Sanofi's (SNY) Filing for Rare Disease Drug Accepted by EMA

Sanofi SNY announced that the European Medicines Agency (“EMA”) has accepted the marketing authorization applications (MAA) for olipudase alfa, the company’s investigational enzyme replacement therapy for the treatment of acid sphingomyelinase deficiency (ASMD). ASMD is a rare, progressive and potentially life-threatening disease for which no treatment has been approved.

The regulatory agency has accepted the MAA for review under an accelerated assessment procedure. An EMA decision is expected in second-half 2022.

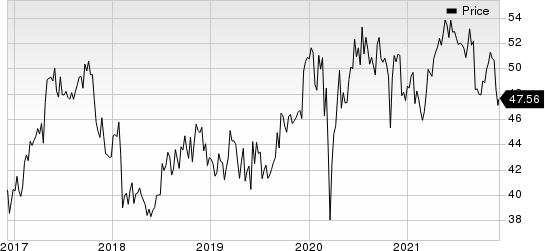

Sanofi’s stock has declined 2.1% this year so far against the industry’s 12.4% rise.

Image Source: Zacks Investment Research

The EMA’s acceptance of the MAA is based on data from two clinical studies — ASCEND and ASCEND-Peds — evaluating olipudase alfain adult and pediatric patients, respectively, with non-central nervous system manifestations of ASMD type A/B and ASMD type B.

Please note that olipudase alfa has been granted the PRIority Medicines (PRIME) designation. Candidates that are designated as PRIME receive expedited approval and development support from the EMA.

We also inform investors that olipudase alfahas been granted the Breakthrough Therapy designation by the FDA. Earlier in September,Sanofi filed a regulatory application with the Japanese health regulator seeking approval for olipudase alfa in ASMD.

ASMD is caused by a deficiency in enzyme acid sphingomyelinase (ASM), which is required to break down lipids called sphingomyelin. If sphingomyelin builds up within cells, it eventually causes cell death and malfunction of major organ systems. Per management, an estimated 2,000 people in Europe, Japan and the United States are affected by ASMD.

Olipudase alfa is designed to replace the deficient ASM, thus allowing the breakdown of sphingomyelin. If approved, olipudase alfa will become the first therapy for treating ASMD.

Sanofi Price

Sanofi price | Sanofi Quote

Zacks Rank & Stocks to Consider

Sanofi currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the drug/biotech sector include Endo International ENDP, GlaxoSmithKline GSK and Roche Holding RHHBY. While Endo International sports a Zacks Rank #1 (Strong Buy) at present, both GlaxoSmithKline and Roche each carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Endo International’s earnings per share estimates for 2021 have increased from $2.29 to $2.84 in the past 60 days. The same for 2022 has increased from $2.24 to $2.47 in the past 60 days.

Earnings of Endo International beat estimates in all the last four quarters, with the average being 57.7%.

GlaxoSmithKline’s earnings per share estimates for 2021 have increased from $2.80 to $3.06 in the past 60 days. The same for 2022 has increased from $3.08 to $3.26 in the past 60 days. Shares of Glaxo have risen 13.5% in the year so far.

Earnings of GlaxoSmithKline beat estimates in three of the last four quarters and missed once, with the average surprise being 15.3%.

Roche Holding’s earnings per share estimates for 2021 have increased from $2.76 to $2.78 in the past 60 days. The same for 2022 has increased from $2.79 to $2.81 in the past 60 days.

Shares of Roche have risen 13.4% in the year so far.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

GlaxoSmithKline plc (GSK) : Free Stock Analysis Report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Endo International plc (ENDP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance