Savings app sees record growth as Brits strive for financial security during pandemic

Savings app Chip saw record growth this summer, as Brits’ priorities shifted towards financial security in the midst of the COVID-19 lockdown.

Chip’s uses AI to analyse savers’ finances and calculate the amount to put aside, before moving the money into an account in their name — with an option to cancel — meaning it was able to pick up on the drop off in spending and adjust savings accordingly, it said.

Combined with increased manual contributions from savers, this resulted in a sharp rise in the amount put aside during lockdown. June saw the highest average amount put aside per user per month in Chip’s history, at £214.70 ($284) — an increase of 138% year-on-year, and 103% since March, when lockdown began.

“Auto-saves” alone also saw a significant increase, with May being the highest on record, as users put away about £114.69 over the month. Compared to the start of lockdown in March, when they put away just £74.79, July’s monthly auto-save amount went up by 42% to £106.33.

READ MORE: Brits more concerned about financial hit of COVID-19 than

Chip users also made more manual contributions to their savings, the company said.

The average monthly manual deposits saw a massive 356% increase compared to this time last year, with single monthly manual deposits hitting a record high of £257.55 in June — a 355% increase from the same period of 2019.

Over the first six months of the year, the average single manual save amount increased by an impressive 256%, Chip reported.

As a result, Chip’s assets under management grew 40% in just two months. Meanwhile, its user base has nearly doubled in 2020, it claimed.

READ MORE: COVID-19 lockdown boosts household financial confidence and savings

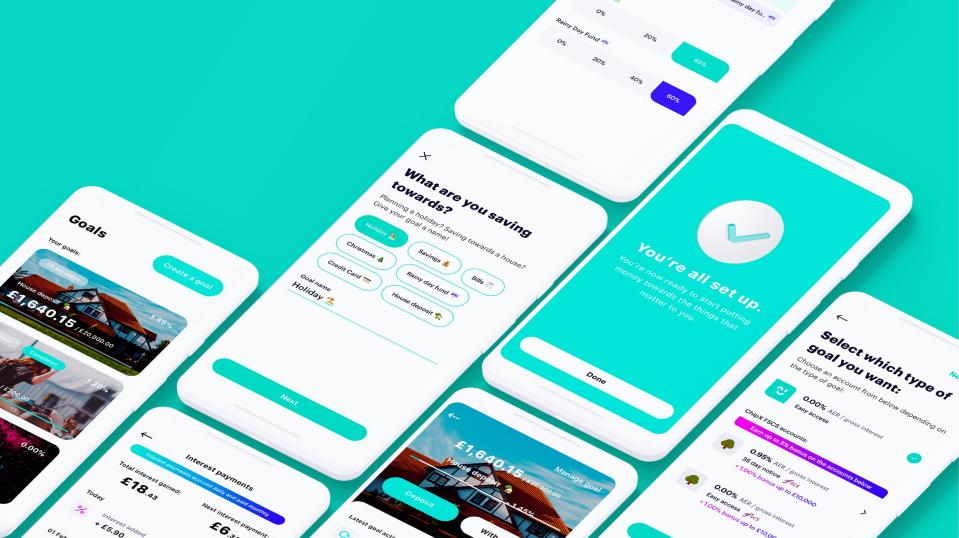

The change in Brits’ financial priorities was also reflected in the “goals” Chip users set on the app, with "safety net fund", "bills", "overdraft" and "credit card" making the top 10 in July, and “safety net fund” holding its number one spot since the start of lockdown.

Brits’ top 10 saving “goals”

Safety net fund

Holiday

Home

Christmas

Bills

Overdraft

Australia

Playstation 5

Credit card

Clothes

“This year has been without a doubt one of the most turbulent in our lifetimes. The events of 2020 have really highlighted the importance of having a financial buffer and taking control of your finances,” said Chip CEO Simon Rabin.

“Many of our peers across the fintech sector have been focussed on making it easier to manage your spending, but we’re using this disruptive tech-led approach to make sure people are saving up and earning the best returns.

“As Chip continues to grow, our focus is on providing more people with the tools for making saving easy, effortless and rewarding. We’re committed to opening up the exclusive world of the traditional savings industry and building the digital app-based future of savings.”

Yahoo Finance

Yahoo Finance