Russia’s Embrace of Chinese Yuan Stalls Over Risk From Sanctions

(Bloomberg) -- The rapid uptake of China’s yuan in President Vladimir Putin’s war economy, spurred by the fallout with the West over the invasion of Ukraine, may have hit its limit.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Microsoft Orders China Staff to Use iPhones for Work and Drop Android

The End of the Cheap Money Era Catches Up to Chelsea FC’s Owner

Asia’s Richest Banker Gets Caught in Adani-Hindenburg Crossfire

Countries that continue to do business with Russia face growing US pressure, most notably through the threat of secondary sanctions. That’s proved an effective brake on further yuan usage in the country as it stifles bilateral trade and payments.

“Moscow may be more eager to adopt the yuan than Chinese banks are willing to accommodate,” Alex Isakov, Russia economist at Bloomberg Economics, said. “US secondary sanctions threats scare banks.” The market is indicating a yuan shortage in Russia, as well as an aversion to provide liquidity among Chinese banks, he says.

The gap in yuan overnight borrowing rates in Russia and China drastically widened after US Treasury Secretary Janet Yellen in December said that the US will not hesitate “to take decisive, and surgical, action against financial institutions that facilitate the supply of Russia’s war machine.” That difference has remained at several percentage points since the warning. The US also in December authorized secondary sanctions on overseas financial firms, and China’s state-owned banks tightened curbs on funding to Russian clients.

In a report published late Tuesday on financial market risks, the Bank of Russia disclosed that it had to double its offer of yuan liquidity under swap operations as a surge in demand following the end of dollar and euro swaps caused rates to spike to 31%. That helped decrease rates to 5%-7% versus 0%-5% before the sanctions were imposed, according to the report.

In two years, Russia has overtaken Germany, Australia and Vietnam in terms of trade volume with China, which surged by more than 60% to $240 billion in 2023, China customs data shows. China benefits from purchasing Russian oil and other commodities at a discount while Russia gets access to a wide range of consumer and high-tech products.

As a result, China has become Russia’s main trading partner, and the yuan now accounts for about 40% of Russia’s export and import payments and more than half the turnover on Russia’s foreign currency market. The scale of Russia’s yuanization is even more dramatic considering it started from almost zero at the beginning of 2022, before Putin invaded Ukraine.

That’s made Russia the largest contributor to Beijing’s efforts to increase the yuan’s role in international payments.

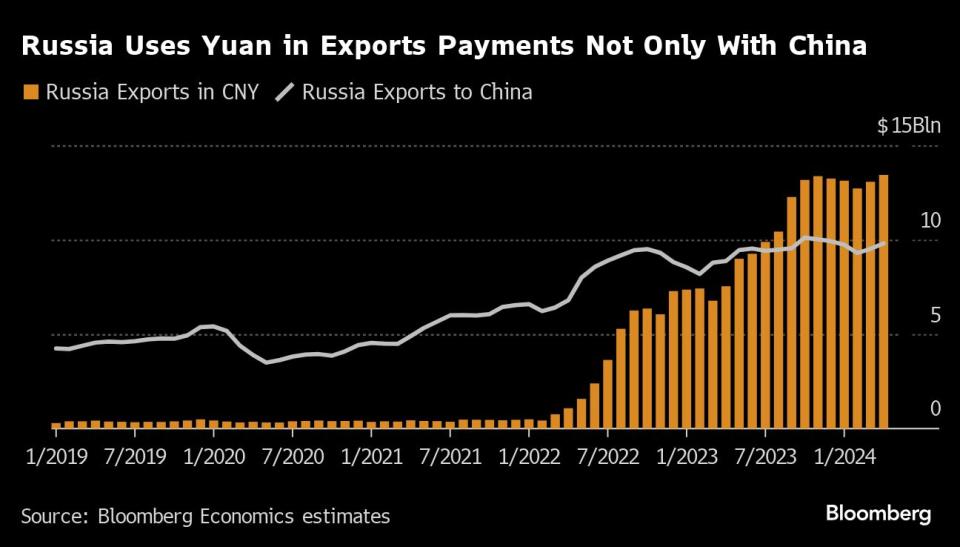

The share of China’s trade settled in yuan continued to climb through the first quarter of this year, and Russia accounted for 29% of that increase since 2021, Bloomberg Economics estimates. Russia’s trade with China is almost entirely in yuan, and Russia’s yuan-based exports exceed what it’s selling to China, meaning other countries are paying Russia in yuan, estimates shows.

Still, annual growth in total trade between China and Russia slowed to just 3% in the first five months of 2024 compared to almost 42.5% a year ago, according to Bloomberg calculations based on China’s custom data. The share of Russia’s trade conducted in friendly currencies didn’t increase compared to last year, Bank of Russia estimates show.

What Bloomberg Economics Says...

“Russia’s yuan adoption may have peaked in 2023 for two reasons. First, the threat of secondary sanctions is a powerful deterrent for some of China’s largest institutions for dealing with Russian counterparties. A sudden and persistent decoupling of yuan overnight rates in Russia from Shibor after Janet Yellen’s statement provides compelling evidence. Second, Russia’s yuan use is mostly driven by exports of Russia’s oil, while other countries are still reluctant to accept yuan as payment for imports. This means that if oil prices were to remain stagnant in the coming quarters, so would Russia’s yuan trade.”

Alex Isakov

Several of China’s biggest banks stopped accepting yuan from Russia, impacting imports for several months. Russian companies told local media that the issue was resolved using small regional banks after Putin met Chinese President Xi Jinping in May, but the country’s authorities have indicated concerns remain.

“The yuan’s usage has a certain peak and it is dependent, first of all, by how much Russia will trade with China,” Alexander Gabuev, director of the Carnegie Russia Eurasia Center, said. “Also much will depend on how widespread the yuan will be as a currency for settlements with other countries.”

Evidence of the yuan’s newfound place in Russia’s economy is everywhere. US shareholders of the Netherlands’s Yandex NV received yuan instead of dollars or euros, which were impossible to transfer from Russia, when it sold its Russian business, according to two people familiar with the roughly $2.5 billion cash component of the deal, who asked not to be identified.

Elsewhere, companies have turned to the yuan alongside the ruble when converting dollar and euro loans and issuing new bonds, while the Bank of Russia uses the Chinese currency for National Wellbeing Fund operations. At the start of this year, the yuan had overtaken the dollar in terms of deposits in Russian banks, becoming the main foreign currency for savings. In 2023, the volume of yuan deposits in Russia doubled to $68.7 billion which is several times higher than in other top offshore yuan economies, such as the UK and Singapore.

The latest round of US restrictions in June led to a halt in exchange trading for the dollar and the euro in Russia. The yuan became the only liquid currency available for trades and purchase in brokerage accounts in the country, accounting for 99.6% of the total, the Bank of Russia’s report showed.

“There is still potential to increase yuan usage, but it is small and incomparable to the move that has already happened,” said Sofya Donets, an economist at T-Investments. “Most of the journey has already been completed,” she said.

--With assistance from Qizi Sun.

(Updates with Bank of Russia data in fifth paragraph)

Most Read from Bloomberg Businessweek

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

Family Offices of the Ultra-Rich Shed Privacy With Activist Bets

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance