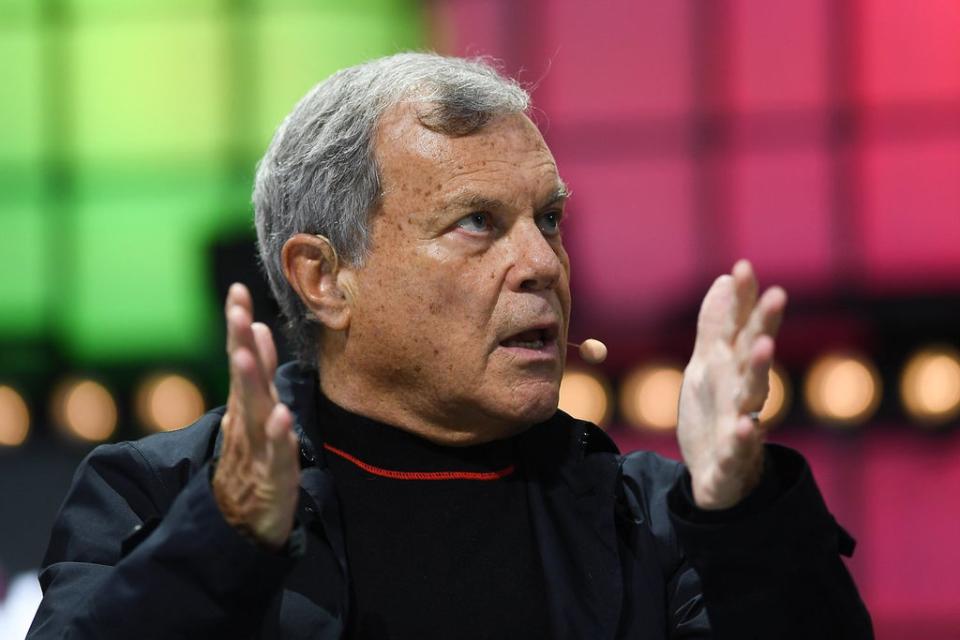

Sage of Soho warns on “perfect storm” for economy as recession fears mount

BRITAIN’S top ad man today warned of a hard landing for the UK, one day after the Bank of England predicted that inflation will top 10% and the economy could fall into recession.

Sir Martin Sorrell, the Sage of Soho to some, says a “perfect storm” of supply chain difficulties, the Ukraine war, the oil price and central bank policies means he fears the worst.

His S4 Capital, which today reported annual results twice delayed due to an auditing snafu, made a loss of £42 million for the year.

But revenues jumped 100% to £686 million, as Sorrell continues to build a business to rival WPP, the empire from which he was turfed out in 2018.

Central banks including the Bank of England, led by Andrew Bailey, are under fire for being too slow to combat inflation. While the effects of government spending to combat Covid could be brutal.

Sage of Soho tells Standard: “It was inevitable that excessive government spending would lead to excessive inflation. The central banks are trying to put the brakes on, but they are behind the curve.”

“We still think 2022 can be a reasonably good year, but the rubber really hits the road in 2023. I can see why the Bank is worried about it.”

There were strong signs last year that the bounce back from Covid would be strong, as economies re-opened and consumers started spending.

Sorrell added: “2021 was a false dawn. People forget that central banks pumped about $15 trillion into the economy to deal with Covid. That was bound to be problematic. It is ending in tears.”

Sorrell is “bearish on Europe” in particular, where the ripple effects from the Ukraine war will be most keenly felt. He is still positive on the US and the Middle East.

S4 Capital shares bounced 12p to 338p, though they are still down 40% on the year due to the accounting confusion. Sir Martin called the delay to the results announcement “embarrassing”.

PwC had refused to sign off the accounts in March due to, it became clear today, to some control weaknesses and concern about staff turnover.

S4 Capital has bought 29 media companies since launch, an aggressive acquisition strategy that Sir Martin is likely to rein in from here.

Analysts at Citi said the results were “solid” and welcomed to tighter financial controls.

Yahoo Finance

Yahoo Finance