Retirement group Saga in 'advanced' talks to raise £150m

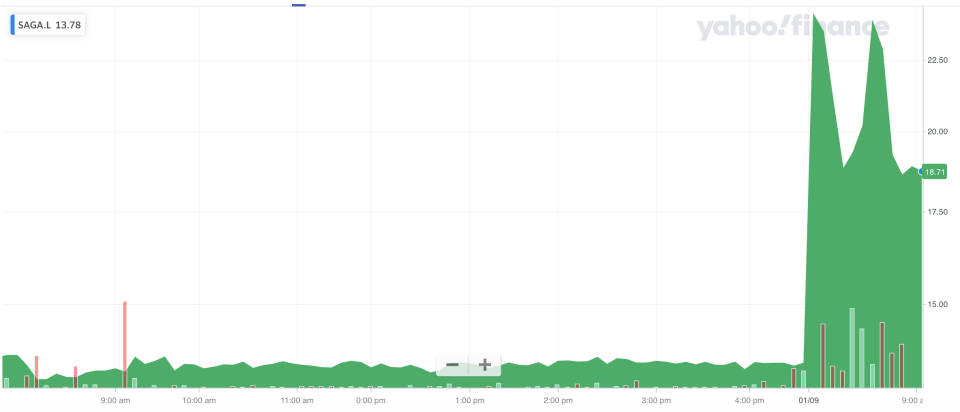

Shares in retirement group Saga (SAGA.L) surged on Tuesday, after the company confirmed it was in “advanced” talks with the son of its founder about a potential £150m ($201m) cash injection.

Saga said in a statement to the market on Tuesday it was “at the advanced stage of a prospective £150 million equity capital raise... in order to strengthen its balance sheet, improve liquidity and support the execution of its reinvigorated strategy under its strengthened management team.”

The company said it had also rejected a “unsolicited and highly conditional” takeover bid from “a consortium of two US financial investors.” The group offered to buy the business for 33p per share, a 140% premium on Friday’s closing price.

The statement followed a story from Sky News over the weekend saying Sir Roger de Haan, the son of Saga’s founder, was poised to return to the group as its chairman and invest in the business. Sir Roger previously ran the business for 20 years before leaving in 2004.

Saga confirmed that Sir Roger, who sold the company to private equity, is lined up to provide £100m and rejoin the board as non-executive chairman.

The proposed terms would see Sir Roger buy shares in Saga at various prices but the bulk of new shares — £60m-worth — will be sold at 27p, which represents a 98% premium on Friday’s closing price.

Saga said the big premium represents Sir Roger’s “belief in the underlying strength of the Saga brand and business and his confidence in the new strategy under the strengthened management team.”

Shares in Saga jumped as much as 70% at the open in London on Tuesday. (Markets were closed for an annual holiday on Monday).

Prior to Tuesday’s rally, shares in the group had fallen by almost 75% so far this year. Saga offers insurance to over-50s and operates retirement cruises. Both parts of the business have suffered as a result of the COVID-19 pandemic.

“In some ways, it would be hard to design a company more susceptible to a pandemic than the group’s travel operations – and Saga didn’t start the year in the best of health either,” said William Ryder, an equity analyst at Hargreaves Lansdown.

Saga said the fundraising would help it “return... to sustainable growth and lead to the restoration of significant shareholder value.”

Management have completed a strategic review of the business and plan to set out details on 10 September, alongside interim results. Full details of the equity raise will also be published at the same time.

Yahoo Finance

Yahoo Finance