Profit dives at world's largest oil company but 'signs of recovery'

Saudi Aramco (2222.SR), the world’s largest oil company, has reported plummeting profits as the COVID-19 pandemic leads to collapsing demand for oil.

Net income at the Saudi state-owned oil company was $11.8bn (£9.1bn) in the third quarter, Aramco said on Tuesday, 44% lower than the same period a year earlier.

Aramco declared a dividend of $18.7bn for the quarter, up 40% of last year. The increase reflects the company’s commitment to shareholder payouts and the price of attracting investor interest in tough market conditions.

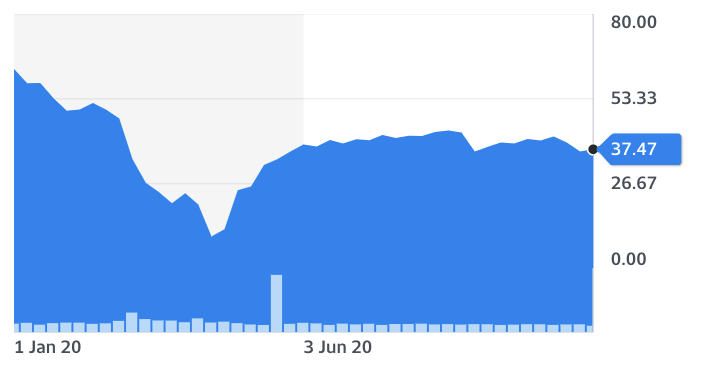

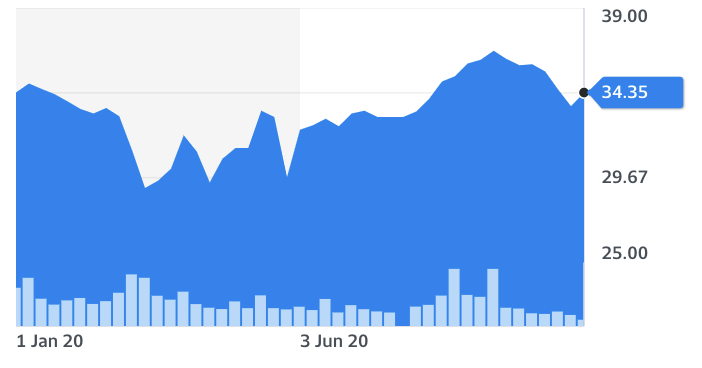

The price of oil (BZ=F, CL=F) has fallen by more than 35% since the start of the year as the pandemic has led to plummeting demand for fuel.

Global stay at home orders and restrictions on international travel have suppressed mobility both within and between countries.

Saudi Aramco’s profits are down by half in the first nine months of the year, reflecting lower demand.

Amin H. Nasser, president and chief executive of Saudi Aramco, said there were “early signs of a recovery in the third quarter due to improved economic activity, despite the headwinds facing global energy markets.”

WATCH: Oil prices tumble to five-year low

Aramco’s third quarter results cover the three months to 30 September. Since then, a wave of second lockdowns have swept Europe as COVID-19 cases have once again begun to rise sharply.

Nasser made no mention of the pandemic’s second wave but analysts believe it will once again suppress oil demand. JP Morgan last week cut its forecast for global oil demand in November.

The investment bank now believes the world will consume 94.2 million barrels of oil per day — 6.7% less than it was a year ago. Oil prices fell by 4% on Monday morning, reflecting investor concerns.

Shares in Aramco were up 0.4% in Riyadh on Tuesday, trading at the same levels they were at in January.

Yahoo Finance

Yahoo Finance