Saratoga Investment (SAR) Beats on Q2 Earnings, Stock Up 1.2%

Shares of Saratoga Investment Corp. SAR gained 1.2% in aftermarket trading in response to better-than-expected second-quarter fiscal 2022 (ended Aug 31) results. Adjusted net investment income of 63 cents per share beat the Zacks Consensus Estimate of 53 cents. The bottom line was up 28.6% year over year.

Results were aided by a rise in total investment income and a solid balance sheet. Further, overall portfolio activity remained decent in the reported quarter with strong originations. However, higher expenses posed a headwind.

Net investment income came in at $6.4 million, up 19.8% from the prior-year quarter.

Total Investment Income & Expenses Rise

Total investment income was $18.4 million, jumping 33.1% year over year. The rise mainly resulted from higher interest income, dividend income, and management fee income.

Total operating expenses increased 41.4% from the prior-year quarter to $12 million.

Total Portfolio Value & Originations Decent

The fair value of Saratoga Investment’s total investment portfolio was $666.1 as of Aug 31, 2021, up 31.1% year over year. This was primarily invested in 43 portfolio companies and one collateralized loan obligation fund.

In the reported quarter, the company originated $116 million in four new and six existing portfolio companies and had $134.8 million in an aggregate amount of exits and repayments, including realized gains. Thus, this resulted in net repayments of $18.8 million.

Strong Balance-Sheet Position

As of Aug 31, 2021, Saratoga Investment’s net asset value was $28.97 per share compared with $26.68 on Aug 31, 2020.

With $45 million available under the credit facility and $73.3 million of cash and cash equivalents as of Aug 31, 2021, Saratoga Investment has a total of $118.3 million of undrawn borrowing capacity and cash and cash equivalents. Also, the company had $111 million in undrawn SBA debentures from the most recently approved SBIC II license to finance new SBIC-eligible portfolio companies.

Share Repurchase Update

During the quarter, Saratoga Investment repurchased 9,623 shares at the average price of $25.85 for roughly $0.2 million.

Our Take

Solid loan origination activity continues to be on track and this is expected to support Saratoga Investment’s financials. However, steadily rising operating costs pose a concern.

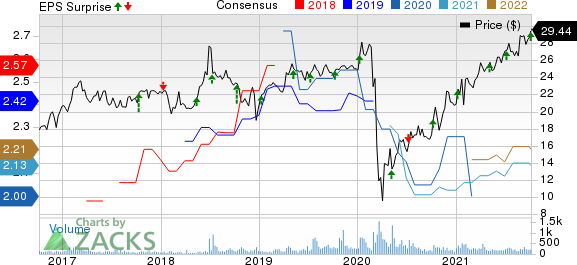

Saratoga Investment Corp Price, Consensus and EPS Surprise

Saratoga Investment Corp price-consensus-eps-surprise-chart | Saratoga Investment Corp Quote

Currently, Saratoga Investment carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Finance Stocks

Hercules Capital Inc.’s HTGC second-quarter 2021 net investment income of 32 cents per share was in line with the Zacks Consensus Estimate. The figure indicates no change from the year-ago quarter’s reported number.

Ares Capital Corporation’s ARCC second-quarter 2021 core earnings of 53 cents per share surpassed the Zacks Consensus Estimate of 43 cents. Moreover, the bottom line reflects a rise of 35.9% from the prior-year quarter’s reported number.

FS KKR Capital Corp.’s FSK second-quarter 2021 adjusted net investment income per share of 74 cents surpassed the Zacks Consensus Estimate of 61 cents. In the prior-year quarter, the company reported earnings of 62 cents. The reported quarter’s results exclude accretion resulting from the merger with FS KKR Capital Corp. II.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ares Capital Corporation (ARCC) : Free Stock Analysis Report

Hercules Capital, Inc. (HTGC) : Free Stock Analysis Report

Saratoga Investment Corp (SAR) : Free Stock Analysis Report

FS KKR Capital Corp. (FSK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance