Sabre (SABR) Q1 Loss Narrower Than Expected, Revenues Rise Y/Y

Sabre SABR reported a narrower-than-expected loss for the first quarter of 2023. The company’s top line surpassed the Zacks Consensus Estimate and improved year over year.

The company’s adjusted loss was 18 cents per share, which came lower than the Zacks Consensus Estimate of a loss of 24 cents. Also, the figure was narrower than the year-ago quarter’s loss of 29 cents per share.

Sabre reported revenues of $743 million for the first quarter, surpassing the consensus mark of $727.7 million. The top line came in 27% higher than $584.9 million in the year-ago period. This year-over-year surge in the top line reflects a significant improvement in global air, hotel and other bookings.

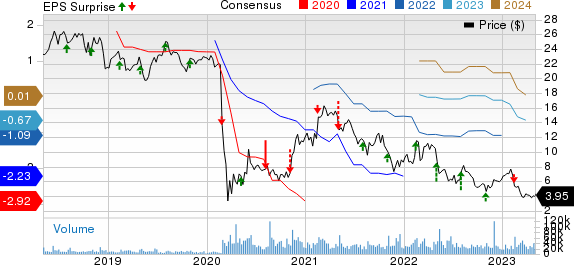

Sabre Corporation Price, Consensus and EPS Surprise

Sabre Corporation price-consensus-eps-surprise-chart | Sabre Corporation Quote

Quarter in Detail

The Travel Solutions segment’s revenues increased 26.9% year over year to $677.4 million, primarily on the gradual recovery of global air and other travel bookings, partially offset by the sale of the AirCentre portfolio in February 2022. The segment’s revenues also benefited from favorable rate impacts as international and corporate bookings improved.

Distribution’s (a sub-division of Travel Solutions) revenues improved to $525.9 million from $342.9 million in the first quarter of 2022. This was chiefly driven by the gradual recovery of bookings and an increase in average booking fees due to a shift in the booking mix.

IT Solutions’ (a sub-division of Travel Solutions) revenues were $151.6 million, down 20.7% from the year-ago quarter’s $191.1 million. This decline was primarily due to lower revenues from a change in Russian law and lower Commercial and Operations revenues, primarily due to the sale of the AirCentre portfolio.

The aforementioned negative factors for IT Solutions’ dismal performance were partially offset by higher reservation revenues from the ongoing recovery in passengers boarded. The number of boarded airline passengers — a key revenue metric for the IT Solutions division — increased 28% year over year to 165 million.

The Hospitality Solutions segment’s revenues totaled $73.8 million compared with the year-ago quarter’s $56 million. This upside was mainly fueled by the increase in central reservation system transactions, which rose 20.4% to $27.7 million.

Sabre reported an adjusted operating income of $28 million, significantly improving from the operating loss of $29 million posted in the year-earlier period. Adjusted EBITDA improved from $5 million reported a year ago to $58 million. This improvement was driven by an increase in revenues.

Balance Sheet and Cash Flow

Sabre exited the March-end quarter with cash, cash equivalents and restricted cash of $838.1 million compared with the previous quarter’s $815.9 million.

In the first quarter, Sabre used $72 million worth cash for operating activities. The company’s free cash flow was negative $91 million during the quarter reported.

Zacks Rank & Key Picks

Sabre currently has a Zacks Rank #3 (Hold). Shares of SABR have declined 58.8% in the past year.

Some better-ranked stocks from the broader Computer and Technology sector are Meta Platforms META, Momo MOMO and ServiceNow NOW. While Meta Platforms and Momo sport a Zacks Rank #1 (Strong Buy), ServiceNow carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Meta Platforms' second-quarter 2023 earnings has been revised 14% upward to $2.79 per share over the past seven days. For 2023, earnings estimates have moved north by 12.1% to $11.76 in the past seven days.

META’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, missing twice, the average surprise being 15.5%. Shares of the company have gained 6% in the past year.

The Zacks Consensus Estimate for Momo’s first-quarter 2023 earnings has been revised southward from 36 cents to 32 cents per share over the past 30 days. For 2023, earnings estimates have moved down by 3 cents to $1.55 in the past 30 days.

MOMO's earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 31.9%. Shares of the company have gained 40% in the past year.

The Zacks Consensus Estimate for ServiceNow’s second-quarter 2023 earnings has been revised northward by 12 cents to $2.04 per share over the past seven days. For 2023, earnings estimates have moved up by 32 cents to $9.54 in the past seven days.

NOW's earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 10.4%. Shares of the company have inched down 12.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

Sabre Corporation (SABR) : Free Stock Analysis Report

Hello Group Inc. Sponsored ADR (MOMO) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance