RWS Group: The risks and rewards of patent translation

One-line summary

RWS Group is a profitable and well managed company, with a defined moat of expertise, but EU legislation threatens its business model and this uncertainty will take many years to play out.

Introduction

RWS Group are one of those low-profile, sensibly-profitable, cash-rich companies that many investors like to have in their portfolio. They may not be a household name but in the world of technical translation for global corporates they appear to be a "go-to" kind of firm. Even better while their listed history, on AIM, extends only to 2003 the group can trace its patent translation roots back to 1958. So that provides a lengthy track-record and a sensible name (derived from Randall Woolcott Services) as good points already!

In addition RWS Group is a proper growth company with turnover tripling, and profit increasing five times over, during the past decade. Most of this has been generated organically, with only a few targeted acquisitions here and there, and the company truly provides global operations serving multiple industry verticals.

What's not to like? Well such success has drawn the attention of government regulators; they, quite sensibly, see the mish-mash of national patent laws as a sizeable frictional cost for business and a deterrent to innovation. Back in 2008 the London Agreement came into force with the explicit goal of reducing the volume of translation required. Now the European Unitary Patent is moving slowly towards ratification. These risks will be considered later but before that I'm going to look into the quality of earnings, the sustainability of cash generation and the equity used to support both of these.

Excellent track-record

When looking at a new company I always check out the various profit margins (gross, operating and net). This gives me a feel for how much pricing power the business has and whether they have good control over their sales and administration costs. If any of these margins are slim (less than 10% say) then that's a cause for concern.

Fortunately RWS is able to command decent margins and these show very little volatility:

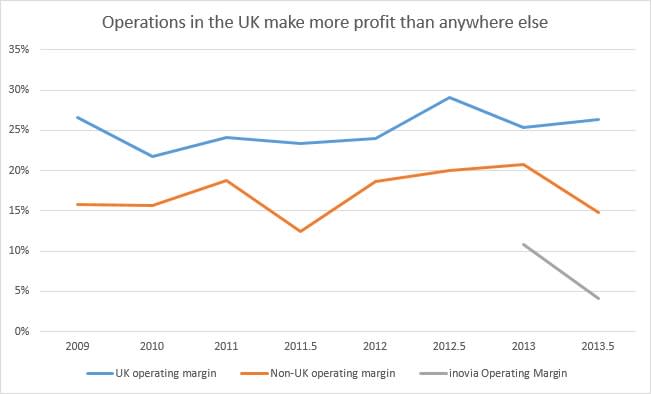

However the margins have fallen off 2-3% in the last couple of years and much of this change is down to the acquisition of inovia (essentially a quotation engine for translations). The margins here are low and falling:

While inovia appears extremely useful as a means to drive business to RWS it isn't a profit engine in its own right. For comparison PatBase is extremely profitable and clearly occupies a hard-to-copy-niche with its database of 45 million patents. Sadly PatBase provides less than 10% of the firm's turnover and this fraction is pretty static:

The upshot of this is that margins are very much driven by core translation business carried out in the UK although, to be fair, RWS are making a genuine effort to diversify. Historically a very large percentage of turnover (70% or more) has been generated by customers based in Europe and this is a business risk due to the European Unitary Patent. So RWS have been pushing towards winning more non-EU business and moving away from a reliance on patent translation:

Clearly this diversification is paying off with the EU-generated percentage of turnover down to 50%. On the other hand the translation business performed by UK operatives is much more profitable than that handled by non-UK staff. So there is an element of tension here given that UK staff are more likely to be handling European translation:

Given that RWS have decent sales and margins my next question is whether they're able to turn their declared profits into cash. A surprisingly large number of companies seem unable to achieve this so it's reassuring to see all of the operating profit consistently convert into cash flow here:

Even better pretty much all of this money is free cash-flow and thus isn't required to cover recurring capital expenditure and such-like. With just a few dips, as a consequence of acquisitions and office expansion, most of the funds generated have gone straight into the bank account - which explains why RWS has remained debt-free since flotation:

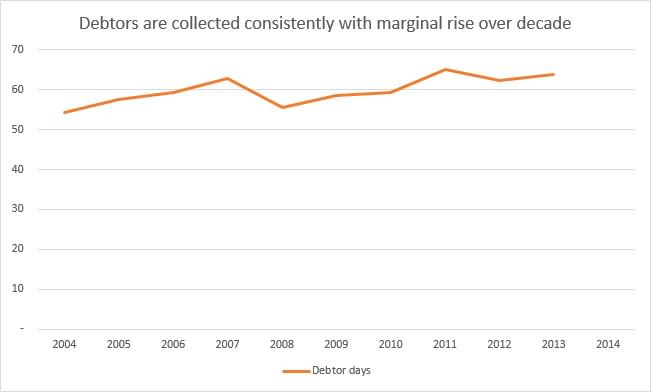

Granted the clear focus on cash and cost-control by management it's no real surprise that RWS ensures that customers pay up promptly. Despite the international growth of the business outstanding trade debtors have remained very stable as a fraction of turnover:

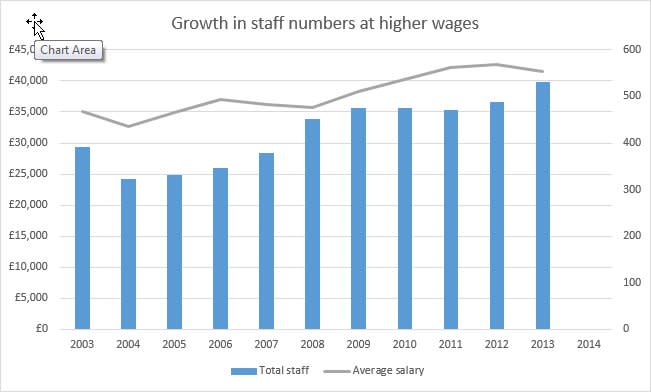

On the other hand this expansion has only been achievable because RWS employs a large number of very technical, high calibre translators who are able to meet the exacting needs of customers and the ISO 9001 certification that the company champions. I imagine that locating, and retaining, staff without blowing the budget is a constant headache for management. This quality comes at a cost:

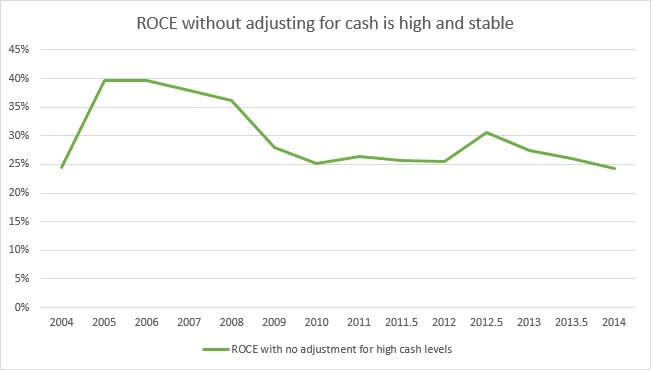

Progressing onto considering the quality of RWS's earnings the first metric that I like to examine is ROCE. If a company can consistently earn a return from its capital in excess of 20% then that's a strong indicator of quality and a firm's ability to add value from its incremental growth. On this front RWS presents well:

Considering all of the cash being thrown off by the business, and its distinctive franchise, it seems reasonable to ask whether shareholders are sharing in the success? From a share price perspective they've done well with this multiplying by over 7x in the decade to 2014 and for much of this period a pretty decent dividend has been paid:

Right now the yield on offer isn't great at 2.7% (bang on the average) but it is well-covered (about 1.75x) by earnings. The share is also expensive (P/E > 23) and new investors are being asked to pay a premium for current earnings and potential growth. The corollary of this is that the earnings yield is low (it's the inverse of the P/E ratio) and this acts as a cap on the maximum yield possible if every pound of profit is distributed:

As things stand RWS is not a high-yield share then! On the flip-side will the share price growth continue? What's plain from the share price chart is that the all-time maximum of just over £10 was hit 11 months ago and since then it's been largely downhill all the way. Why is this? Let's see.

How does the future look?

In a word: challenging. The problem isn't customers (the prospect pipeline is healthy); it's the European Unitary Patent and its slow grinding towards implementation. This may not take place before 2016 but it is inevitable; hence broker profit forecasts have slumped by about 10% in the past year. That said management are pretty sanguine about the legislation:

Because the proposed Unitary Patent will run in parallel with the existing system, it will not provide any financial advantage to many corporates seeking patent protection in only selected key countries, and will have a new and untried litigation system. Our research indicates that there is currently little interest amongst large corporates and their professional advisers in full usage of the new system. That being the case, we anticipate minimal, incremental loss of revenues in the first few years after the introduction of the Unitary Patent.

Now I take anything that directors say with a large pinch of salt but they do have a decent track record in this department. Five years ago the London Agreement came into force and management both accurately forecast the drop in patent translation revenue and handled this without undue impact on the business.

Even so not everyone is so relaxed by the prospect of simplification in the EU patent world. There is a clear and present risk to RWS from these changes. Looking at this presentation on the financial impact of the unitary patent it seems that the average cost of a patent grant could drop from 32,000 Euros to just 5,000 Euros. That feels like quite a step-change but I guess that no one really knows how these changes will play out.

In the very same slide-deck Joseph Lenthall mentions that the EU authorities are publicly collaborating with Google to improve the capability of machine translation. This area is only going to grow in importance as another competitor to RWS. Now given the track-record of management and their transparency in steadily moving away from patents, as the core business, and onto other technical translation you've got to believe that they're putting in the leg-work to minimise this risk. Have they done enough though?

Conclusion

Looking at the positives RWS is clearly a well-run company with zero debt, a very stable share count and a strong balance sheet; there's no risk of the company failing on this front. It's a highly rated, cash generative enterprise that's grown consistently over last 10 years. Arguably the business was more capital-efficient in the first 5-years, than it has been over the last 5, but it remains a cash machine despite capex and acquisitions.

On the negative side the shares are as expensive as they have ever been and there's limited headroom for any increase in yield. Also the recent acquisition of inovia is barely profitable in its own right and this weighs on the margins of the business as a whole. While it's impossible to predict the future it's hard to see how the European Unitary Patent can have anything but a negative impact on profits since it's all about simplifying the IP process.

Weighing against this is the fact that the chairman, Andrew S Brode, clearly believes in the future of RWS since his stake stands in excess of £150M! From floatation he's barely off-loaded any shares and he's getting on a bit; hence this public statement that he intends to sell his shares for the benefit of his daughters. So a trade sale seems likely, sooner rather than later, and there must be some bid speculation in the current price.

Ultimately I can't make a decision about whether to invest in RWS or not. There is so much to like about this firm that in the absence of EU legislation I'd be taking a stake right now. But the director narrative in recent reports talks about a reasonable start to the year and continued consolidation; hardly words designed to set the pulse racing and not quite in keeping with the current P/E rating:

So on balance I'm going to hold off until the full annual report is published in mid-January. With this I'll have some extra detail on how profits have split across business segments and the success, or otherwise, of diversification plans. This feels like a low-risk approach as the shares don't go ex-dividend until the end of January and there are no obvious other share price drivers to worry about.

Read more investing articles & commentary from RandomAmbler

Yahoo Finance

Yahoo Finance