SCANA (SCG) Misses Q1 Earnings Estimates on Higher Costs

SCANA Corporation’sSCG first-quarter 2018 earnings of $1.18 per share missed the Zacks Consensus Estimate of $1.44 and the year-ago quarter’s $1.19, thanks to a rise in expenses. This was partly offset by growth in customer base and improvement in gas margin.

Quarterly operating revenues increased to $1,180 million from $1,173 million in the year-ago quarter.

Segment Performance

South Carolina Electric & Gas Company (SCE&G): Quarterly profits from this segment — SCANA’s principal subsidiary — were $128 million, up from $112 million in the year-ago quarter on healthy gas margins.

As of Mar 31, 2018, SCE&G provided services to about 371,000 customers of natural gas, higher 2.9% annually and 723,000 electric clients, higher 1.4% annually.

PSNC Energy: This segment recorded profits of $49 million in the first quarter, higher than $43 million in the prior-year quarter. The upside was driven by an expanded customer base.

SCANA Energy Marketing: The segment saw profit of $17 million, higher from $15 million in the prior year quarter.

Expenses

During the first quarter, the company reported $991 million in operating expenses, higher than $853 million in the prior-year quarter.

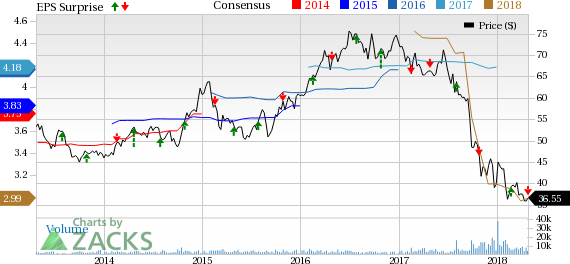

SCANA Corporation Price, Consensus and EPS Surprise

SCANA Corporation Price, Consensus and EPS Surprise | SCANA Corporation Quote

Zacks Rank & Stocks to Consider

SCANA carries a Zacks Rank #3 (Hold). A few better-ranked players in the energy space are Mammoth Energy Services, Inc. TUSK, Baytex Energy Corp. BTE and EOG Resources, Inc. EOG. All the stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Mammoth Energy is expected to witness a year-over-year rise of 246.5% in 2018 earnings.

Baytex managed to beat the Zacks Consensus Estimate in each of the last three quarters.

EOG Resources is likely to see year-over-year earnings growth of 317.9% in 2018.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SCANA Corporation (SCG) : Free Stock Analysis Report

Baytex Energy Corp (BTE) : Free Stock Analysis Report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

MAMMOOTH ENERGY (TUSK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance