Sanofi (SNY), Regeneron's Dupixent sBLA Gets FDA Priority Tag

Sanofi SNY and partner Regeneron REGN announced that the FDA has accepted their supplemental biologics license application (sBLA) seeking approval for the blockbuster medicine Dupixent for adolescents with inadequately controlled chronic rhinosinusitis with nasal polyposis (CRSwNP). These children should be aged between 12 to 17 years. Given the priority review of the sBLA, the FDA is expected to give its decision on Sep 15.

If approved by the FDA, Dupixent will be the first medicine approved for adolescents with this disease, which is driven in part by underlying type II inflammation that obstructs the sinuses and nasal passages and can result in loss of sense of smell.

Dupixent is already approved in the United States for treating CRSwNP in adults. The sBLA is based on extrapolation of efficacy data from two pivotal CRSwNP studies on Dupixent in adults as well as safety data of Dupixent in its currently approved indications for adolescents like moderate-to-severe eczema (atopic dermatitis).

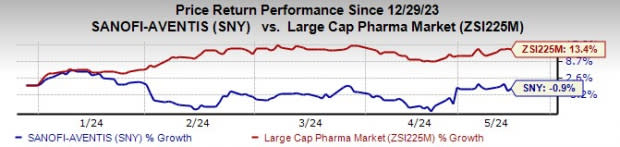

Sanofi stock has declined 0.9% year to date against the industry’s rise of 13.4%.

Image Source: Zacks Investment Research

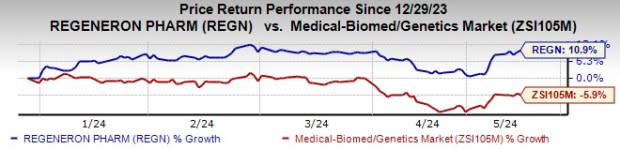

Shares of Regeneron have shot up 10.9% year to date against the industry’s decline of 5.9%.

Image Source: Zacks Investment Research

Dupixent is being jointly marketed by Regeneron and Sanofi under a global collaboration agreement. Sanofi records global net product sales of Dupixent, while Regeneron records its share of profits/losses in connection with the global sales of the drug.

Other than CRSwNP, Dupixent is approved in several countries, including the United States and EU, for four type II inflammatory diseases, namely severe asthma, moderate-to-severe atopic dermatitis, eosinophilic esophagitis and prurigo nodularis.

Dupixent has become the key driver of the top line for Sanofi as well as Regeneron. In the first quarter of 2024, Dupixent generated global product sales of $3.09 billion (€2.84 billion), which were recorded by Sanofi, representing growth of 24.9% at a constant exchange rate. With outside U.S. revenues accelerating and multiple approvals for new indications and expansion in younger patient populations expected, its sales are likely to be higher.

Sanofi expects Dupixent to achieve more than $€13 billion in sales in 2024 and a low double-digit CAGR till 2030.

For Regeneron, Dupixent generated collaboration revenues of $910 million from Sanofi in the first quarter, rising 14% year over year.

Sanofi and Regeneron are also studying dupilumab in late-stage studies for bullous pemphigoid and chronic spontaneous urticaria. Dupixent is under review in the United States and EU for the chronic obstructive pulmonary disease (COPD) indication. A FDA decision is expected on Jun 27. Sanofi believes Dupixent has the potential to become a breakthrough medicine for COPD, as it will be the first and only biologic medicine approved for this disease.

Sanofi and Regeneron have a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stocks to Consider

Some top-ranked stocks in the drug/biotech sector are ANI Pharmaceuticals ANIP and Ligand Pharmaceuticals LGND. While Ligand has a Zacks Rank #1, ANI Pharmaceuticals carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, the Zacks Consensus Estimate for ANI Pharmaceuticals has improved from $4.40 per share to $4.44 per share for 2024. For 2025, earnings estimates have improved from $5.01 per share to $5.04 per share in the past 60 days. So far this year, shares of ANIP have risen 23.4%.

Earnings of ANI Pharmaceuticals beat estimates in each of the last four quarters, delivering a four-quarter average earnings surprise of 53.90 %.

In the past 60 days, the Zacks Consensus Estimate for Ligand Pharmaceuticals has improved from $4.42 per share to $4.56 per share for 2024. For 2025, earnings estimates have improved from $5.11 per share to $5.27 per share in the past 60 days. So far this year, shares of LGND have risen 22.2%.

Earnings of Ligand Pharmaceuticals beat estimates in each of the last four quarters. LGND delivered a four-quarter average earnings surprise of 56.02%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Sanofi (SNY) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance