Saul Centers Inc (BFS) Reports Revenue and Net Income Growth in Q4 2023

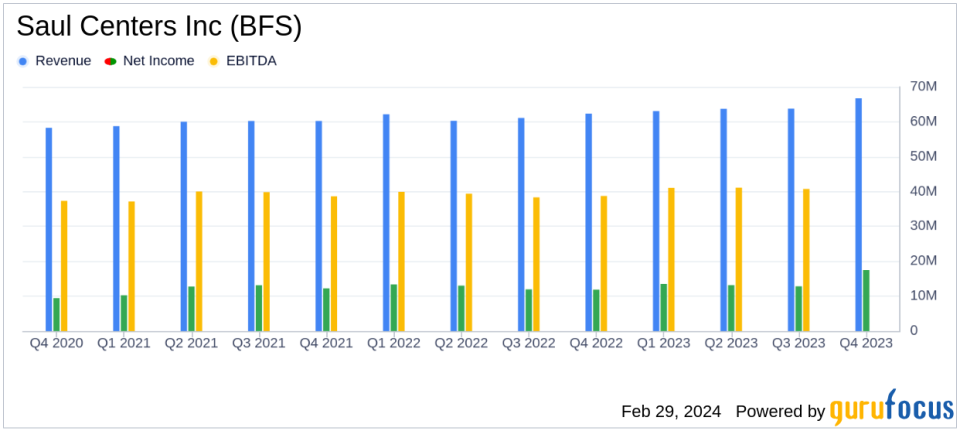

Total Revenue: Increased to $66.7 million in Q4 2023 from $62.3 million in Q4 2022.

Net Income: Rose to $17.5 million in Q4 2023, up from $15.4 million in the same quarter last year.

FFO: Funds From Operations available to common stockholders and noncontrolling interests grew to $26.9 million in Q4 2023.

Occupancy Rates: Commercial portfolio was 94.2% leased as of December 31, 2023, showing an improvement from 93.2% the previous year.

Same Property Operating Income: Increased by 8.8% in Q4 2023 compared to Q4 2022.

Earnings Per Share: Net income available to common stockholders was $0.43 per basic and diluted share in Q4 2023, up from $0.38 in Q4 2022.

Saul Centers Inc (NYSE:BFS) released its 8-K filing on February 29, 2024, revealing a solid financial performance for the fourth quarter ended December 31, 2023. The company, a self-managed real estate investment trust (REIT), focuses on retail and commercial properties, primarily in the Washington, D.C. and Maryland metropolitan areas. With a portfolio that includes community and neighborhood shopping centers, office properties, and mixed-use properties, Saul Centers operates through two segments: shopping centers and mixed-use properties.

The company's total revenue for the 2023 Quarter saw an increase to $66.7 million, up from $62.3 million in the 2022 Quarter. This growth was attributed to higher termination fees and base rent, which were partially offset by increased interest expenses and general and administrative expenses. Net income also saw an uptick, reaching $17.5 million compared to $15.4 million in the previous year's quarter.

Financial Highlights and Performance Metrics

One of the key performance indicators for Saul Centers is the same property revenue, which increased by 7.0% in the 2023 Quarter compared to the 2022 Quarter. This metric, alongside an 8.8% increase in same property operating income, underscores the company's ability to enhance the profitability of its existing property portfolio. The shopping center segment, in particular, demonstrated robust growth with a 10.9% increase in same property operating income, mainly due to higher termination fees and base rent.

The company's Funds From Operations (FFO), a critical measure for REITs, also reflected positive momentum, increasing to $26.9 million ($0.79 per basic and diluted share) from $24.7 million ($0.74 and $0.72 per basic and diluted share, respectively) in the 2022 Quarter. This growth in FFO is significant as it indicates the company's ability to generate cash flow from its operations.

Occupancy rates are another vital metric for real estate companies, and Saul Centers reported a healthy commercial portfolio occupancy of 94.2% as of December 31, 2023. This is an improvement from the 93.2% occupancy rate at the end of 2022, suggesting that the company's properties continue to attract and retain tenants.

Balance Sheet and Income Statement Details

The balance sheet of Saul Centers as of December 31, 2023, shows total assets of $1,994,137,000, with real estate investments, net of accumulated depreciation, accounting for $1,891,635,000. The company's liabilities totaled $1,489,708,000, with mortgage notes payable and other forms of debt constituting the majority of the liabilities. Equity stood at $504,429,000, reflecting the value attributable to Saul Centers Inc and noncontrolling interests.

For the year ended December 31, 2023, Saul Centers Inc reported a total revenue of $257.2 million, an increase from $245.9 million in the previous year. Net income for the year also increased to $69.0 million from $65.4 million in the 2022 Period. These figures demonstrate the company's sustained growth over the fiscal year.

In conclusion, Saul Centers Inc's Q4 2023 earnings report reflects a company that is successfully navigating the complexities of the real estate market, with increased revenue, net income, and FFO. The company's focus on maintaining high occupancy rates and growing same property revenue and operating income suggests a strategic approach to maximizing asset value and shareholder returns. For more detailed information and analysis, investors and stakeholders are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Saul Centers Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance