Saudi Arabia Construction Equipment Rental Markets Report 2022-2027: Pricing Analysis, Policy and Regulatory Landscape, Market Trends and Developments

Saudi Arabian Construction Equipment Rental Market

Dublin, June 15, 2022 (GLOBE NEWSWIRE) -- The "Saudi Arabia Construction Equipment Rental Market, By Equipment Type (Wheel Loader, Crane, Excavator, Bulldozer, Dump Truck, Diesel Genset, Motor Grader and Telescopic Handler, Others), By Region, By Province, Competition, Forecast and Opportunities, 2017-2028" report has been added to ResearchAndMarkets.com's offering.

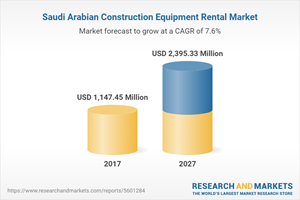

The Saudi Arabian Construction Equipment Rental Market is expected to grow at a steady CAGR of 7.57% to reach a value of USD2395.33 million by 2027.

Factors such as favorable government policies and the rise in infrastructure developments are the primary drivers for the Saudi Arabian Construction Equipment Rental Market. Also, the changing preference of end-users towards the adoption of rental construction equipment services owing to their enhanced affordability and easy availability are expected to play a crucial role in accelerating the market demand over the forecast period.

Saudi Arabia is majorly dependent on the oil & gas industry for revenue generation. The government is trying to reduce its dependency on the oil & gas industry and diversify its income sources by launching mega-budget plans like the Saudi Vision 2030 National Transformation Program. To achieve the targets set by the leading authorities, the government is promoting infrastructural development in the country.

Several projects launched by the government, including the Red Sea Tourism Project, Qiddiya entertainment city, and Riyadh Metro, are expected to boost the demand for construction equipment rental services over the forecast period. The ongoing infrastructure development activities are supported by National Infrastructure Fund (NIF) in 2021 with an aim to attract private investment and partnerships in the country.

The Saudi Arabian Construction Equipment Rental Market is segmented into equipment type, region, province, and competitive landscape. Based on the provincial analysis, the Eastern region dominated the market in 2021, with a market share of 34.57% of the overall market share.

Eastern province is witnessing rapid urbanization, industrialization, and infrastructure development activities in line with the Kingdom's Vision 2030. Recently, Prince Saud Bin Naif, emir of the Eastern Province, launched a Central Awamiyah project to develop a tourist destination and a civil, cultural, and artistic center in the Eastern province, which is expected to fuel the demand for construction equipment rental services.

Objective of the Study:

To analyze the historical growth in the market size of the Saudi Arabian Construction Equipment Rental Market from 2017 to 2021.

To estimate and forecast the market size of the Saudi Arabian Construction Equipment Rental Market from 2022E to 2027F and growth rate until 2027F.

To classify and forecast the Saudi Arabian Construction Equipment Rental Market based on equipment type, region, province, competitive landscape.

To identify the dominant region or segment in the Saudi Arabian Construction Equipment Rental Market.

To identify drivers and challenges for the Saudi Arabian Construction Equipment Rental Market.

To examine competitive developments such as expansions, mergers & acquisitions, etc., in the Saudi Arabian Construction Equipment Rental Market.

To identify and analyze the profiles of leading players operating in the Saudi Arabian Construction Equipment Rental Market.

To identify key sustainable strategies adopted by the market players in the Saudi Arabian Construction Equipment Rental Market.

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi Arabian Construction Equipment Rental Market.

Zahid Tractor and Heavy Machinery Co. Ltd

General Contracting Company (GCC)

Bin Quraya for Rental and Heavy Equipment

Industrial Supplies Development Co. Ltd. (ISDC Rental Company)

Abdulla Nass & Partners Co. Ltd. (ANPC)

Saad Al Qahtani Contracting Co. (SAQCO)

Arabian Consolidated Trading (ACT Crane & Heavy Equipment)

Altaaqa Alternative Solutions Company

Al Faris Group

Rezayat Sparrow Arabian Crane Hire Co. Ltd

Key Topics Covered:

1. Service Overview

2. Research Methodology

3. Executive Summary

4. Impact of COVID-19 on Saudi Arabia Construction Equipment Rental Market

5. Voice of Customer

5.1. Factors Influencing Renting Decisions

5.2. Challenges/Unmet Needs

5.3. Rental Company Switching Attributes

5.4. Key Satisfaction Level

6. Saudi Arabia Construction Equipment Rental Market Outlook

6.1. Market Size & Forecast

6.1.1. By Value

6.2. Market Share & Forecast

6.2.1. By Equipment Type (Wheel Loader, Crane, Excavator, Bulldozer, Dump Truck, Diesel Genset, Motor Grader and Telescopic Handler, Others)

6.2.2. By Region (South & West, North & Central, East)

6.2.3. By Province (East, Mecca, Riyadh, Eastern, Asir, Medina)

6.2.4. By Company (2021)

6.3. Product Market Map (By Equipment Type, By Region, By Province)

7. Saudi Arabia Wheel Loader Rental Market Outlook

7.1. Market Size & Forecast

7.1.1. By Value

7.2. Market Share & Forecast

7.2.1. By Operating Weight

7.2.2. By Company

7.3. Wheel loader Rental Tariff

8. Saudi Arabia Crane Rental Market Outlook

9. Saudi Arabia Excavator Rental Market Outlook

10. Saudi Arabia Bulldozer Rental Market Outlook

11. Saudi Arabia Dump Truck Rental Market Outlook

12. Saudi Arabia Diesel Genset Rental Market Outlook

13. Saudi Arabia Motor Grader Rental Market Outlook

14. Saudi Arabia Telescopic Handler Rental Market Outlook

15. Market Dynamics

15.1. Drivers

15.2. Challenges

16. Pricing Analysis

17. Policy and Regulatory Landscape

18. Market Trends and Developments

19. SWOT Analysis

20. Supply Chain Analysis

21. Saudi Arabia Economic Profile

22. Company Profiles

For more information about this report visit https://www.researchandmarkets.com/r/mrbfce

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance