Science Applications International Corp (SAIC) Reports Solid FY24 Results and Upbeat FY25 Outlook

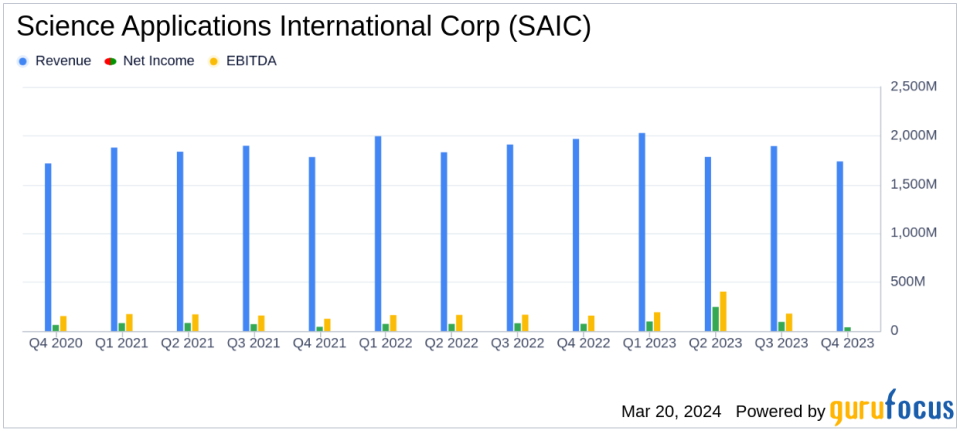

Revenue: FY24 revenues reached $7.44 billion, with a 7.4% organic growth.

Net Income: Reported at $477 million for FY24, marking a significant increase from the previous year.

Earnings Per Share (EPS): Diluted EPS for FY24 stood at $8.88, with an adjusted EPS of $7.88.

Cash Flow: Operating activities generated $396 million in FY24, with transaction-adjusted free cash flow of $486 million.

Guidance: Upgraded FY25 guidance anticipates higher revenue and free cash flow.

Backlog: Estimated backlog at the end of FY24 was approximately $22.8 billion.

On March 18, 2024, Science Applications International Corp (NASDAQ:SAIC) released its 8-K filing, detailing the financial results for the fourth quarter and full fiscal year 2024. SAIC, a leading provider of technical, engineering, and enterprise IT services primarily to the U.S. government, showcased a year of robust organic growth and strong financial performance, despite facing challenges such as divestitures and higher incentive-based compensation.

Financial Performance and Challenges

SAIC's revenue for FY24 was $7.44 billion, a 7.4% organic growth year-over-year, reflecting the impact of divestitures and an additional five working days in the prior year. The company's net income for the fiscal year was reported at $477 million, with an adjusted EBITDA of $668 million, or 9.0% of revenue. This performance was influenced by higher incentive-based compensation. The fourth quarter saw a net income of $39 million, with an adjusted EBITDA of $127 million or 7.3% of revenue.

The company's diluted earnings per share (EPS) for FY24 was $8.88, with an adjusted diluted EPS of $7.88. The fourth quarter diluted EPS was $0.74, with an adjusted diluted EPS of $1.43. SAIC's cash flows from operating activities for the fiscal year were $396 million, with transaction-adjusted free cash flow of $486 million.

Financial Achievements and Importance

SAIC's financial achievements, particularly the growth in net income and free cash flow, underscore the company's ability to navigate operational challenges and maintain profitability. The increase in net income by 59% compared to the previous year and the solid free cash flow are indicative of SAIC's strong financial discipline and operational efficiency. These achievements are particularly important for a company in the software and IT services industry, where consistent cash flow generation and profitability are key indicators of stability and potential for reinvestment in innovation and growth.

Key Financial Metrics

SAIC's financial stability is further evidenced by its balance sheet and cash flow statements. The company's total assets stood at $5.314 billion as of February 2, 2024, with total liabilities and stockholders' equity matching this figure. The company's cash and cash equivalents were reported at $94 million. The total cash flows provided by operating activities for the year reflect a strong ability to generate liquidity, which is crucial for ongoing operations and strategic investments.

"We delivered strong financial results in the quarter with revenue, earnings per share and free cash flow ahead of expectations," said Toni Townes-Whitley, SAIC Chief Executive Officer. "As we embark on the next phase of our corporate strategy to become the premier mission integrator in our market, I am confident that the investments we are making in Fiscal Year 2025 will accelerate our ability to drive value for all our stakeholders."

Analysis and Outlook

SAIC's performance in FY24 demonstrates the company's resilience and strategic focus. The updated FY25 guidance reflects a positive outlook, with anticipated higher revenue and free cash flow. This forward-looking approach, coupled with a strong backlog of approximately $22.8 billion, positions SAIC well for sustained growth and success in the coming fiscal year.

SAIC's commitment to delivering high-quality services and its strategic realignment to optimize growth further solidify its standing in the market. With a clear vision and strong financial results, SAIC is poised to continue its trajectory as a leading technology integrator for the U.S. government and other clients.

For detailed financial tables and further information, readers are encouraged to view the full 8-K filing.

Explore the complete 8-K earnings release (here) from Science Applications International Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance