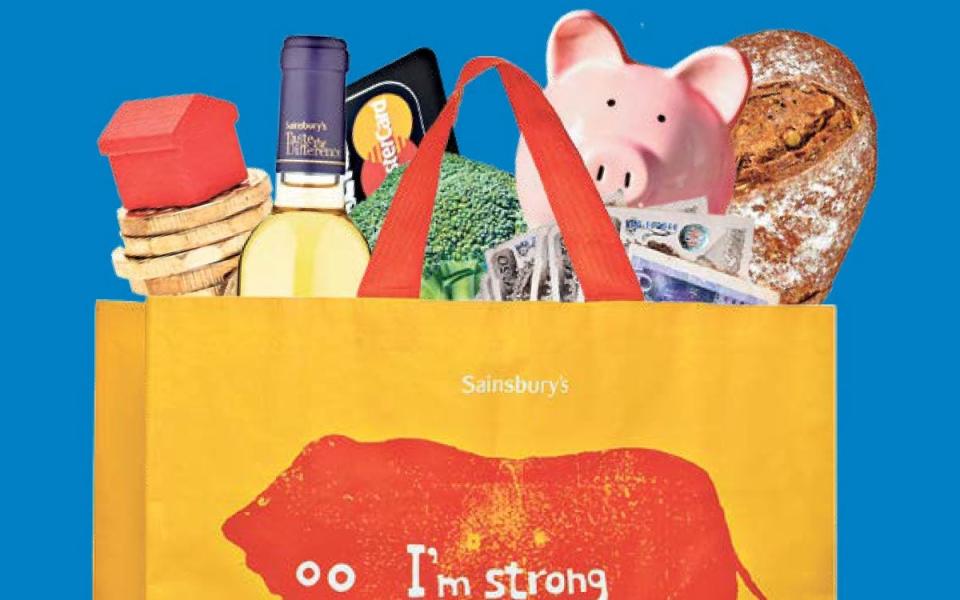

Sainsbury’s bows out of financial services after bank challenge fails

It has not been easy for Britain’s supermarket giants to go from selling bread to banking, even though it looked as though it should have been fairly simple in the years after the financial crisis.

When Sainsbury’s took full control of its bank in 2013 by buying out joint venture partner Lloyds, its then chief executive Justin King had high hopes.

The bank had 23m weekly customers who “know and trust” the Sainsbury’s brand, he said, five years after the 2008 crash battered trust in big banks. For King, this was the chance to shake up the unpopular banking sector and get families across the UK to add financial products to their shopping lists.

It didn’t work. Having heeded the advice of its former slogan, “Try Something New Today”, Sainsbury’s wants out.

It has put its banking venture up for sale and some of the banks it had once hoped to challenge are looking to snap it up. Taxpayer-backed NatWest, which was bailed out during the financial crisis, is among the bidders.

Tough market

Sainsbury’s is not alone. Co-op Bank, which cut historic ties with the wider Co-operative Group following a rescue deal in 2017, is also up for sale. Tesco last year sold its mortgage book to Lloyds for £3.8bn after saying it would abandon the sector due to “challenging market conditions”. M & S Bank is a joint venture with HSBC. None of the supermarkets have managed to steal market share from the big banks.

Sir Philip Hampton, the former chair of both Sainsbury’s and NatWest (formerly known as RBS), says he can see why it has been difficult for grocers to enter the finance sector. For a start, it is notoriously tough to get people to switch banks, even when they know they should (a study last year found £170bn, somewhere between the yearly GDPs of New Zealand and Peru, is sitting in accounts earning big banks money while savers get nothing).

“Most people stayed loyal to their long-standing bank [after the 2008 crash]. They hoped and expected the banks to behave better. I think that’s happening,” Sir Philip says.

Secondly, the likes of Sainsbury’s – which in 1997 became the first supermarket to launch a bank – branched out into financial services when it made much more business sense to do so. Bank returns have since been clobbered by record low interest rates, lenders face tough regulatory requirements and costs have spiked. Combined with Covid, big banks including NatWest and Lloyds have a stock market value much lower than the assets on their books.

“Banking is much less attractive as a business [now]. Much more capital is needed, there’s tougher regulation, a collapse in margins through low interest rates, [plus] technology and competition challenges,” Sir Philip adds. “You need either real scale or something very distinctive … like so many businesses, they need to focus on their main strengths. Banking is no longer an add-on.”

Indeed, the two supermarkets that tried to go it alone by ditching their big bank partners have struggled to make much headway. Tesco gave it a try first by buying out RBS’s share of their Tesco Personal Finance joint venture in 2008, followed by Sainsbury’s doing the same with Lloyds in 2013.

High costs

Clive Black, an analyst at Shore Capital, estimates that Sainsbury’s has spent £1.4bn on its bank, including buying out Lloyds as well as operating expenditure and capital investment, yet it makes low tens of millions.

“On paper at least the stars were aligned for Tesco and Sainsbury’s at the end of the financial crisis, and the reason they didn’t fulfil their potential is several fold but most fundamentally the regulator didn’t make it particularly easy for people to transfer current accounts into challenger banks,” he says.

“The mainstream banks basically acted as an oligopoly. The current account is the key here – that’s where the wages and salaries are paid into, that is the key connection between a bank and a customer. So really for some time Tesco and Sainsbury’s were dancing around handbags in terms of offering credit cards and loans, but in terms of making progress in the core current account market they just didn’t manage to get there, which was mission critical in not reaching scale.”

Black also believes the supermarkets were naive, unaware of how difficult it would be to run a bank in an increasingly regulated market.

“Just as these guys were sailing their boats the regulatory controls that came in around consumer protection were massive and therefore the cost basis of the consumer banks mushroomed,” Black says.

Vultures circle

Ian Gordon, a bank analyst at Investec, can see why grocers may have lost their appetite for banking. Both Sainsbury’s Bank and Co-op Bank, he says, are unable to compete effectively with the larger incumbent banks because they “do not have the same scale efficiencies and face an uneven playing field” in terms of capital requirements.

Yet there are some concerns about which companies will end up swallowing these challenger banks. The Co-op Bank, which has always promoted itself as an ethical alternative to big shareholder-owned banks, has been approached by US private equity giant Cerberus, which in 2018 was accused of misleading the Government on a deal to buy £13bn worth of mortgages from bust lender Northern Rock.

Kevin Hollinrake, the Tory MP who co-chairs the All-Party Parliamentary Group on Fair Business Banking, has written to Andrew Bailey, the governor of the Bank of England, about his fears.

“Given that customers are often attracted by its reputation of ethical and sustainable practices, the sale of a significant stake in the Cooperative Bank to a vulture fund would be of particular concern,” he said in an email to Mr Bailey.

As grocers take banking out of their shopping baskets, the country’s biggest banks and some of the world’s most powerful investors are circling. The dominant players remain largely unchallenged.

Yahoo Finance

Yahoo Finance