Security Robots Market by Type, Application, Component, End-user and Geography - Global Forecast to 2027

Global Security Robots Market

Dublin, July 13, 2022 (GLOBE NEWSWIRE) -- The "Security Robots Market by Type (UAV (Fixed Wing, Rotary Wing), UGV (Wheeled, Tracked, Legged, Hybrid), UUV (Autonomous Underwater Vehicles, Remotely Operated Underwater Vehicles)), Application, Component, End User and Geography - Global Forecast to 2027" report has been added to ResearchAndMarkets.com's offering.

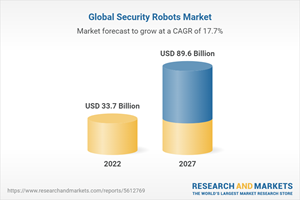

The security robots market was valued at USD 33.7 billion in 2021 and is projected to reach USD 89.6 billion by 2027; it is expected to grow at a CAGR of 17.7% from 2022 to 2027.

The major drivers of the market include the growing adoption of security robots for commercial and residential applications, rising emphasis on security at national or regional levels, increasing investments and spending on defense by countries globally, and surging demand for autonomous systems that make real-time monitoring smarter.

UAV held the largest share of the security robots market in 2021

UAVs are either remotely controlled, semi-autonomous, or autonomous unmanned aircraft that can be used for civil/commercial, homeland security, and defense applications. UAVs not only perform intelligence, surveillance, and reconnaissance missions, but also attack, strike, suppress, and destroy enemy air defense; and combat search and rescue, among others.

A few of the advantages of unmanned aerial vehicles are these vehicles can enter environments that are dangerous to human life; reduce the exposure risk of the aircraft operators; can stay in the air for a long duration; perform a precise, repetitive faster scan of a region, day-after-day, night-after-night, in complete darkness, or fog, under computer control; and can be programmed to complete the mission autonomously.

Market for residential end-users is expected to grow at the highest rate from 2022 to 2027

Consumer drones have become popular among prosumers and hobbyists, vloggers, and videographers worldwide. This is because these drones are cost-effective and offer high-resolution wide-angle photography. Presently, governments of different countries worldwide are using drones for law enforcement and governance applications owing to their compactness and quick services. The demand for UAVs has significantly increased during the COVID-19 pandemic, with governments employing drones for carrying out surveillance activities, spraying disinfectants in public areas, and controlling crowds, along with the identification of the COVID-19 hotspots.

North America held the largest share of the security robots market in 2021

North America accounted for the largest share of 37.2% of the global security robots market in 2021. The US and Canada are the major countries contributing to the growth of the security robots market in North America. North America is a major hub for technological innovations and an early adopter of new technologies.

The presence of major players in the region also supports the demand and awareness regarding security robots. The US is the largest developer, operator, and exporter of military unmanned systems. UAVs are used to counter terrorist operations and are extensively used by the US police for crowd control. Major players such as Lockheed Martin (US) and Northrop Grumman (US) develop unmanned systems for commercial as well as homeland security applications. Several such UAVs have been developed by these major players for the defense and commercial purposes, in recent years.

Key Topics Covered:

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights

4.1 Attractive Growth Opportunities for Security Robots Market

4.2 Security Robots Market, by Type

4.3 Security Robots Market, by End-user

4.4 Security Robots Market, by Region

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Defense Spending of Countries Worldwide

5.2.1.2 Surging Adoption of Security Robots in Civil and Commercial Applications

5.2.1.3 Increasing Capital Expenditure of Offshore Oil & Gas Companies

5.2.1.4 Growing Demand for Autonomous Systems in Defense and Commercial Sectors

5.2.1.5 Improvements in Regulatory Frameworks Related to Drone Operations

5.2.2 Restraints

5.2.2.1 Unreliability of Security Robots, in Terms of Their Functionality, in Military Operations

5.2.2.2 High Operational Costs of Security Robots

5.2.2.3 Lack of Trained Staff for Operating Drones and Infrastructures Such as Runways

5.2.2.4 Issues Related to Safety and Security of Security Robots

5.2.3 Opportunities

5.2.3.1 Increase in Adoption of IoT and Cloud Technologies

5.2.3.2 Development and Incorporation of Advanced Technologies in Uuvs

5.2.3.3 Development of Fully Autonomous Ugvs

5.2.4 Challenges

5.2.4.1 Requirement for High-Level Expertise Associated with Security Robots and Their Hardware and Software Malfunctions

5.2.4.2 Requirement for Continuous and Uninterrupted Power Supply in Ugvs

5.3 Value Chain Analysis

5.3.1 Planning and Revising Funds

5.3.2 Research and Development

5.3.3 Manufacturing

5.3.4 Assembly and Distribution

5.3.5 Post-Sales Services

5.4 Ecosystem Analysis

5.5 Pricing Analysis of Security Robots

5.5.1 Average Selling Prices of Market Players

5.6 Trends/Disruptions Impacting Customer'S Business

5.7 Technological Trends

5.8 Porter's Five Forces Analysis

5.9 Key Stakeholders and Buying Criteria

5.9.1 Key Stakeholders in Buying Process

5.9.2 Buying Criteria

5.10 Case Studies

5.10.1 Swarmdiver by Aquabotix (Australia)

5.10.2 Vector Hawk from Lockheed Martin (Us)

5.10.3 UAVs Deployed by Various Companies for Delivery Services

5.10.4 UAVs for Delivery Services During Pandemic

5.10.4.1 Drones of Zipline Were Used to Transfer Test Samples to Research Laboratories During Pandemic in Rwanda, Ghana, and US

5.10.4.2 Delivery of Medical Prescriptions Using Drones by Manna Aero in Ireland During Pandemic

5.10.4.3 Mexico-Based Sincronia Logistica Uses Drones to Deliver Medical Supplies to Public Hospitals During Pandemic

5.11 Trade Analysis

5.12 Patent Analysis

5.13 Key Conferences & Events

5.14 Regulatory Landscape

6 Security Robots Market, by Type

6.1 Introduction

6.2 Unmanned Aerial Vehicles

6.3 Unmanned Ground Vehicles

6.4 Unmanned Underwater Vehicles

7 Security Robots Market, by Application

7.1 Introduction

7.2 Spying

7.3 Explosive Detection

7.4 Firefighting

7.5 Demining

7.6 Rescue Operations

7.7 Transportation

7.8 Patrolling

8 Security Robots Market, by End-user

8.1 Introduction

8.2 Commercial

8.2.1 Increasing Applications of Security Robots in Commercial Sector Owing to Their Efficiency in Operations

8.3 Civil/Residential

8.3.1 Ease of Usage of Security Robots for Residential Purposes to Drive Demand for Security Robots

8.4 Military & Defense

8.4.1 Rising Demand for Small Drones in Defense Sector for Surveillance and Reconnaissance Activities and Border Security Applications

8.5 Others

8.5.1 Law Enforcement

8.5.1.1 Increase in Terrorist Activities Has Resulted in Use of Security Robots for Law Enforcement Applications

8.5.2 Federal Law Enforcement

8.5.2.1 Ugvs Are Extensively Used by Federal Law Enforcement Agencies for Dangerous Missions

9 Geographic Analysis

10 Competitive Landscape

10.1 Introduction

10.2 Key Player Strategies/Right to Win

10.2.1 Overview of Strategies Deployed by Key Players in Security Robots Market

10.3 Top 5 Company Revenue Analysis

10.4 Market Share Analysis of Top Players, 2020-2021

10.5 Competitive Evaluation Quadrant, 2020

10.5.1 Star

10.5.2 Emerging Leader

10.5.3 Pervasive

10.5.4 Participant

10.6 Small and Medium-Sized Enterprises (SME) Evaluation Quadrant, 2020

10.6.1 Progressive Company

10.6.2 Responsive Company

10.6.3 Dynamic Company

10.6.4 Starting Block

10.6.5 Security Robots Market: Company Footprint

10.6.6 Security Robots Market: Startup Matrix

10.7 Competitive Situations and Trends

10.7.1 Product Launches

10.7.2 Deals

11 Company Profiles

11.1 Key Players

11.1.1 Aerovironment, Inc.

11.1.2 BAE Systems

11.1.3 Boston Dynamics

11.1.4 Saab

11.1.5 Cobham Limited

11.1.6 Eca Group

11.1.7 Elbit Systems Ltd.

11.1.8 Knightscope, Inc.

11.1.9 Kongsberg

11.1.10 Leonardo S.P.A.

11.1.11 Lockheed Martin Corporation

11.1.12 Northrop Grumman

11.1.13 Qinetiq

11.1.14 Smp Robotics

11.1.15 Thales

11.2 Other Key Players

11.2.1 Autonomous Solutions, Inc.

11.2.2 Boeing

11.2.3 Dji

11.2.4 Flir Systems

11.2.5 Textron

11.2.6 Rheinmetall Ag

11.2.7 L3 Harris Technologies

11.2.8 Reconrobotics Inc.

11.2.9 Robotex Inc.

11.2.10 Cobalt Robotics

12 Adjacent & Related Markets

13 Appendix

For more information about this report visit https://www.researchandmarkets.com/r/bqqbs8

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance