Security fears loom over hostile bid battle for GKN

A hostile takeover bid for FTSE-100 engineer GKN is set to face intense government scrutiny on both sides of the Atlantic amid concerns over national security and the prospect of politically sensitive job losses.

The company, which is involved in a number of major defence projects, was the subject of an uninvited £7.4bn approach from Melrose, the listed turnaround specialist, a fortnight ago.

However, Melrose immediately went hostile, sparking concerns that its track record of boosting profits through heavy streamlining could affect GKN’s work, particularly in the defence and aerospace industries. It is involved in the production of the F-35 stealth fighter and America’s new B-21 Raider bomber.

Melrose typically aims to hold on to the companies it buys for a three to five-year turnaround before selling them on for a profit. The company has generated a 3,000pc total shareholder return since floating in 2003.

However, it is feared that its highly successful “buy, improve, sell” strategy, could be hampered by security concerns when it attempts to offload GKN’s aerospace arm.

Meanwhile, any restructuring that affected the workforce at the company’s automotive business could also be hampered by state interference.

Greg Clark, the Business Secretary, has met both GKN and Melrose, and the Government is “closely monitoring” the situation, a spokesman said, adding that “it is early days and being regarded as a commercial matter at the moment”.

One of GKN’s biggest shareholders said: “There are government interests, especially in military and customers such as Airbus, but even automotive manufacturing is highly politicised. This makes restructuring and any cutting of budgets or jobs very difficult.”

Another investor added: “Through GKN’s defence programmes, you have enough government customers effectively buying parts from it and they could bring pressure to bear. Melrose will need to reassure governments and partners that it will still be able to supply them and at a reasonable price.”

The US military is expected to demand assurances that its secrets will be protected when Melrose eventually looks to dispose of the aerospace division – reducing the pool of companies who can take on the business and holding down the price.

Defence analyst Howard Wheeldon added: “There are bound to be concerns about the future long-term ownership of GKN’s aerospace division and its defence contracts.”

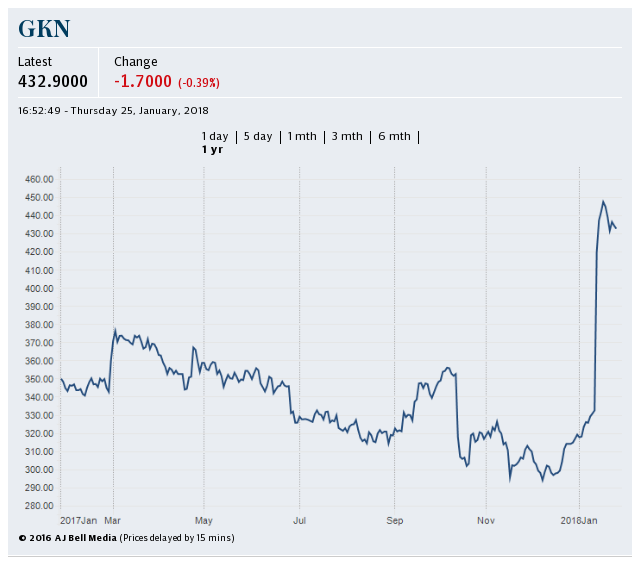

Investors are awaiting the next move in the takeover battle after Melrose made a formal 430p cash and paper bid for GKN. This would give investors 57pc of the combined company.

GKN has responded with its own break-up plans and issued a stinging rebuke of Melrose’s offer and “fake premium”. It has also installed interim boss Anne Stevens as permanent chief executive.

Melrose is pledging to “unlock” value in GKN after a long struggle to hit margin targets, several profit warnings and a disastrous succession plan, that led to non-executive director Ms Stevens taking charge.

GKN has hit back, saying Melrose is “fundamentally” undervaluing the company. GKN says the true uplift from its bid is just a third of the claimed amount as it uses shareholders’ own money to finance the cash payment.

Both sides are now touring the City trying to convince shareholders to back their respective plans. However, one investor said it was unlikely either will deliver a “quick fix”, noting GKN has been in upheaval for years as it seeks to boost returns with little impact.

The investor added: “If a restructuring is even possible, it will take three to five years and be expensive.”

Yahoo Finance

Yahoo Finance