Russia’s Invasion of Ukraine Rattles Global Markets (Capital Market Research) (Weekly Market Outlook)

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

1

Moody’s Analytics and Moody’s Investors Service maintain separate and independent economic forecasts. This publication uses the

forecasts of Moody’s Analytics. Moody’s Analytics markets and distributes all Moody’s Capital Markets Research materials.

Moody’s Analytics does not provide investment advisory services or products. For further detail, please see the last page.

Russia’s Invasion of Ukraine

Rattles Global Markets

The significant escalation of the

Ukraine - Russia conflict rattled equity

markets and led to an increase in global

oil prices, which likely had some risk

premium already embedded. West

Texas Intermediate and Brent crude oil

prices both increased and are trading

near, or above, $100 per barrel. The

conflict will have a significant impact on

economic growth in Eastern Europe , as

it is the most reliant on Russian imports.

The effect on the U.S. economy is tied

to equity markets and oil prices.

Earlier this month, we ran two scenarios

through our Global Macroeconomic

Model. In the first scenario, West Texas

Intermediate crude oil prices jump to

$100 per barrel, and the second has oil

prices hitting $150 . In each scenario,

increases in oil prices occur in the

second quarter and remain there in the

third quarter before returning to the baseline. This movement in oil prices would be

consistent with a sudden but temporary supply shock.

The more economic costs increase, the higher oil prices rise. In the $100 -per-barrel oil

price scenario, GDP growth in the second quarter is reduced by 0.1 of a percentage point,

but it reduces GDP growth in the third quarter by 0.5 of a percentage point and 0.2 of a

percentage point in the final three months of the year. If oil prices are $150 per barrel in

the second and third quarters, the hit to GDP growth this year is more noticeable. GDP

growth in the second quarter is reduced by 0.2 of a percentage point, 1 percentage point

in the third quarter, and 0.4 percentage point in the final three months of the year. Year-

over-year growth in the CPI is 0.5 of a percentage point higher than in the baseline in the

second quarter and 0.6 of a percentage point in the third quarter.

WEEKLY MARKET

OUTLOOK

FEBRUARY 24, 2022

Lead Author

Ryan Sweet

Senior Director-Economic Research

Asia-Pacific

Shahana Mukherjee

Economist

Illiana Jain

Economist

Europe

Barbara Teixeira Araujo

Economist

Ross Cioffi

Economist

Olga Kuranova

Economist

U.S.

Steven Shields

Economist

Ryan Kelly

Data Specialist

Podcast

Table of Contents

Top of Mind ............................................ 3

Week Ahead in Global Economy ... 6

Geopolitical Risks ................................ 7

The Long View

U.S. ............................................................................. 8

Europe .................................................................... 12

Asia-Pacific ..........................................................13

Ratings Roundup ................................ 15

Market Data ......................................... 18

CDS Movers .......................................... 19

Issuance..................................................22

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

2

Higher oil prices will boost inflation and increase the cost at

the pump. Wholesale gasoline futures, which lead U.S. retail

gasoline prices by two weeks, point toward prices at the

pump reaching $3.75 per gallon, compared with $3.58 in

the week ended February 18. If oil prices continue to climb,

then $4 -per-gallon gasoline will become a reality. Our rule

of thumb is that for every $10 increase in oil prices, retail

gasoline prices rise by 30 cents per gallon.

U.S. corporate bond market not immune

U.S. high-yield corporate bond issuance has come to a

grinding halt as geopolitical tensions, wider spreads,

heightened volatility in equity markets and fund outflows

have taken a toll. The Barclays/Bloomberg high-yield

corporate bond spread has widened by 76 basis points since

the beginning of the year to 359 basis points, the widest

since early 2021. Though high-yield corporate bond spreads

are well below their historical average of 496 basis points,

the abruptness of the widening in spreads is hurting

issuance, contributing to the more-than-4% decline in junk

bond total returns this year.

Investors have been pulling money out of high-yield funds

for more than a month. Issuance doesn’t look like it’s going

to improve soon as the pipeline is very lean and geopolitical

tensions have intensified. So far, the issues in the high-yield

corporate bond market are attributed to interest rates rather

than defaults, with the latter near historic lows. High-yield

corporate bond issuance normally doesn’t thrive when there

is a lot of volatility in equity markets. The VIX has jumped

recently and is at 30, which foreshadows further widening in

high-yield corporate bond spreads.

The Russian-Ukraine conflict will continue to impact the U.S.

high-yield corporate bond market, but the implications for

the broader domestic banking system are minimal. U.S.

banks have a small exposure to Russian banks, according to

the Bank for International Settlements. Therefore, U.S.

sanctions are unlikely to ripple through the domestic

banking system, keeping the risk of contagion low. The

Russian- Ukraine conflict is weighing on U.S. equity markets,

but there has also been a significant increase in Russia’s five-

year credit default-swap spreads.

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

3

TOP OF MIND

Navigating Uncertainty

BY SHAHANA MUKHERJEE

The global economy is now in expansion following the record

pandemic-induced recession. Unprecedented fiscal stimulus in

the U.S. and trade-led growth in China pushed the world

economy toward peak growth in the last quarter of 2021. The

economic situation, however, has changed for some

economies. China’s economy is contending with headwinds

as concerns over a cooling property market and the potential

for spillovers into the domestic financial sector weigh on

market expectations and the country’s growth prospects.

Most advanced and emerging economies are better

positioned relative to mid-2021. But recovery remains

uneven. Disruptive resurgences, suboptimal policy support,

differences in vaccine rollout, and susceptibility to supply-

chain disruptions have resulted in growing divergence

amongst the leading economies (including the U.S. , China ,

Japan , India , and the five largest European countries). We

forecast that the large European countries will join the U.S. ,

China and India in exceeding precrisis levels of GDP in 2022,

while other countries, including Japan , will recover over the

next two years.

Inflation prompts monetary policy pivot

Unprecedented levels of fiscal and monetary policy stimulus

had anchored the global economic rebound in 2021. But a

combination of firming domestic recoveries, tight labour

markets, and supply-side disruptions is fueling inflation,

prompting some central banks to dial back on these support

measures several quarters ahead of earlier predications.

Consumer price inflation in the U.S. rose to 7.1% year on

year in December, marking the steepest rise in 40 years.

Concerned about the growing impact of higher prices on

households’ real purchasing power, the Federal Reserve

maintained its hawkish tone at its January meeting, but

adjusted its forward guidance to signal higher potential for

the first increase in the fed funds rate to come as early as

March.

The pivot to an accelerated rollback in pandemic-related

monetary policy stimulus contrasts with the position held by

the Fed until just a few months ago, when the central bank

had not yet started to taper its $120 billion in monthly asset

purchases, and it was still unclear whether an interest rate

liftoff would occur in 2022. Financial market conditions

were described as accommodative in the latest policy

statement and there is confidence in the strength of the

labour market recovery. But the Fed’s statement also

imparted a sense of urgency to respond to price pressures by

winding up the tapering process with priority. Consequently,

on the balance sheet front, the Fed decided to continue

reducing the monthly pace of its net asset purchases,

bringing them to an end in early March.

We expect the Fed to raise rates four times this year, once

each quarter, with the first increase of 25 basis points at its

March meeting, and quantitative tightening likely to begin

this summer. Our estimate of the long-run equilibrium fed

funds rate remains unchanged at 2.5%, and we expect the

fed funds rate to reach this level by the end of 2024.

How aggressively the Fed moves this year will depend on

how stubborn current inflation is and how financial

conditions evolve following the rate hikes and tighter

liquidity settings.

100

105

110

115

120

125

130

135

15

16

17

18

19

20

21

Merchandise world trade

Industrial production

Trade and Production Have Rebounded

Sources: CPB World Trade Monitor, Moody’s Analytics

Global trade and industrial production, volume, 2010=100

Nov 2018 – Trade war

Jan 2020 – COVID-19

Data through Nov 2021

Growth to Moderate in 2022

Source: Moody’s Analytics

Real GDP growth, Aug baseline forecast, % change

-8

-6

-4

-2

0

2

4

6

8

World North

America

South

America

Asia

Euro

zone

Other

Europe

Eastern

Europe

Middle

East &

Africa

2019 2020 2021E 2022F 2023F

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

4

Inflation has also intensified in other advanced economies

such as the U.K. , prompting the Bank of England to decrease

its stock of government bond purchases and hike the policy

rate twice since November to 0.5%, marking an earlier start

to policy normalisation.

But policymakers in some regions are maintaining a more

cautious approach towards tightening. The European Central

Bank left its policy rate unchanged at -0.5% at its February

meeting and kept its forward guidance on the timing of rate

hikes unaltered. The ECB’s asset purchases under the

Pandemic Emergency Purchase Program would continue at a

moderately slower pace and be discontinued beyond March,

but purchases under its regular Asset Purchase Program

would increase for at least two quarters beyond this period

to balance out the transition.

In comparison, the Reserve Bank of Australia announced the

end of its bond purchase program effective February 10, in

response to rising inflation and stronger employment

conditions. But the central bank maintained status quo on

the cash rate, which remains at a record-low 0.1%,

acknowledging the elevated uncertainty regarding the near-

term inflation path.

Emerging market vulnerability

Emerging economies, however, face other challenges. On

one hand, runaway inflation in Brazil , Mexico , and other

parts of Latin America has necessitated aggressive rate hikes

to tame inflation expectations; on the other hand, emerging

Asian economies are facing other concerns. Consumer

inflation in India has risen since September, but the rise has

been more moderately paced relative to other economies

and headline inflation has yet to breach the upper limit of

the Reserve Bank of India’s inflation target range of 2% to

6%. Indonesia , in contrast, has seen a much slower rise in

consumer prices in Asia , with the headline rate (at 2.2%)

breaking into the central bank’s inflation target range of 2%

to 4% only in January.

With private consumption yet to return to pre-pandemic

levels in some of these emerging economies, an impending

and coordinated rise in international borrowing costs will

build pressure on central banks to act. Though some central

banks in Asia are on a better economic footing with respect to

their foreign exchange market reserves and current account

positions, depreciation pressures could persist for longer and

prompt an off-cycle move, particularly by countries faced

with a more uncertain near-term growth outlook.

A premature move towards policy normalization or

tightening can also prove particularly painful for emerging

markets where investment has yet to stabilise from repeated

disruptions or in markets where the risk of crowding out

private investment runs high.

Several emerging market Asian economies are likely to maintain

accommodative fiscal policy settings to support domestic

recoveries. While this is a positive and will bolster their medium-

term growth outlook, one risk is that such a position could

exacerbate or prolong inflation pressures, particularly in

countries where central banks have taken no sizeable measures

to trim their expansionary monetary stance. How fiscal and

monetary policies interact against the backdrop of yet-to-settle

pandemic-related disruptions will have a sizeable bearing not

only on emerging market recoveries in 2022 and 2023 but also

on their medium-term budget deficits and debt burdens.

0.0

0.5

1.0

1.5

2.0

2.5

3.0

20

21

22F

23F

24F

25F

Australia

U.S.

U.K.

Euro zone

Canada

Earlier Start to Policy Normalization

Benchmark monetary policy rate or target rate, %

Source: Moody’s Analytics

-2

-1

0

1

2

3

4

5

6

Japan

Hong Kong

China

Indonesia

Vietnam

Malaysia

Thailand

Taiwan

Singapore

Australia (Q4)

Korea

India

Philippines

New Zealand (Q4)

Apr 2021

Dec 2021

Inflation Gathers Pace in Some Economies

Sources: National statistical offices, RBA, Moody’s Analytics

CPI, % change yr ago, SA, Dec 2021 except as noted

0

50

100

150

200

Turkey

Indonesia

Brazil

Vietnam

India

Philippines

Thailand

China

Divergence in Foreign Reserves

Sources: World Bank , Moody’s Analytics

Total reserves, % of total external debt in 2020

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

5

China’s property market woes

The People’s Bank of China has responded to concerns over

slowing growth by pivoting to conditionally more

accommodative monetary policy meant to direct financial

support to key areas. Such a position contrasts with the global

momentum toward policy normalization and has the potential

to exacerbate conditions for local high-yield corporate bond

issuers to the extent that the move stokes capital outflows.

But in the context of the broader vulnerabilities linked with

the local property market, such a policy stance is more likely

to be interpreted as an initiative that could materially

alleviate the sector’s financial strain by mobilizing more

affordable refinancing options. This will play a role in

anchoring investor confidence in the medium term and will be

seen as a net positive beyond the current market volatility.

Supply disruptions remain pertinent

Supply-chain disruptions caused by virus-related factory and

port closures emerged across various industries and

intensified in the second half of last year. These have

become one of the key drivers of the recent surge in

inflation. While supply-side bottlenecks have eased a bit and

the worst is likely behind us, it remains a concern. The

spread of the Omicron variant has resulted in reinstated

restrictions and new quarantine requirements, which,

together with large-scale staff illnesses, have disrupted

distribution and logistics in some industries. With the future

waves still relevant and major manufacturing hubs such as

China still maintaining a strict zero-COVID policy, there is a

risk of further disruptions resulting from temporary factory

closures or shipment delays.

Unless the existing backlog in distribution clears, this could

exacerbate freight and input costs, constrain productivity for

manufacturers globally, and fuel cost-push inflation for an

extended period of time. The disruption to global auto

production caused by the semiconductor shortage is likely

to have peaked, but the difficulties of increasing supply or

finding alternative sources for chips will keep conditions

tight throughout the year.

Outlook

GDP growth will steadily decelerate over the next year as

policy support fades, pent-up demand cools, and supply-chain

stress remains. Global GDP growth is fore-cast at 4% in 2022

and 3.5% in 2023, after peaking at 5.6% in 2021. The U.S. is

expected to keep powering global growth, with GDP growth

of 3.7% in 2022 and 3% in 2023. China’s GDP is forecast at

5.2% in 2022 and 5.8% in 2023, and India’s GDP is forecast

to grow by 8.6% in 2022 and 5.9% in 2023. Euro zone GDP

growth is forecast at 3.9% in 2022 and 2.9% in 2023, while

Japan will grow 2.1% in 2022 and 2.2% in 2023.

Downside risks still dominate

The spread of the Omicron variant will undermine the

spending appetite and weigh on the March-quarter growth,

but it is not expected to derail the recovery momentum.

Higher vaccination rates mean that several economies are

better positioned now to see a swifter rebound in mobility

and consumption. Economies reliant on tourism and higher-

education immigration, however, will likely see a delayed

resumption, with more barriers preventing international

borders from fully reopening.

China’s property market weakness is another short-term risk

that could expose the country and Asia’s high-yield

corporate bond market to an extended period of volatility

and higher risk premiums.

Supply bottlenecks, the global semiconductor shortage,

rising energy prices, and inflation pressures add uncertainty

to the timing and pace of global recovery. Finally, the

reopening of international borders increases exposure to

newer and poten-tially vaccine-resistant strains of the virus,

which could create significant difficul-ties in getting

economies on a sustained recovery path.

Supply Troubles Hit Japan Auto Exports

Real exports index, Jan 2019=100, SA

Sources: BoJ, Moody’s Analytics

40

60

80

100

120

140

Jan-19

Jul-19

Jan-20

Jul-20

Jan-21

Jul-21

Total exports

Motor vehicles

IT goods

Capital goods

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

6

The Week Ahead in the Global Economy

U.S.

It will be an other busy week for U.S. economic data. The

focus will be on the February employment report. This will

be the last employment report before the March meeting of

the Federal Open Market Committee . Odds are that the

February data won’t alter the Fed’s plan as it has zero

tolerance for upside surprises on inflation. Other key data

released next week include both the ISM manufacturing and

nonmanufacturing surveys for February. Advance data on

the goods deficit and inventories for January could have

implications for our high-frequency GDP model’s tracking

estimate of first-quarter GDP growth, currently 1.4% at an

annualized rate. February vehicle sales could also impact

first-quarter GDP. Revisions to productivity growth and unit

labor costs should be fairly modest.

Europe

The preliminary estimate of the euro zone’s Harmonized

Index of Consumer Prices will top headlines next week. We

expect the inflation rate accelerated to 5.3% year over year

from 5.1% in January. Although natural gas prices were

stable through much of the month, oil prices continued

climbing at a quick pace. The persistence of supply-chain

disruptions and elevated energy costs likely convinced more

firms to hike consumer prices. Indeed, the euro zone’s

February composite PMI reported the sharpest rise in the

survey’s history of average prices charged.

We also forecast another step-down in the euro zone’s

unemployment rate, to 6.9% in January from 7% in

December. The labor market has been heating up in recent

months. The unemployment rate is at its lowest in years at

the same time that the vacancy rate was at its highest on

record in the fourth quarter of 2021.

We expect a soft rebound in retail sales this January, by

0.9% month over month after the 3% drop in December.

We fear that rising consumer prices and the outbreak of

Omicron infections, which peaked during the month, held

back consumers. Indeed, the consumer confidence reading

slumped to -8.5 in January, and declined another 0.3 point

in February. Confidence will perk up and households will go

back to spending as the pandemic abates, though higher

prices will weigh on purchasing power.

Russia’s unemployment rate likely came in at 4.3% in

January, unchanged over the past four months. Good

prospects for the gas and oil sectors likely supported

employment. Italy’s unemployment rate likely was

unchanged, at 9%, in January as firms looked through the

current outbreak of COVID-19 during their hiring plans.

Germany’s February unemployment rate likely came in at

5.1%, unchanged from the previous month for similar

reasons. German retail sales, meanwhile, will recover by just

1.7% month over month in January following the 5.5%

decline in December.

Italy’s final estimate of fourth-quarter GDP growth likely

came in at 0.6% quarter over quarter, slowing from the

2.6% reading in the third quarter. We expect private

consumption slowed considerably and that this was

accompanied by a weaker trade balance on account of

import growth outpacing exports.

Asia-Pacific

Australia’s fourth-quarter GDP will be the highlight on the

economic calendar. We expect GDP to have expanded 1%

quarter over quarter after a 1.9% contraction in the

September quarter. The severe Delta outbreak disrupted

Australia’s recovery in the third quarter as retail and

contact-sensitive services witnessed a notable setback in

demand. An accelerated vaccine rollout and the easing of

state-level restrictions in the largest states of New South

Wales and Victoria have subsequently supported a strong

rebound in spending since October, although an intensifying

Omicron wave cut short this recovery. We expect some

improvement in private consumption and a lift from capital

expenditure to have driven the fourth-quarter expansion,

although the pickup will be moderated by a narrower trade

surplus.

The Reserve Bank of Australia is expected to hold the cash

rate steady at its monetary policy meeting. The central bank

ended its bond purchases program earlier this month and

has maintained that a hike in the cash rate will be

considered when inflation is sustainably within the 2% to

3% inflation target range. We expect the RBA to remain

patient in this instalment, allowing more space for domestic

demand to meaningfully revive following the Omicron-led

disturbance to this quarter’s growth.

India’s GDP is likely to have expanded 6.7% year over year in

the fourth quarter, building on the 8.4% growth in the prior

quarter. Domestic conditions were largely stable in the

closing months of the year, and household confidence was

lifted by higher vaccination rates and a notable

improvement in mobility in major consumer pockets. The

slower growth in manufacturing is expected to have

weighed on output growth, but this will be partially offset by

a more notable pickup in services.

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

7

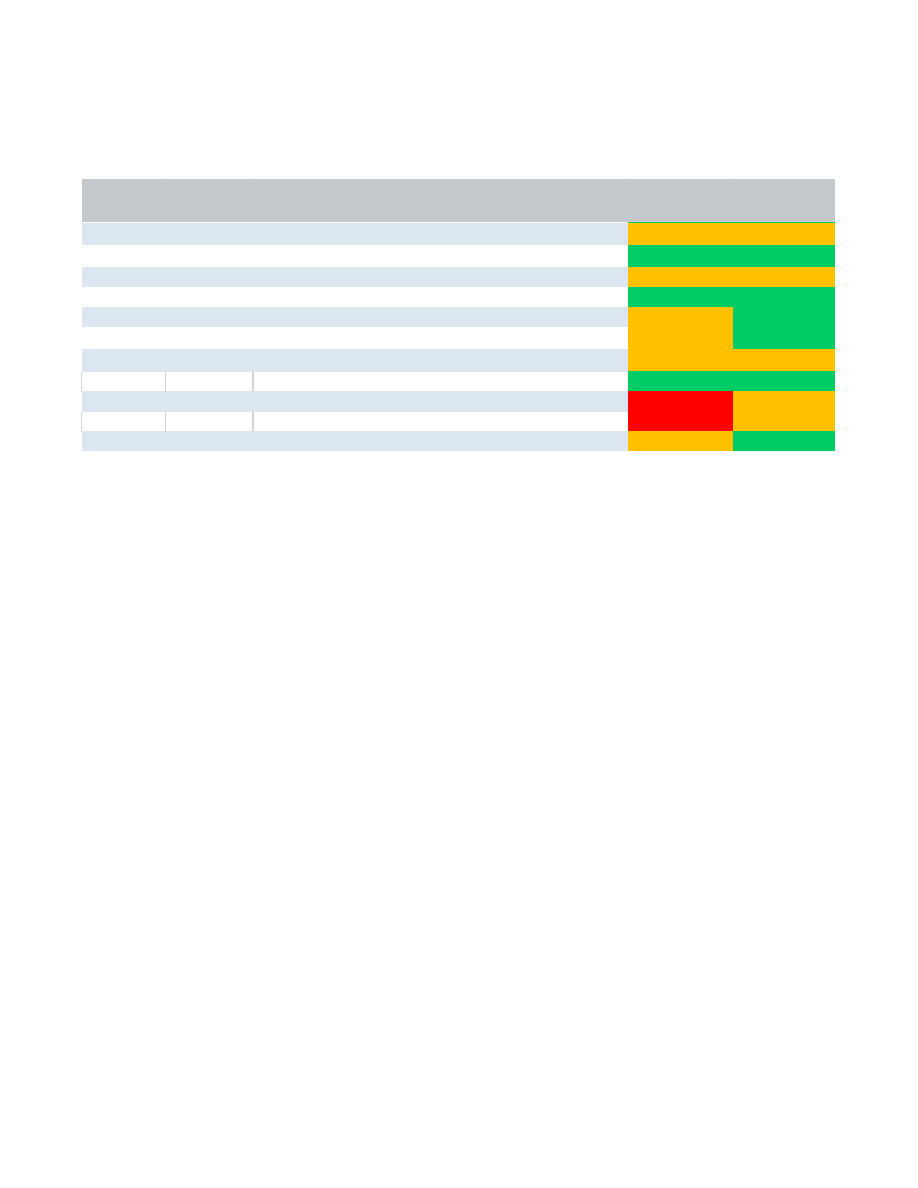

Geopolitical Calendar

Date

Country

Event

Economic

Importance

Financial Market Risk

9-Mar

South Korea

Presidential election

Medium

Medium

27-Mar

Hong Kong

Chief executive election

Low

Low

10-Apr

France

General elections

Medium

Medium

9-May

Philippines

Presidential election

Low

Low

29-May

Colombia

Presidential election

Medium

Low

Jun

Switzerland

World Economic Forum annual meeting

Medium

Low

29-30-Jun

NATO

NATO Summit, hosted by Madrid

Medium

Medium

Jun/Jul

PNG

National general election

Low

Low

2-Oct

Brazil

Presidential and congressional elections

High

Medium

Oct/Nov

China

National Party Congress

High

Medium

7-Nov

U.N.

U.N. Climate Change Conference 2022 (COP 27)

Medium

Low

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

8

THE LONG VIEW: U.S.

High-Yield Issuance Falls as Spreads Widen

BY RYAN SWEET

CREDIT SPREADS

Moody's long-term average corporate bond spread is 143

basis points, 7 bps wider than the 136 bps at this time last

week and wider than the 115 bps average in January. The

long-term average industrial corporate bond spread widened

by 5 bps to 130. It averaged 103 bps in January.

The recent ICE BofA U.S. high-yield option-adjusted bond

spread widened over the past week by 4 basis points to 372

bps. The Bloomberg Barclays high-yield option-adjusted

spread has bounced around recently and is currently 359

bps, compared with 354 at this time last week. The high-

yield option adjusted bond spreads approximate what is

suggested by the accompanying long-term Baa industrial

company bond yield spread but a little tighter than that

implied by a VIX of 34.

The ISM manufacturing survey points toward some widening

in high-yield U.S. corporate bond spreads, but nothing

suggests that issuance would take a significant hit. To

highlight this, we calculated z-scores. These measure the

standard deviations above or below the mean for both the

ISM manufacturing survey and the Bloomberg/Barclays

high-yield corporate bond spread. This points toward some

widening in the high-yield corporate bond spread.

Defaults

Defaults remain very low. According to the latest Moody’s

monthly default report, the global speculative-grade default

rate fell to 1.7% for the trailing 12 months ended in

December, from 2% the prior month. The rate has fallen

steadily since touching a cyclical peak of 6.9% at the end of

2020 and remains below the pre-pandemic level of 3.3%.

Under our baseline scenario, Moody's Credit Transition

Model predicts that the global speculative-grade default

rate will fall to a cyclical low of 1.5% in the second quarter

of 2022 before gradually rising to 2.4% at year end.

We also expect default risk to remain low for speculative-

grade companies as a whole because many have refinanced

their debt in the last two years at very low interest rates,

therefore mitigating their near-term default risks. However,

some low-rated companies that are under liquidity or

solvency stress could be vulnerable to default in the event of

tighter liquidity, higher borrowing costs, and profit erosion.

U.S. Corporate Bond Issuance

First-quarter 2020’s worldwide offerings of corporate bonds

revealed annual advances of 14% for IG and 19% for high-

yield, wherein US$-denominated offerings increased 45%

for IG and grew 12% for high yield.

Second-quarter 2020’s worldwide offerings of corporate

bonds revealed annual surges of 69% for IG and 32% for

high-yield, wherein US$-denominated offerings increased

142% for IG and grew 45% for high yield.

Third-quarter 2020’s worldwide offerings of corporate

bonds revealed an annual decline of 6% for IG and an

annual advance of 44% for high-yield, wherein US$-

denominated offerings increased 12% for IG and soared

upward 56% for high yield.

Fourth-quarter 2020’s worldwide offerings of corporate

bonds revealed an annual decline of 3% for IG and an

annual advance of 8% for high-yield, wherein US$-

denominated offerings increased 16% for IG and 11% for

high yield.

First-quarter 2021’s worldwide offerings of corporate bonds

revealed an annual decline of 4% for IG and an annual

advance of 57% for high-yield, wherein US$-denominated

offerings sank 9% for IG and advanced 64% for high yield.

Issuance weakened in the second quarter of 2021 as

worldwide offerings of corporate bonds revealed a year-

over-year decline of 35% for investment grade. High-yield

issuance faired noticeably better in the second quarter.

Issuance softened in the third quarter of 2021 as worldwide

offerings of corporate bonds revealed a year-over-year

decline of 5% for investment grade. U.S. denominated

corporate bond issuance also fell, dropping 16% on a year-

ago basis. High-yield issuance faired noticeably better in the

third quarter.

Fourth-quarter 2021’s worldwide offerings of corporate

bonds fell 9.4% for investment grade. High-yield US$

denominated high-yield corporate bond issuance fell from

$133 billion in the third quarter to $92 billion in the final

three months of 2021. December was a disappointment for

high-yield corporate bond issuance, since it was 33% below

its prior five-year average for the month.

In the week ended February 18, US$-denominated high-

yield issuance totaled $0.15 billion , bringing the year-to-

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

9

date total to $44.04 billion . Investment-grade bond

issuance rose $35 billion in the current week, bringing its

year-to-date total to $239.4 billion . Total US$-

denominated issuance is currently between that seen in

2018 and 2019.

U.S. ECONOMIC OUTLOOK

There were some minor adjustments to our forecast

between the January and February baselines. Bottom line:

the most likely economic outlook is sanguine, characterized

by full employment and comfortably low inflation by early

next year. But it depends on the Federal Reserve successfully

calibrating monetary policy, and this tightening cycle will be

significantly different than the last one.

Smaller fiscal package

In the February vintage of the baseline forecast, Democrats

pass a $1.2 trillion Build Back Better package of social safety

net and climate investments in the first half of 2022. Some

implementation will occur by the end of the second quarter.

Most notably, this is less than the $1.8 trillion package

assumed in prior baselines.

We dropped the following investments: $210 billion for

home care, $150 billion for affordable housing, $135 billion

for an expanded Earned Income Tax Credit, and $30 billion

for higher education. As a result, the remaining initiatives

are $560 billion for clean energy and the climate, $430

billion for healthcare coverage, $215 billion for universal

preschool, and $45 billion for a fully refundable Child Tax

Credit. The first three are provisions that West Virginia

Democrat Joe Manchin has said he would support, while a

fully refundable CTC would be a consolation prize for

Democrats , who had sought to extend the enhanced CTC

from the American Rescue Plan. Under our new assumption,

gross BBB investments represent 0.1% of GDP in 2022,

0.3% in 2023, and 0.4% in 2024 before peaking at nearly

0.5% in 2026.

The cost of the BBB investments are nearly paid for by

higher taxes on corporations and well-to-do households, as

well as prescription drug savings. Because the dollar figure of

BBB investments is lower than before, we have also

jettisoned some of the pay-fors that we previously assumed.

Specifically, we dropped a 15% corporate minimum tax on

large corporations, as well as new surtaxes on the top 0.02%

of earners.

Besides the two examples mentioned above, the rest of our

BBB pay-fors are the same as before. The February forecast

still includes the following changes to the personal tax code:

ensuring high-income business owners pay either the 3.8%

Medicare tax or the 3.8% net investment income tax, and

limiting business loss deductions for noncorporate

taxpayers. In addition, IRS funding would increase to

improve tax compliance. On the corporate side, a new

excise tax would apply to stock buybacks, and U.S.

multinationals would face higher taxes on global intangible

low-taxed income, among other international tax changes.

Finally, we assume prescription drug savings would come

from repealing a Trump-era rule that would eliminate safe

harbor from a federal anti-kickback law for rebates paid by

pharmaceutical manufacturers to health plans and

pharmacy benefit managers in Medicare Part D.

That said, the longer it takes Democrats to rally around BBB,

the closer we get to discarding BBB altogether from the

baseline forecast. For now, we still assume Democrats will

strive to pass some version of BBB in a bid to rally their base

ahead of the 2022 midterm election. The State of the Union

address on March 1 is an opportunity for Democrats to

outline a resurrected BBB that President Biden can then tout

during his address.

If we do not get any BBB clarity by the SOTU address, the

March forecast will likely water down our assumption of a

$1.2 trillion package to one costing about $600 billion .

Moreover, we would delay the start of implementation from

the second to the third quarter. An approximately $600

billion BBB package would largely revolve around green

energy tax credits and climate investments. It could also

include modest amounts of social safety net spending.

It would not be a game changer for the economy if the BBB

failed to become law, but it will diminish the economy’s

growth prospects and ding the fortunes of lower- and

middle-income households. Our outlook for real GDP

growth in 2022 would be reduced by 0.75 percentage point,

since BBB is front-loaded—with budget deficits in the near

term and surpluses in the longer run that roughly net out

over the 10-year budget horizon. Long term, the economy’s

potential growth would be reduced by several basis points

per year as the BBB agenda lifts labor force participation by

lowering the cost of work, particularly for lower-income

minority women.

COVID-19 assumptions

We adjusted our epidemiological assumptions to anticipate

that total confirmed COVID-19 cases in the U.S. will be 82.9

million, noticeably less than the January baseline

assumption that cases would total 107.1 million. However,

the number of assumed cases is still well above that

assumed before the Omicron variant. The seven-day moving

average of daily confirmed cases has dropped sharply

recently and is around 250,000, below its recent peak of

807,000. The date for abatement of the pandemic, where

total case growth is less than 0.05% per day, changed

slightly; it is now April 4, a few weeks earlier than in the

January baseline.

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

10

We have replaced the concept of herd immunity with

“effective immunity,” which is a rolling number of infections

plus vaccinations to account for the fact that immunity is

not permanent. The forecast still assumes that COVID-19

will be endemic and seasonal.

A little less balmy

The new fiscal policy assumptions about the Omicron

variant of COVID-19 led to a downward revision to the

forecast for real GDP growth this year; it is now expected to

be 3.7% at an annualized rate, compared with 4.1% in the

January baseline. The bulk of the downward revision was in

the first quarter, as real GDP is expected to rise 0.5% at an

annualized rate. Our high-frequency GDP model now has

first-quarter GDP on track to rise 0.8% at an annualized

rate. Risk bias, or the difference between our high-frequency

GDP model’s estimate of fourth-quarter GDP growth and

our official forecast, is 0.3 percentage point. It's early in

tracking first-quarter GDP, as there isn’t a lot of source data

released.

We expect GDP growth to bounce back in the second

quarter, similar to the pattern seen during the Delta wave.

The forecast is for GDP to rise 6% at an annualized rate in

the second quarter, but it will be south of 3% at an

annualized rate in the second half of the year. We look for

GDP to rise 3% next year, a touch lighter than the 3.1% in

the January baseline. The Bloomberg consensus is for real

GDP to increase 3% this year and 2.5% in 2023.

Inventories and global supply-chain issues remain a

downside risk to the near-term forecast. The level of real

GDP is currently 0.6% lower than if the recession didn’t

happen and the pre-pandemic trend had continued; that

gap will be closed later this year, but inventories are a risk.

Inventories played an enormous role in the gain in fourth-

quarter GDP. Inventories jumped by $173.6 billion at an

annualized rate in the fourth quarter after falling in each of

the prior three months. Inventories added 4.9 percentage

points to fourth-quarter GDP growth, among the largest

gains since the 1980s.

The sizable inventory build could be an issue for first-quarter

GDP growth because it is unlikely to be duplicated. For GDP,

it’s the change in the change in inventories that matters. In

other words, inventories would need to increase more than

that seen in the fourth quarter to add to first-quarter GDP

growth. That seems unlikely because of the Omicron variant

and its impact on supply chains.

Also, supply chains remain a downside risk. The issues with

U.S. supply chains are both supply- and demand-related. On

the demand front, wealth effects associated with rising asset

prices, unprecedented fiscal stimulus, and fewer

opportunities to spend on services led to an enormous

increase in consumer goods spending. The good news is that

our U.S. Supply- Chain Stress Index has improved recently

along with our Asia-Pacific region SCSI.

Business investment and housing

Fundamentals remain supportive but less so than in January,

for business investment as corporate credit spreads have

widened. However, corporate profit margins are fairly wide,

and banks are easing lending standards.

We have real business equipment spending rising 8.2% this

year, compared with 9.7% in the January baseline. The

forecast is for real business equipment spending to increase

5.4% in 2023, a touch stronger than the 5.2% gain in the

January baseline forecast.

Risks are weighted to the downside, as financial markets

could tighten more than we anticipate and corporate credit

spreads widen further. The correlation coefficient between

monthly changes in the high-yield corporate bond spread

and changes in the S&P 500 is -0.71 since 2000. The

relationship is still strong if we look at it on a weekly basis.

Using no and various lags, the Granger causality tests

showed changes in the S&P 500 caused changes in the

high-yield corporate bond spread. The causal relationship

runs in one direction. Also, now that interest rates are rising

and the market value of global bonds with negative yields is

declining, it could put some upward pressure on U.S. long-

term rates and cause some widening in high-yield corporate

bond spreads as investors have less pressure to search for

yield.

The real nonresidential structures investment was cut this

year and next. We now look for real nonresidential

structures investment to rise 11% this year (17% in the

January baseline) and 10.7% in 2022 (11.5% in the January

baseline). The downward revision to the forecast was broad-

based across components, including structures investment

in commercial/healthcare and manufacturing. We did revise

higher the forecast for structures investment in mining

exploration, shafts and wells because of the rise in energy

prices. The Bureau of Economic Analysis uses the American

Petroleum Institute’s weighted average of footage drilled

along with rotary rig counts from Baker Hughes in its

current-quarter estimate of private fixed investment in

mining exploration, shafts and wells. This segment now

accounts for more than 10% of nominal private fixed

investment in nonresidential structures. Therefore, a sudden

rise in energy prices would lead to an increase in the number

of active rotary rigs. Separately, growth in the Commercial

Property Price Index was revised higher by 30 basis points

this year and next, to 1.7% and 2.3%, respectively.

Revisions to housing starts were small. Housing starts are

expected to be 1.84 million, compared with 1.82 million in

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

11

the January baseline. Revisions to housing starts next year

were also modest. Risks are heavily weighted to the

downside. There are likely only so many homes that can be

built each year because of labor-supply constraints and lack

of buildable lots. Some of the labor-supply issues will ease

as the pandemic winds down, but the reduction in

immigration is particularly problematic for homebuilders'

ability to find workers. Revisions to the forecast for new-

and existing-home sales this year were minor, as mortgage

rates haven’t risen either fast or high enough to cut

noticeably into sales.

We nudged up the forecast for the FHFA All-Transactions

House Price Index this year, with it rising 9.8%, compared

with 8.9% in the January baseline. House price growth

moderates noticeably in 2023, as prices are forecast to rise

2.4%, a touch stronger than the 2.1% in the January

baseline. This is attributable to rebalancing of supply and

demand.

Labor market weathers Omicron

The January jobs report delivered an upside surprise with

gains totaling 467,000, which far exceeded expectations.

After much concern, the impact of the Omicron virus

variant on job growth was minimal, as January’s total fell

only slightly short of the impressive 555,000 average gain in

2021. Given that the Omicron wave has already begun to

fade, the stage is set for substantial payroll gains to continue

this year.

The January employment data are incorporated into the

February baseline forecast. They led to minor tweaks to the

forecast. We have job growth averaging 384,000 per month

this year, better than the 360,000 in the January baseline

forecast. There wasn’t any material change to the forecast

for the unemployment rate this year, but it's now expected

to bottom at 3.3% next year, compared with 3.2% in the

baseline forecast.

We assume a full-employment economy is one with a 3.5%

unemployment rate, around a 62.5% labor force

participation rate, and a prime-age employment to

population ratio of 80%. All of these conditions will be met

by late this year or early next.

Marching toward March

The Federal Open Market Committee used its January

meeting to tee up the potential for the first increase in the

target fed funds rate as early as March. The post -meeting

statement noted that it “will soon be appropriate” to raise

the target range for the fed funds rate. The inflation criteria

for raising interest rates had already been met, but the Fed

was waiting for further improvement in the labor market,

and the market appears closer to meeting the threshold. The

statement described the labor market as “strong.” This was

absent in the December statement. It looks as if the tapering

process will end a week earlier; the statement said the

process will be wrapped up in early March rather than mid-

month. The statement subtly hints that the balance sheet

will eventually shrink.

Given Fed communication, new data on inflation, and job

growth, we have pulled our first rate hike forward to March.

We expect the Fed to raise the funds rate three additional

times this year, once each quarter, by 0.25 percentage point

each time. The Fed is also expected to begin quantitative

tightening this summer. That is, the central bank will not

replace the Treasury and mortgage securities it owns as they

mature or prepay, allowing its balance sheet to slowly

shrink, and putting upward pressure on longer-term rates.

We didn’t make significant changes to the forecast for the

10-year Treasury yield.

The forecast for the Dow Jones Industrial Average was

unchanged between the January and February baseline

forecasts. It still calls for stocks to steadily decline this year,

bottoming in early 2023.

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

12

THE LONG VIEW: EUROPE

Russia’s Invasion Worsens Energy Crisis

BY BARBARA TEIXEIRA ARAUJO AND

OLGA KURANOVA

Financial markets were rattled on Thursday after Russian

President Vladimir Putin launched a broad military offensive

targeting Ukraine . The attack came as a surprise and took

place on multiple fronts, prompting Western leaders to

threaten to impose further sanctions on Russia in the

coming hours or days. These will have grave consequences

for the financial markets and the economy.

The scale of the economic disruption will depend on the

extent of the sanctions, which could range from export

bans—most notably in energy and commodities markets—

to Russia being cut off from the SWIFT global interbank

payments system. Although Ukraine and Russia will be hit

the hardest, most global economies will feel the pain.

The per-barrel price of Brent crude has already surged more

than 6% to $102.85 , the first time it has breached the $100

mark since 2014. The price of U.S. WTI crude rose by almost

6% to $97.47 . Most shocking was the jump in European gas

prices, which climbed by around 40% to reach €115 MWh.

Although oil and gas flows from Russia to Europe have not

been disrupted yet, Western nations will likely impose

further harsh sanctions on Russia, prompting a decline or

eventually a full stop in gas imports from Russia .

Oil prices were already high as international futures markets

rose considerably during January. The average per-barrel

futures price for Brent crude was up 14.4% from December

to January. Consumers’ gas prices also increased. Although

market natural gas prices actually declined in January, some

companies continued to pass through higher prices to

consumer electricity bills, which is not immediate. Indeed,

households’ utility contracts in much of Europe are

negotiated on a fixed-price basis, and some companies

managed to hike their rates only in January, with further

hikes planned for coming months.

Rising oil prices will fortify Russia’s economy, but longer-

term consequences of a war could crimp the nation’s status

as a key exporter. Russia is the world’s third-biggest oil

producer and second-biggest producer of natural gas:

Almost two-thirds of Russia’s natural gas exports flow to

Europe along with around half of its global oil sales. This

revenue will help Russia’s economy and compensate in part

for any upcoming embargo on exports. However, the tide is

turning for Europe’s dependency on Russian energy, and this

could have longer-term consequences for the nation. As part

of the backlash against Russia's actions, Germany refused to

certify the Nord Stream 2 pipeline earlier this week. On

Thursday, U.S. President Biden announced sanctions against

the firm in charge of building the gas pipeline. Overall

European sentiment has recently prioritized diversifying

away from Russian-provided energy.

In the near term, higher gas and oil prices will likely push up

inflation across Europe , which is already seeing record-high

prices for food and energy. In the short term, Ukraine will

suffer the brunt of the fallout, as activity in the country is

disrupted across the board. Meanwhile, several European

nations that depend on food and industrial exports from

Russia and Ukraine will also feel the squeeze. The extent to

which the broader world economy will be impacted depends

on the level of measures implemented by Western leaders.

It is difficult to gauge how things will evolve in the coming

days, but we expect that oil and gas prices will continue to

increase, and this will worsen the energy price crisis

throughout Europe . Commodity prices, especially that of

aluminum, will also reach record highs, as investors fear a

disruption in supplies from Russia , which is a major metal

producer. Elsewhere, volatility will remain the word of the

day, with stocks under pressure and money flowing to safe

havens.

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

13

THE LONG VIEW: ASIA-PACIFIC

Central Banks Return to Normalisation

BY SHAHANA MUKHERJEE AND ILLIANA JAIN

Interest-rate decisions dominated headlines in the Asia-

Pacific region. The Bank of Korea decided to leave its

benchmark policy rate unchanged, at 1.25%, at its February

meeting. This was in line with our expectations after the 25-

basis point rate increase in January.

The central bank noted that the global economy had

continued to recover despite the disruptions caused by

Omicron and other variants of the COVID-19 virus.

Importantly, this process has been anchored by improving

vaccination rates. That said, pandemic-related uncertainty,

inflation pressures, monetary policy changes, and

geopolitical factors will continue to shape global growth and

financial markets.

South Korea’s growth prospects have largely held up in the

face of multiple COVID-19 resurgences, partly because

robust global demand has generated a consistently strong

export performance. The country’s unique position in the

global semiconductor industry will continue to be a key

source of strength in coming quarters. And private

consumption and facilities investment, which had

moderated because of outbreaks and associated supply

disruptions, are expected to gradually pick up and bolster

growth beyond the current quarter.

The Bank of Korea’s gradual restoration of the benchmark

policy rate to its pre-pandemic level of 1.25% was intended

to tame inflation pressures and the buildup of financial

imbalances in the interest of long-term financial stability.

But this normalisation of interest rates also showed

confidence in the strength of the economic recovery.

Tackling inflation is one of the BoK’s main priorities, even

with the virus keeping the domestic economic recovery

from hitting its full stride. January’s headline inflation

remained uncomfortably high at 3.6%, while core inflation

gained pace, rising to 3% from 2.7% previously. With energy

prices staying high, the impact of pandemic-related

uncertainty on global growth yet to settle, and geopolitical

developments causing near-term volatility in oil prices, the

potential for inflation to remain above 3% in the coming

months is high. We see this as one of the main drivers that

will lead to further rate hikes in 2022.

Moody’s Analytics forecasts South Korea’s inflation to hold

above 3% this quarter and drop nearer to 2% only in the

second half of this year. Assuming that the U.S. Federal

Reserve moves with a 25-basis point rate hike in March, we

expect the BoK to implement a total of three rate hikes in

2022, which will take the benchmark policy rate to 1.75% by

the end of 2022. The upcoming presidential election and the

ending of Lee Ju-Yeol’s term as BoK governor add some

uncertainty regarding the timing of the next rate hike.

Elsewhere, the Reserve Bank of New Zealand raised its

official cash rate by 25 basis points to 1% in February. This

increase, which follows others in October and November,

returns the benchmark policy rate to its pre-pandemic level.

The central bank also said that it will gradually reduce its

bond holdings under its asset purchase program through

bond maturities and managed sales. The rate hike was

consistent with our expectations and in line with the central

bank’s guidance on its intention to progress monetary

tightening. The unwinding of quantitative easing shows that

the RBNZ is getting serious about tackling inflation and that

interest rates may increase faster than anticipated this year.

New Zealand is imposing more restrictions to slow the

spread of the Omicron variant. It is also preparing for a

staged reopening of its borders, starting later this month. It

is worth noting that self-isolation restrictions are likely to

remain in place until late 2022 for some arrivals. The central

bank observed that although domestic spending and

investment have been strong, recent conditions have been

difficult for those businesses most exposed to pandemic-

related restrictions. Additionally, the central bank said

Omicron will disrupt economic activity, with the severity of

disruptions closely tied to health outcomes.

Prolonged border closures have progressively tightened the

labour market in New Zealand , placing upward pressure on

wages. The outlook for net migration and its implications for

labour supply is uncertain.

But it was not surprising that the central bank upwardly

revised its March-quarter CPI inflation forecast to 6.6% year

over year from the 5.7% cited in the prior policy statement.

The revision was attributed to domestic capacity

constraints—the economy is operating well above

potential—and higher prices for imported goods, the result

of supply-chain disruptions. Fuel prices have risen

dramatically and are likely to stay high, as supply-side issues

remain.

The central bank said it had considered increasing the

benchmark by 50 basis points but opted for 25 basis points,

partly because of the uncertainty about Omicron. In

addition to the rate hike, the sales of its bond holdings will

put pressure on long-term interest rates. Notably, the cash

rate is expected to peak at a higher rate than expected in

the previous statement.

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

14

We expect the RBNZ to stay committed to its tightening

stance, with the pace of normalisation to be faster than

previously expected. The next monetary policy review

should provide more insight on how the economy reacts to

the Omicron variant and the monetary policy tightening in

place so far.

PBoC holds fire on LPR

As expected, the People’s Bank of China left interest rate

settings unchanged at its February meeting. The one-year

loan prime rate was kept steady at 3.7% and the five-year

loan prime rate at 4.6%. This decision was anticipated by

markets after the PBoC left the interest rate on one-year

medium-term lending facility loans unchanged, at 2.85%, in

last week’s announcement. The decision to maintain the

status quo follows rate cuts announced last month, on the

medium-term lending facility rate and subsequently the

one-year and three-year loan prime rates, which were part

of a broader policy push to counter China’s slowing growth.

Fears surrounding property market weakness and the

potential for strong spillovers to the domestic financial

system remain pertinent. The PBoC’s commitment to an

accommodative monetary policy that is flexible but

targeted will help alleviate liquidity shortfalls in certain

sectors. Therefore, the PBoC is expected to continue with its

calibrated approach to monetary policy management for a

large part of this year. The pickup in new bank lending in

January to CNY3.98 trillion from CNY1.13 trillion in

December was partly due to seasonal factors but was

nonetheless favourable. So was January’s inflation reading at

0.9%, which will create some room for easing. More

liquidity injections are expected, and we do not dismiss the

possibility of additional cuts in the reserve requirement ratio

or the medium-term lending facility rate in the first half of

this year.

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

15

RATINGS ROUNDUP

Positive Week for U.S. Credit Ratings

BY STEVEN SHIELDS

U.S.

U.S. credit rating activity was overwhelmingly positive in the

latest week. For the period ended February 18, credit

upgrades accounted for fourteen of the eighteen ratings

issued by Moody’s Investors Service and two-thirds of the

affected debt. Rating change activity spanned a diverse set

of industrial groups. Of the changes, Pioneer Natural

Resources Company’s senior unsecured bond rating was

raised to Baa1 from Baa2. In the ratings actions, Moody’s

Analyst John Thieroff said, “Pioneer's very strong

competitive position in the premier North American oil-

producing basin and financial policies will allow the

company to maintain modest financial leverage.” The

improved rating comes on the heels of an eventful year for

Pioneer with the company closing on the acquisitions of

Parsley Energy and DoublePoint Energy. Meanwhile, Xerox

Holdings Corporation headlined U.S. credit downgrades with

its corporate family and senior unsecured ratings lowered to

Ba2 from Ba1. The rating action reflects Moody's

expectation that revenue growth in 2022 will remain

challenged by supply-chain disruptions and the slowdown in

return-to-office trends. It also reflects Xerox's willingness to

fund significant share buybacks in the fourth quarter and

engage in aggressive financial policies considering its weak

21Q4 operating results.

Europe

Western European rating change activity was negative with

only two credit ratings issued in the period. Electricite de

France was the largest change in the region with Moody’s

Investors Service downgrading EDF’s long-term issuer rating

and senior unsecured ratings to Baa1 from A3. This rating

action follows the firm’s action plan announcement to

mitigate low nuclear output over the next two years and

reflects Moody's view that EDF's risk profile has become

more volatile because of unstable and unpredictable nuclear

output associated with fleet ageing, increased exposure of

earnings to volatile wholesale electricity prices, and

detrimental political intervention to protect end-customers

in a context of elevated power prices.

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

16

RATINGS ROUND-UP

0.0

0.2

0.4

0.6

0.8

1.0

0.0

0.2

0.4

0.6

0.8

1.0

Apr01

Aug04

Dec07

Apr11

Aug14

Dec17

Apr21

FIGURE 1

Rating Changes - US Corporate & Financial Institutions: Favorable as a % of Total Actions

By Count of Actions

By Amount of Debt Affected

* Trailing 3-month average

Source: Moody's

FIGURE 2

BCF

Bank Credit Facility Rating

MM

Money-Market

CFR

Corporate Family Rating

MTN

MTN Program Rating

CP

Commercial Paper Rating

Notes

Notes

FSR

Bank Financial Strength Rating

PDR

Probability of Default Rating

IFS

Insurance Financial Strength Rating

PS

Preferred Stock Rating

IR

Issuer Rating

SGLR

Speculative-Grade Liquidity Rating

JrSub

Junior Subordinated Rating

SLTD

Short- and Long-Term Deposit Rating

LGD

Loss Given Default Rating

SrSec

Senior Secured Rating

LTCF

Long-Term Corporate Family Rating

SrUnsec

Senior Unsecured Rating

LTD

Long-Term Deposit Rating

SrSub

Senior Subordinated

LTIR

Long-Term Issuer Rating

STD

Short-Term Deposit Rating

Rating Key

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

17

FIGURE 3

Rating Changes: Corporate & Financial Institutions - US

Date

Company

Sector

Rating

Amount

($ Million)

Up/

Down

Old

LTD

Rating

New LTD

Rating

IG/S

G

2/16/2022

OLD NATIONAL BANCORP-FIRST MIDWEST

BANK

Financial

LTIR/LTD/Sub/PS

485.00

U

Baa2

A3

IG

2/16/2022

PITNEY BOWES INC.

Industrial

SrUnsec/SrSec/BCF/

LTCFR/PDR

1653.06

D

B1

B3

SG

2/16/2022

TORO COMPANY (THE)

Industrial

SrUnsec

225.00

U

Baa3

Baa2

IG

2/16/2022

DIVERSIFIED HEALTHCARE TRUST

Industrial

SrUnsec/LTCFR

2850.00

D

B1

B3

SG

2/16/2022

RESIDEO TECHNOLOGIES, INC. - RESIDEO

FUNDING INC.

Industrial

SrUnsec/SrSec/BCF/

LTCFR/PDR

300.00

U

B1

Ba3

SG

2/16/2022

CHINOS INTERMEDIATE 2 LLC

Industrial

SrSec/BCF/LTCFR/PDR

U

B3

B2

SG

2/17/2022

CARPENTER TECHNOLOGY CORPORATION

Industrial

SrUnsec/LTCFR/PDR

700.00

D

Ba3

B2

SG

2/17/2022

REGIONS FINANCIAL CORPORATION

Financial

SrUnsec/LTIR/LTD/Sub/

PS

4700.00

U

Baa2

Baa1

IG

2/17/2022

PIONEER NATURAL RESOURCES COMPANY

Industrial

SrUnsec/LTIR/Sub/PS

5735.79

U

Baa2

Baa1

IG

2/17/2022

GATES GLOBAL LLC

Industrial

SrUnsec/SrSec/BCF/

LTCFR/PDR

568.00

U

Caa1

B3

SG

2/17/2022

ENGINEERED MACHINERY HOLDINGS, INC.

Industrial

SrSec/BCF/LTCFR/PDR

U

SG

2/17/2022

XEROX HOLDINGS CORPORATION

Industrial

SrUnsec/LTCFR/PDR

3700.00

D

Ba1

Ba2

SG

2/18/2022

D.R. HORTON, INC. - FORESTAR GROUP INC. Industrial

SrUnsec/LTCFR/PDR

700.00

U

B1

Ba3

SG

2/18/2022

PRO MACH GROUP, INC. (OLD)-PRO MACH

GROUP, INC.

Industrial

SrSec/BCF/LTCFR/PDR

U

B2

B1

SG

2/18/2022

CAA HOLDINGS, LLC-CREATIVE ARTISTS

AGENCY, LLC

Industrial

SrSec/BCF/LTCFR/PDR

U

B3

B2

SG

2/18/2022

EIF CHANNELVIEW HOLDINGS II, LLC-EIF

CHANNELVIEW COGENERATION, LLC

Industrial

SrSec/BCF

U

Ba3

Ba1

SG

2/18/2022

MR. COOPER GROUP INC. -NATIONSTAR

MORTGAGE HOLDINGS INC.

Financial

SrUnsec/LTIR

2700.00

U

B2

B1

SG

2/22/2022

ENERGY TRANSFER LP-SUNOCO LP

Industrial

SrUnsec/LTCFR/PDR

2600.00

U

B1

Ba3

SG

Source: Moody's

FIGURE 4

Rating Changes: Corporate & Financial Institutions - Europe

Date

Company

Sector

Rating

Amount

($ Million)

Up/

Down

Old

LTD

Rating

New

LTD

Rating

O

d

IG/

SG

Country

2/18/2022

ANACAP FINANCIAL EUROPE S.A. SICAV-RAIF Financial

SrSec

358.13

D

B2

B3

SG LUXEMBOURG

2/21/2022

ELECTRICITE DE FRANCE

Utility

SrUnsec/LTIR/JrSub

63904.99

D

A3

Baa1

IG FRANCE

Source: Moody's

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

18

MARKET DATA

0

200

400

600

800

0

200

400

600

800

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Spread (bp)

Spread (bp)

Aa2

A2

Baa2

Source: Moody's

Figure 1: 5-Year Median Spreads-Global Data (High Grade)

0

400

800

1,200

1,600

2,000

0

400

800

1,200

1,600

2,000

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Spread (bp)

Spread (bp)

Ba2

B2

Caa-C

Source: Moody's

Figure 2: 5-Year Median Spreads-Global Data (High Yield)

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

19

CDS MOVERS

CDS Implied Rating Rises

Issuer

Feb. 23

Feb. 16

Senior Ratings

Meritor, Inc.

Baa2

B1

B1

PepsiCo, Inc.

Aa1

Aa2

A1

3M Company

Aa3

A1

A1

Merck & Co., Inc.

Aa3

A1

A1

Charles Schwab Corporation (The)

A2

A3

A2

Becton, Dickinson and Company

Baa1

Baa2

Baa3

Waste Management, Inc.

A2

A3

Baa1

Cargill, Incorporated

A1

A2

A2

Emerson Electric Company

A3

Baa1

A2

Welltower Inc.

A1

A2

Baa1

CDS Implied Rating Declines

Issuer

Feb. 23

Feb. 16

Senior Ratings

CenterPoint Energy, Inc.

Baa2

A3

Baa2

PepsiCo, Inc.

A2

A1

A1

Philip Morris International Inc.

A2

A1

A2

General Electric Company

Baa3

Baa2

Baa1

Eli Lilly and Company

Aa2

Aa1

A2

FirstEnergy Corp.

Baa3

Baa2

Ba1

Emerson Electric Company

Baa1

A3

A2

Danaher Corporation

A3

A2

Baa1

Archer-Daniels-Midland Company

A2

A1

A2

United Rentals ( North America ), Inc.

Ba2

Ba1

Ba2

CDS Spread Increases

Issuer

Senior Ratings

Feb. 23

Feb. 16

Spread Diff

Talen Energy Supply, LLC

Caa2

4,421

4,168

253

American Airlines Group Inc.

Caa1

836

774

63

CSC Holdings , LLC

B3

471

409

62

Rite Aid Corporation

Caa2

1,191

1,145

46

Lumen Technologies, Inc.

B2

513

469

44

TEGNA Inc.

Ba3

512

474

38

Nabors Industries, Inc .

Caa2

630

592

38

R.R. Donnelley & Sons Company

B3

215

180

35

International Game Technology

B2

313

279

34

Xerox Corporation

Ba2

296

267

29

CDS Spread Decreases

Issuer

Senior Ratings

Feb. 23

Feb. 16

Spread Diff

Meritor, Inc.

B1

85

300

-215

American Axle & Manufacturing, Inc .

B2

447

494

-46

Dillard's, Inc.

Baa3

112

125

-13

Realogy Group LLC

B2

373

381

-9

Macy's Retail Holdings, LLC

Ba3

311

317

-6

TJX Companies, Inc. (The)

A2

47

53

-6

Emerson Electric Company

A2

53

59

-5

Sysco Corporation

Baa1

75

80

-5

Avery Dennison Corporation

Baa2

50

54

-4

Commercial Metals Company

Ba2

192

197

-4

Source: Moody's, CMA

CDS Spreads

CDS Implied Ratings

CDS Implied Ratings

CDS Spreads

Figure 3. CDS Movers - US ( February 16, 2022 – February 23, 2022)

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

20

CDS Movers

CDS Implied Rating Rises

Issuer

Feb. 23

Feb. 16

Senior Ratings

Spain , Government of

Aa3

A1

Baa1

CaixaBank, S.A.

A3

Baa1

Baa1

Portugal , Government of

Aa3

A1

Baa2

UniCredit S.p.A .

Baa2

Baa3

Baa1

Svenska Handelsbanken AB

Aa1

Aa2

Aa2

Anheuser-Busch InBev SA /NV

Baa1

Baa2

Baa1

Banco Sabadell, S.A.

Baa2

Baa3

Baa3

BNP Paribas Fortis SA/NV

Aa3

A1

A2

NXP B.V.

A2

A3

Baa3

Banco BPI S.A.

Baa3

Ba1

Baa2

CDS Implied Rating Declines

Issuer

Feb. 23

Feb. 16

Senior Ratings

Carlsberg Breweries A/S

A2

Aa3

Baa2

Societe Generale

A2

A1

A1

Natixis

A2

A1

A1

Danske Bank A/S

A2

A1

A3

UniCredit Bank AG

Aa3

Aa2

A2

Credit Suisse Group AG

Baa3

Baa2

Baa1

Bayerische Motoren Werke Aktiengesellschaft

Baa1

A3

A2

ENGIE SA

A2

A1

Baa1

Norddeutsche Landesbank GZ

Baa2

Baa1

A3

E.ON SE

A3

A2

Baa2

CDS Spread Increases

Issuer

Senior Ratings

Feb. 23

Feb. 16

Spread Diff

Casino Guichard-Perrachon SA

Caa1

895

731

164

Novafives S.A.S.

Caa2

1,055

898

157

Boparan Finance plc

Caa1

1,400

1,324

76

Alpha Services and Holdings S.A.

Caa1

363

288

75

CMA CGM S.A.

B2

420

356

64

Piraeus Financial Holdings S.A.

Caa2

572

515

57

Vue International Bidco plc

Ca

627

597

31

TDC Holding A/S

B2

173

144

29

Vedanta Resources Limited

B3

825

800

24

Telefonaktiebolaget LM Ericsson

Ba1

113

92

22

CDS Spread Decreases

Issuer

Senior Ratings

Feb. 23

Feb. 16

Spread Diff

NXP B.V.

Baa3

49

51

-3

Finland , Government of

Aa1

7

9

-2

Swedish Export Credit Corporation

Aa1

7

10

-2

Sweden , Government of

Aaa

7

9

-2

Banco Sabadell, S.A.

Baa3

83

84

-1

British Telecommunications Plc

Baa2

103

104

-1

Denmark , Government of

Aaa

7

8

-1

ASML Holding N.V.

A2

44

45

-1

United Kingdom , Government of

Aa3

10

11

0

Ireland , Government of

A2

15

16

0

Source: Moody's, CMA

CDS Spreads

CDS Implied Ratings

CDS Implied Ratings

CDS Spreads

Figure 4. CDS Movers - Europe ( February 16, 2022 – February 23, 2022)

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

21

CDS Movers

CDS Implied Rating Rises

Issuer

Feb. 23

Feb. 16

Senior Ratings

Mitsubishi Corporation

Aaa

Aa1

A2

Oversea-Chinese Banking Corp Ltd

Aa3

A1

Aa1

Telstra Corporation Limited

A1

A2

A2

Shinhan Bank

Aa1

Aa2

Aa3

Woori Bank

Aa1

Aa2

A1

Korea Expressway Corporation

Aa2

Aa3

Aa2

SP PowerAssets Limited

Aa2

Aa3

Aa1

Flex Ltd.

Baa2

Baa3

Baa3

Nomura Securities Co., Ltd.

Baa1

Baa2

A3

Kia Corporation

A3

Baa1

Baa1

CDS Implied Rating Declines

Issuer

Feb. 23

Feb. 16

Senior Ratings

Westpac Banking Corporation

A1

Aa3

Aa3

Suncorp-Metway Limited

A3

A2

A1

JFE Holdings, Inc.

A2

A1

Baa3

ITOCHU Corporation

Aa1

Aaa

A3

Hitachi, Ltd.

Aa1

Aaa

A3

Japan , Government of

Aaa

Aaa

A1

China , Government of

A3

A3

A1

Australia , Government of

Aaa

Aaa

Aaa

India , Government of

Baa3

Baa3

Baa3

Indonesia , Government of

Baa3

Baa3

Baa2

CDS Spread Increases

Issuer

Senior Ratings

Feb. 23

Feb. 16

Spread Diff

Halyk Savings Bank of Kazakhstan

Ba2

337

315

23

Pakistan , Government of

B3

425

415

10

SoftBank Group Corp.

Ba3

341

332

9

Development Bank of Kazakhstan

Baa2

148

140

8

SK Hynix Inc.

Baa2

86

79

8

Tata Motors Limited

B1

246

239

7

Holcim Finance ( Australia ) Pty Ltd

Baa2

101

95

6

Kazakhstan , Government of

Baa2

82

78

5

Indonesia , Government of

Baa2

95

91

4

JFE Holdings, Inc.

Baa3

45

42

4

CDS Spread Decreases

Issuer

Senior Ratings

Feb. 23

Feb. 16

Spread Diff

Flex Ltd.

Baa3

80

89

-9

Bank of East Asia, Limited

A3

68

71

-3

Woori Bank

A1

28

28

-1

Japan , Government of

A1

17

17

0

Korea , Government of

Aa2

27

27

0

Chubu Electric Power Company, Incorporated

A3

23

23

0

Nomura Holdings, Inc.

Baa1

74

74

0

Shinhan Bank

Aa3

29

29

0

Kyoto , City of

A1

24

24

0

Korea Expressway Corporation

Aa2

35

35

0

Source: Moody's, CMA

Figure 5. CDS Movers - APAC ( February 16, 2022 – February 23, 2022)

CDS Implied Ratings

CDS Implied Ratings

CDS Spreads

CDS Spreads

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

22