SABESP's (SBS) Q2 Earnings Miss Estimates, Revenues Rise Y/Y

Companhia de Saneamento Basico do Estado de Sao Paulo SBS or SABESP's net income in second-quarter 2019 improved 149.8% year over year to R$454.4 million ($118 million). The company’s earnings per share (EPS) totaled R$0.66, up from the year-ago figure of R$0.27.

Considering the ADR equivalent of EPS, the bottom line in the reported quarter was 17 cents, lagging the Zacks Consensus Estimate of 25 cents by 32%.

Total Revenues

In the reported quarter, SABESP's net operating revenues (including construction sales) were R$3,997.9 million ($1,038.3 million), up 8.9% year over year. The figure also surpassed the Zacks Consensus Estimate of $969 million by 7.1%.

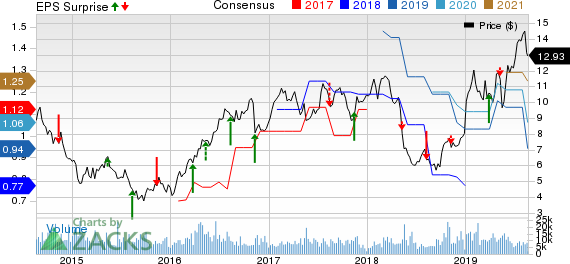

Companhia de saneamento Basico Do Estado De Sao Paulo - Sabesp Price, Consensus and EPS Surprise

Companhia de saneamento Basico Do Estado De Sao Paulo - Sabesp price-consensus-eps-surprise-chart | Companhia de saneamento Basico Do Estado De Sao Paulo - Sabesp Quote

Highlights of the Release

In the second quarter, costs and expenses, including construction costs, totaled R$3,195 million ($829.7 million), increasing 22.1% year over year.

Adjusted earnings before interest, taxes, depreciation and amortization were R$1,231.6 million ($319.8 million), declining 10.9% from the prior-year quarter.

Billed water and sewage volumes in second-quarter 2019 grew 2.6% year over year to 955.4 million cubic meters.

Zacks Rank

SABESP currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Water Supply Utilities’ Release

Here are some other players from the water utility space that have reported second-quarter earnings. American States Water AWR, SJW Group SJW and Connecticut Water Service, Inc. CTWS beat the Zacks Consensus Estimate by 23.1%, 9.4% and 1.5%, respectively.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Companhia de saneamento Basico Do Estado De Sao Paulo - Sabesp (SBS) : Free Stock Analysis Report

Connecticut Water Service, Inc. (CTWS) : Free Stock Analysis Report

American States Water Company (AWR) : Free Stock Analysis Report

SJW Group (SJW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance