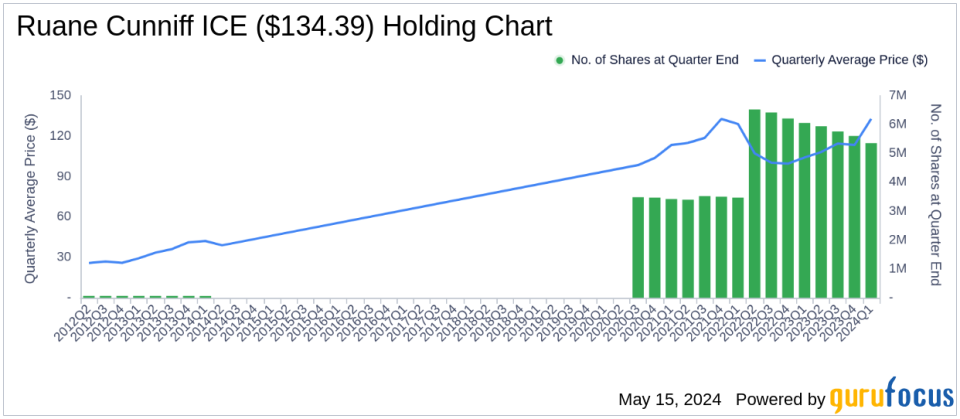

Ruane Cunniff (Trades, Portfolio), a firm established by Bill Ruane and Rick Cunniff in 1969, continues to make strategic investment moves based on their philosophy of owning quality businesses at reasonable prices. The firm's latest 13F filing for the first quarter of 2024 reveals significant transactions, including a notable reduction in Taiwan Semiconductor Manufacturing Co Ltd (NYSE:TSM), reflecting a -0.59% impact on their portfolio. This move comes despite TSM's strong performance, with an 18.01% return over the past three months and a 46.69% year-to-date increase.

Summary of New Buys

Ruane Cunniff (Trades, Portfolio)'s portfolio welcomed new additions this quarter, with a focus on expanding into promising sectors:

American Express Co (NYSE:AXP) was the standout new buy with 932 shares, valued at $212 million.

Key Position Increases

The firm also strategically increased its holdings in certain stocks, reinforcing its confidence in these companies:

Group 1 Automotive Inc (NYSE:GPI) saw an addition of 33 shares, bringing the total to 2,784 shares. This adjustment represents a significant 1.2% increase in share count, though it had a neutral impact on the current portfolio, valued at $813,570.

Key Position Reductions

Despite some increases, Ruane Cunniff (Trades, Portfolio) made substantial reductions in several key positions:

The most significant reduction was in Taiwan Semiconductor Manufacturing Co Ltd (NYSE:TSM), with a decrease of 353,629 shares, resulting in an -8.69% reduction in shares.

Capital One Financial Corp (NYSE:COF) also saw a notable decrease of 272,466 shares, marking an -8.45% reduction in shares and a -0.57% impact on the portfolio.

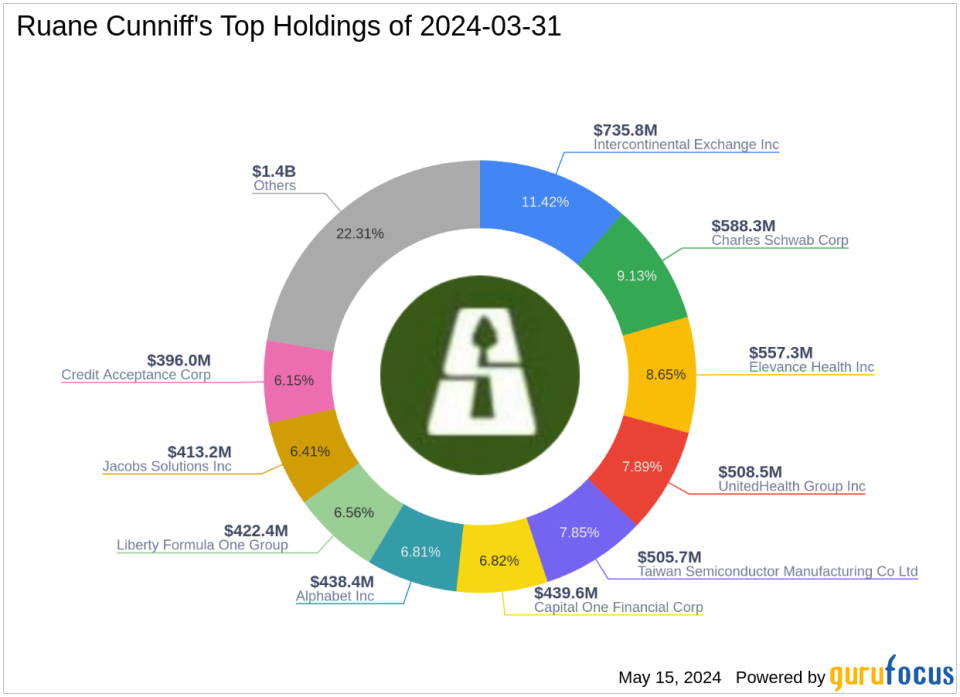

Portfolio Overview

As of the first quarter of 2024, Ruane Cunniff (Trades, Portfolio)'s portfolio included 34 stocks. The top holdings were notably diverse, with significant investments across several industries:

Intercontinental Exchange Inc (NYSE:ICE) at 11.42%

Charles Schwab Corp (NYSE:SCHW) at 9.13%

Elevance Health Inc (NYSE:ELV) at 8.65%

UnitedHealth Group Inc (NYSE:UNH) at 7.89%

Taiwan Semiconductor Manufacturing Co Ltd (NYSE:TSM) at 7.85%

The portfolio shows a strong concentration in sectors such as Financial Services, Communication Services, Healthcare, Technology, Industrials, Consumer Cyclical, and Consumer Defensive.

This quarter's adjustments reflect Ruane Cunniff (Trades, Portfolio)'s ongoing strategy to optimize their portfolio by focusing on quality and growth potential, even if it means making tough decisions on well-performing stocks like Taiwan Semiconductor. Investors and market watchers will be keen to see how these moves play out in the firm's performance in the upcoming quarters.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance