Schneider National Inc Reports Q1 2024 Earnings: Misses Analyst Forecasts Amid Freight Recession

Operating Revenues: Reported at $1.319 billion, down 8% from $1.429 billion in the same quarter last year.

Net Income: Recorded at $18.5 million, a significant decrease of 81% from $98.0 million in the previous year, falling short of the estimated $23.06 million.

Diluted Earnings per Share (EPS): Came in at $0.10, an 82% decline from $0.55 year-over-year, below the estimated $0.12.

Adjusted Net Income: Came in at $19.5 million, representing an 80% drop compared to the $98.0 million in the same period last year.

Free Cash Flow: Decreased by $76.5 million compared to the same period in the prior year.

Updated Full-Year Guidance: Adjusted diluted EPS now expected to be between $0.85 and $1.00, revised down from previous forecasts of $1.15 to $1.30.

Capital Expenditures: Updated full year guidance suggests a reduction to $350.0 - $400.0 million from the prior estimate of $400.0 - $450.0 million.

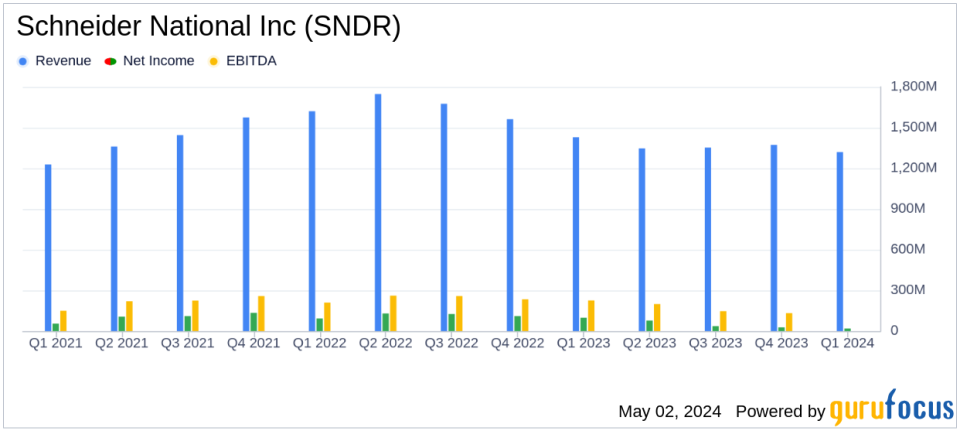

On May 2, 2024, Schneider National Inc (NYSE:SNDR), a prominent provider of transportation and logistics solutions in North America, disclosed its first-quarter earnings for 2024 through its 8-K filing. The company reported operating revenues of $1.319 billion, a decrease from $1.429 billion in the same quarter the previous year. This decline reflects an 8% year-over-year drop, falling short of the estimated revenue of $1.361 billion.

Company Overview

Schneider National Inc offers a wide range of transportation services including truckload, intermodal, and logistics solutions. It operates through several segments, with Truckload being the largest revenue generator. The company serves a diverse customer base across the United States, Canada, and Mexico, leveraging its extensive network and technology to meet transportation needs efficiently.

Financial Performance and Challenges

The first quarter saw Schneider grappling with the ongoing freight recession, which significantly impacted its financial outcomes. Net income plummeted to $18.5 million from $98 million in the prior year, marking an 81% decrease. This result was below the analyst's expectation of $23.06 million. Diluted earnings per share (EPS) were reported at $0.10, compared to $0.55 in Q1 2023, also missing the estimated EPS of $0.12.

The company's income from operations witnessed a sharp decline of 75%, standing at $28.7 million compared to $114.6 million in the previous year. Schneider's operating ratio deteriorated from 92.0% to 97.8%, indicating decreased operational efficiency. Adjusted EBITDA also fell by 41% to $130.7 million.

Segment Performance

The Truckload segment slightly increased its revenue to $538.1 million, up from $537 million in Q1 2023. However, income from operations in this segment dropped by 76% due to pricing and volume pressures. The Intermodal segment saw a revenue decrease of 7% to $247.2 million, with a corresponding 77% drop in income from operations, primarily due to lower revenue per order and higher empty repositioning costs. The Logistics segment experienced a 15% revenue decrease to $324.9 million, driven by lower brokerage volumes and revenue per order.

Strategic Responses and Outlook

Despite the challenging conditions, Schneider's management remains proactive. President and CEO Mark Rourke emphasized the company's efforts to improve asset productivity, maintain price discipline, and execute cost initiatives. The company has updated its full-year guidance for adjusted diluted EPS to $0.85 - $1.00, reflecting the ongoing market challenges.

"As we navigate the challenging freight market conditions that have persisted for far longer than originally contemplated, we are actively managing costs and pursuing margin improvement across our business while continuing to lean into our strategic growth areas of Dedicated, Intermodal, and Logistics," stated Darrell Campbell, Executive Vice President and Chief Financial Officer.

Capital Management and Shareholder Returns

Schneider continues to focus on shareholder returns through dividends and share repurchases. The company declared a quarterly dividend of $0.095 per share and reported share repurchases totaling $79.2 million under its $150 million program.

Conclusion

The first quarter of 2024 posed significant challenges for Schneider National, reflected in its missed earnings projections and revenue decline. However, the company's strategic adjustments and focus on operational efficiency, amid tough market conditions, demonstrate its resilience and commitment to long-term value creation. Investors and stakeholders will be watching closely to see how Schneider's strategies unfold in the upcoming quarters.

For further details and updates, please visit Schneider National Inc's section on GuruFocus.com.

Explore the complete 8-K earnings release (here) from Schneider National Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance