Security and Safety Services' Outlook Bleak for Near Term

The Zacks Security and Safety Services industry comprises companies that provide sophisticated and interactive security solutions and related services. Such products and services are mainly used for residential, commercial and institutional purposes. A few industry players develop electrical weapons for personal defense as well as military, federal, law enforcement and private security.

There are also companies, which provide solutions for the recovery of stolen vehicles, wireless communication devices, equipment for the safety of facility infrastructure and employees, a variety of services to automobile owners and insurance companies, and products for detecting hazards. Many of the companies serve manufacturing, electronics, construction, telecommunications, aerospace, medical and other end markets.

Here are the three major industry themes:

The pandemic-induced low demand environment has weakened prospects for many industry players. For instance, Fortune Brands Home & Security, Inc. (FBHS) — a provider of home and security products — expects governmental restrictions to contain the spread of the virus as well as an operational shutdown at some facilities to adversely impact its performances in the second and third quarters of 2020. Another player, Allegion plc (ALLE) suspended its previously provided projections for 2020 due to the pandemic-led uncertainties. In addition to the pandemic woes, some companies are dealing with the impacts of strained trade relations, high costs and expenses, and unfavorable movements in foreign currencies.

Innovation plays a vital role in the industry. Constant update of products and services is required to keep up with changing customer needs, making steady investments necessary. In addition to these, the companies often make acquisitions to broaden their product portfolios and geographical footprints. Such investments often leave companies with a highly leveraged balance sheet. Notably, Johnson Controls International plc (JCI) had long-term debt of $5.64 billion as of Mar 31, 2020.

Globally, the industry is poised to benefit from the increasing demand for security products (especially cybersecurity-related products) due to the need to deal with fraudulent activities like hacking. Also, growing concerns among corporates to provide a safe and secure working environment to workers as well as secure facility infrastructure are major drivers for the industry.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Security and Safety Services industry is a 22-stock group within the broader Zacks Industrial Products sector. The industry currently carries a Zacks Industry Rank #175, which places it in the bottom 31% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates gloomy near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the bottom 50% of the Zacks-ranked industries is a result of bleak earnings prospects for the constituent companies in aggregate. Looking at the aggregate earnings estimate revision, it appears that analysts are gradually losing confidence in this group’s earnings growth potential. The industry’s earnings estimates for the current year have moved down 28.3% in a year's time.

Before we discuss a few stocks from the industry, let’s have a look at the industry’s shareholder returns and current valuation first.

Industry Underperforms Sector & S&P 500

The Zacks Security and Safety Services industry has underperformed its sector and the S&P 500 in the past year. The industry declined 10.5% compared with the sector’s fall of 9.3% and against the S&P 500’s growth of 2.1%.

One-Year Price Performance

Security and Safety Services Industry’s Valuation

EV/EBITDA ratio is commonly used for valuing security and safety services stocks.

The industry’s forward 12-month EV/EBITDA ratio is 10.8. This clearly shows that the industry is trading below the S&P 500’s forward 12-month EV/EBITDA ratio of 13.21 and the sector’s 18.79.

Over the past five years, the industry has traded at the highest level of 21.49X forward 12-month EV/EBITDA and the lowest level of 5.75X. The median level over the same period was 9.42X.

Security and Safety Services Industry’s Valuation Versus Sector

Security and Safety Services Industry’s Valuation Versus S&P 500

Bottom Line

We believe the industry might not be an appropriate choice for investment in the near term due to the prevalent headwinds. The majority of the stocks in the industry currently carry a Zacks Rank #3 (Hold), 4 (Sell) or 5 (Strong Sell).

Nonetheless, we present two stocks, with a Zacks Rank #1 (Strong Buy) and #2 (Buy) and impressive earnings prospects, which investors might be interested in.

A brief discussion on the stocks is provided below:

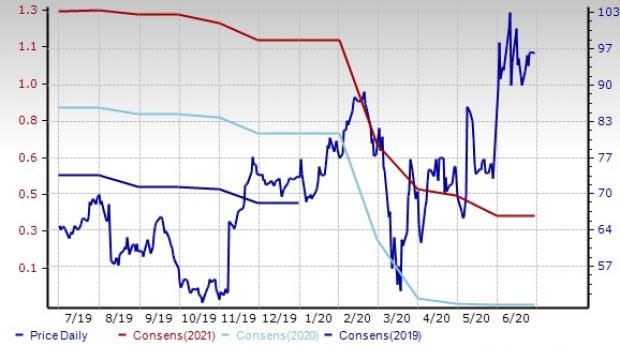

Lakeland Industries, Inc. (LAKE): Shares of this Decatur, AL-based company have surged 97.1% over the past year. The company currently sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Its earnings estimates for fiscal 2021 (ending January 2021) have been raised 198.7% in the past 60 days. The estimate suggests growth of 417.8% from the previous year’s reported figure.

Price and Consensus: LAKE

Axon Enterprise, Inc. (AAXN): Shares of this Scottsdale, AZ-based company has gained 48.4% in the past year. The company currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for its 2020 earnings has been unchanged in the past 60 days. The estimate indicates growth of 12.5% from the year-ago reported figure.

Price and Consensus: AAXN

We also present two stocks, with a Zacks Rank #3, which investors might prefer holding on to at this moment.

MSA Safety Incorporated (MSA): Stock of this Cranberry Township, PA-based company has rallied 6.5% in the past year.

The Zacks Consensus Estimate for its 2020 earnings has been increased 0.2% in the past 60 days.

Price and Consensus: MSA

ADT Inc. (ADT): The stock of this Boca Raton, FL-based company has gained 26.5% in the past year.

The Zacks Consensus Estimate for its 2020 earnings increased 9.6% in the past 60 days.

Price and Consensus: ADT

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MSA Safety Incorporporated (MSA) : Free Stock Analysis Report

Lakeland Industries, Inc. (LAKE) : Free Stock Analysis Report

Johnson Controls International plc (JCI) : Free Stock Analysis Report

Fortune Brands Home Security, Inc. (FBHS) : Free Stock Analysis Report

Allegion PLC (ALLE) : Free Stock Analysis Report

ADT Inc. (ADT) : Free Stock Analysis Report

Axon Enterprise, Inc (AAXN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance