Scotts Miracle-Gro Surpasses Analyst EPS Projections with Strong Q2 Performance

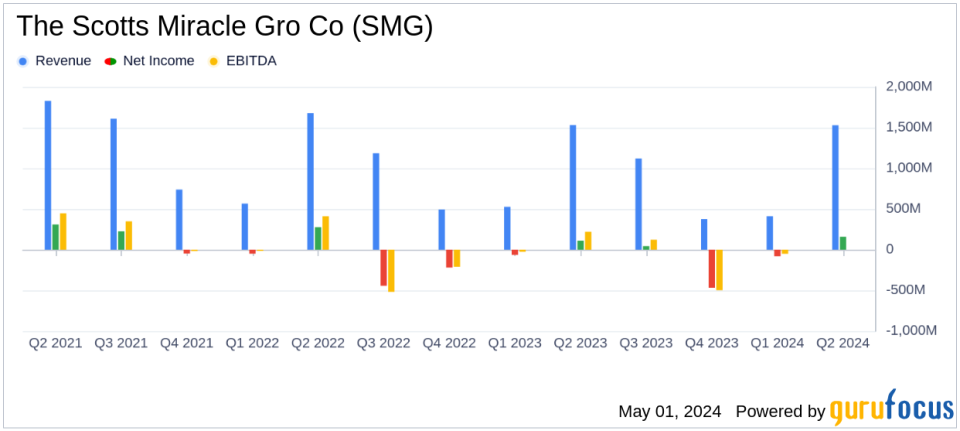

Revenue: Reported at $1.53 billion for Q2 2024, remaining stable year-over-year, aligning closely with estimates of $1.489 billion.

Net Income: Achieved $157.5 million in Q2 2024, up 44% from the previous year, surpassing the estimated $194.10 million.

Earnings Per Share (EPS): GAAP EPS stood at $2.74, exceeding last year's $1.94 but below the estimated $3.38; non-GAAP adjusted EPS was $3.69.

Gross Margin: Improved to 30.4% on a GAAP basis and 35.3% on a non-GAAP adjusted basis in Q2 2024, reflecting enhancements from cost reductions and lower material costs.

Free Cash Flow: Demonstrated strong performance, contributing to a net leverage ratio of 6.95x, which is well below the covenant maximum.

Hawthorne Segment: Sales declined by 28% to $66.4 million due to strategic shifts and market pressures in the hydroponic sector.

Annual Guidance: Reaffirmed non-GAAP fiscal 2024 guidance, expecting continued strong cash flow and debt management.

The Scotts Miracle Gro Co (NYSE:SMG) released its 8-K filing on May 1, 2024, revealing a quarter of robust financial performance that exceeded analyst expectations for earnings per share (EPS). The company, a leading provider of lawn and garden care products as well as indoor and hydroponic growing supplies, reported a GAAP EPS of $2.74 and an adjusted EPS of $3.69, surpassing the estimated $3.38.

Company Overview

Scotts Miracle-Gro is the largest marketer of branded consumer lawn and garden products in the United States. The company's portfolio includes well-known brands such as Scotts, Miracle-Gro, and Ortho. Scotts also leads in the North American cannabis-growing equipment sector through its Hawthorne segment. The majority of its sales are to major retailers like Home Depot, Lowe's, and Walmart.

Financial Performance Highlights

For Q2 2024, The Scotts Miracle Gro Co reported net sales of $1.53 billion, maintaining the level from the previous year, with U.S. Consumer segment sales rising by 2% to $1.38 billion. This performance aligns with record highs achieved two years prior, driven by increased listings and early season promotions in the growing media category. However, the Hawthorne segment saw a 28% decrease in sales to $66.4 million, attributed to strategic shifts and ongoing pressures in the hydroponic industry.

The company's gross margin improved significantly, with GAAP gross margin at 30.4% and adjusted gross margin at 35.3%, reflecting gains from distribution savings and lower material costs, partially offset by net price decreases. Operating expenses were reduced by 4% to $178.7 million, benefiting from the annualization of Project Springboard savings.

Strategic and Operational Developments

CEO Jim Hagedorn emphasized the company's leaner, more cost-efficient structure and its shift from crisis management to strength-based operations. The strategic partnership with BFG Supply aims to optimize the Hawthorne segment's market approach, focusing on higher-margin proprietary brands and exiting third-party brand distribution.

Financial Health and Outlook

The Scotts Miracle Gro Co's net leverage ratio improved to 6.95x, comfortably below the covenant maximum of 7.75x. Looking ahead, the company reaffirms its non-GAAP fiscal 2024 guidance, expecting continued strong performance in cash flow generation and debt reduction.

Challenges and Market Conditions

Despite strong results, the company faces challenges, including the contraction in the Hawthorne segment and the need to navigate a dynamic economic landscape. Market conditions and consumer demand fluctuations, particularly in the hydroponic sector, could impact future performance.

Conclusion

The Scotts Miracle Gro Co's Q2 2024 results demonstrate solid execution and strategic positioning for sustained growth. With a robust balance sheet and strategic initiatives in place, SMG is well-equipped to leverage opportunities in both traditional and emerging markets. Investors and stakeholders can anticipate continued focus on operational efficiency and market expansion as the company moves forward.

For detailed financial figures and future projections, investors and interested parties are encouraged to refer to the full earnings report and supplementary materials provided by The Scotts Miracle Gro Co.

Explore the complete 8-K earnings release (here) from The Scotts Miracle Gro Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance