Saba Capital Management, L.P.'s Strategic Reduction in Nuveen Variable Rate Preferred & ...

Overview of the Recent Transaction

On September 5, 2024, Saba Capital Management, L.P. (Trades, Portfolio), a prominent investment firm based in New York, executed a significant transaction involving the shares of Nuveen Variable Rate Preferred & Income (NYSE:NPFD). The firm reduced its holdings by 381,250 shares, which impacted its portfolio by -0.12%. This move adjusted Saba Capital's position in NPFD to a new total of 1,182,814 shares, reflecting a 4.89% ownership in the company and making up 0.37% of Saba Capital's portfolio.

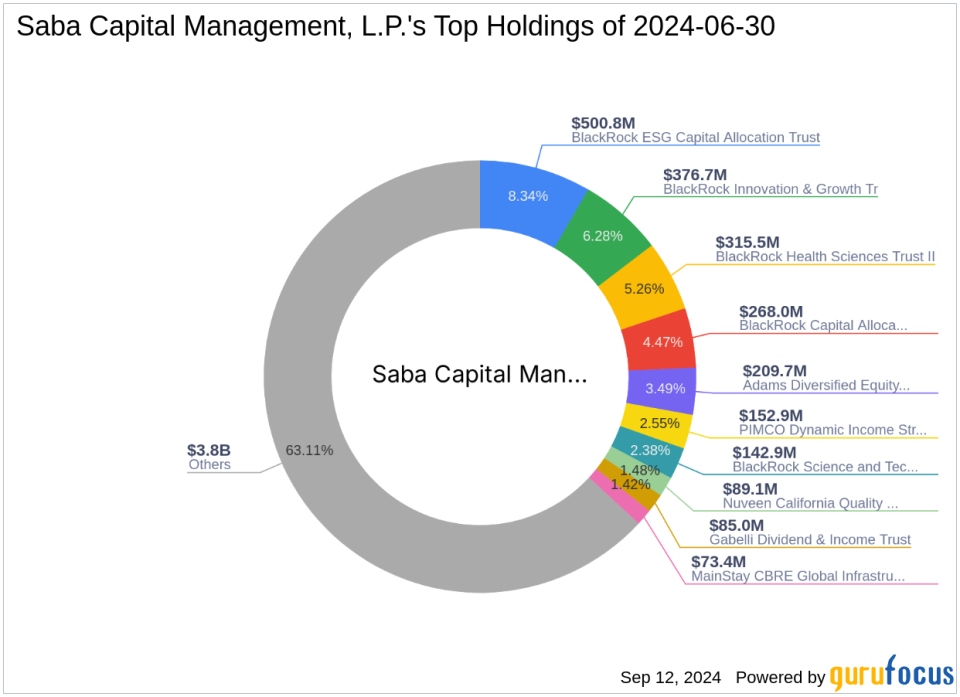

Insight into Saba Capital Management, L.P. (Trades, Portfolio)

Located at 405 Lexington Avenue, New York, NY, Saba Capital Management, L.P. (Trades, Portfolio) is renowned for its strategic investment approaches, focusing primarily on maximizing returns through diverse strategies. The firm manages an equity portfolio worth approximately $6 billion, with significant positions in sectors like Financial Services and Communication Services. Among its top holdings are Adams Diversified Equity Fund Inc (NYSE:ADX) and BlackRock Capital Allocation Trust (NYSE:BCAT).

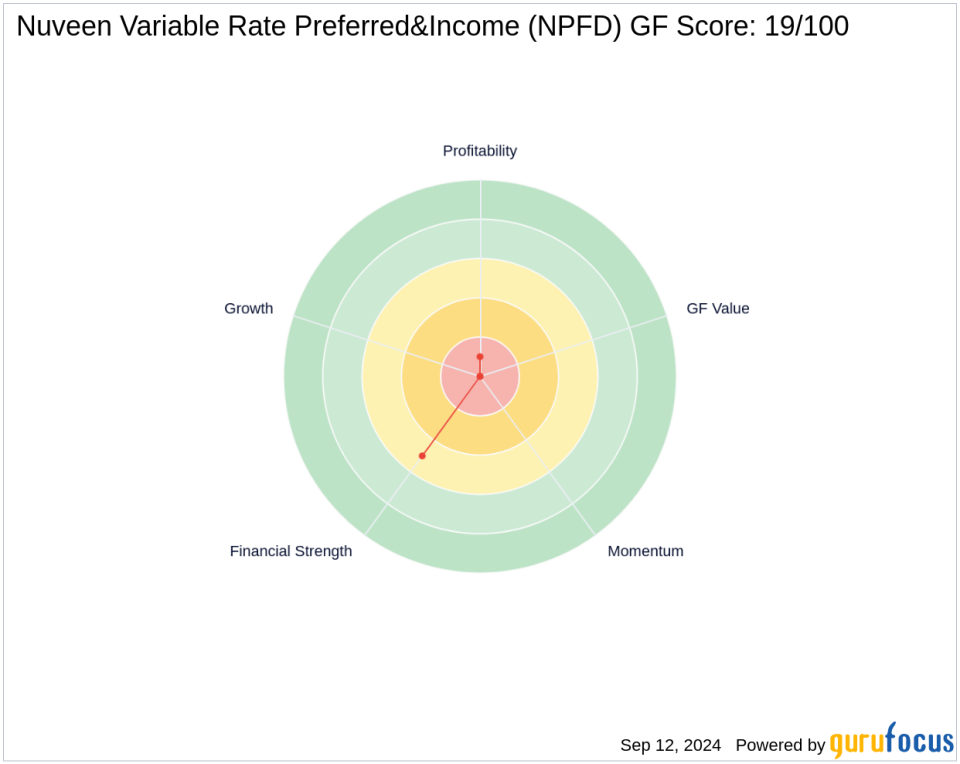

Understanding Nuveen Variable Rate Preferred & Income

Nuveen Variable Rate Preferred & Income operates as a diversified, closed-end management investment company in the USA, aiming to deliver high current income and total return. Despite a market capitalization of $455.736 million, the firm faces challenges, reflected by a GF Score of 19/100, indicating potential underperformance. The company's financial health is further highlighted by a profitability rank of 1/10 and a growth rank of 0/10.

Detailed Analysis of the Transaction

The shares were traded at a price of $18.99 each during the transaction. This strategic reduction by Saba Capital Management, L.P. (Trades, Portfolio) not only alters its stake in NPFD but also adjusts the firm's exposure to the asset management industry. The current stock price of NPFD stands at $18.86, slightly down by 0.68% since the transaction, indicating a minor immediate market reaction.

Market and Sector Implications

The asset management sector, where NPFD operates, is currently experiencing various market dynamics that influence investment decisions. Saba Capital's adjustment in its NPFD position might reflect broader strategic shifts within this sector or a response to the stock's year-to-date performance increase of 15.35%. Despite the stock's decline since its IPO by -24.56%, recent adjustments suggest a recalibration of Saba Capital's investment strategy in this sector.

Concluding Thoughts on Saba Capital's Strategic Move

This transaction by Saba Capital Management, L.P. (Trades, Portfolio) underscores a tactical shift in its investment portfolio, possibly aiming for better alignment with its long-term financial goals. The reduction in NPFD shares reflects a nuanced approach to portfolio management, considering the stock's modest year-to-date gains against a backdrop of broader market and sectoral shifts. Investors and market watchers will likely keep a close eye on Saba Capital's future transactions to gauge its market strategy and alignment with evolving economic conditions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.