Some see gold as an inert, useless lump; we see it as insurance against central banks’ mistakes

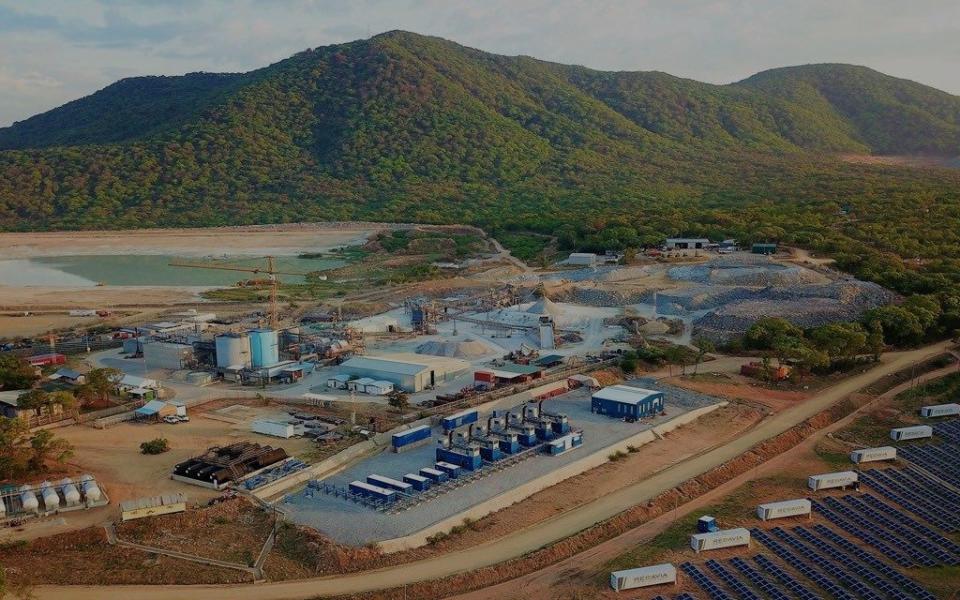

A number of major economic trends are working against the price of gold right now, although it is holding firm above the $1,900 an ounce mark. Better still, East Africa-based producer Shanta Gold is on track to meet its targets for both production and “all-in sustained cost” (AISC) for 2023 as the company’s New Luika mine increases its output and the Singida site starts to produce on schedule.

While this column’s record with junior commodity stocks undeniably needs a polish, Shanta, covered here in January, could yet add some lustre to the portfolio.

Rising interest rates potentially dampen demand for gold: cash and bonds now offer higher returns, whereas the metal generates no cash flow and simply costs money to own.

In addition, the dollar is strong, thanks to the US Federal Reserve’s apparent commitment to keeping American borrowing costs higher for longer. Meanwhile, fiscal stimulus from the Biden administration, which continues to pump money into the US economy via the Chips and Inflation Reduction acts of 2022, may also dampen interest in assets such as gold.

Yet America’s tendency to spend like a drunken sailor at a time when interest rates and bond yields are soaring is one reason gold bugs will continue to champion the precious metal.

The US federal interest bill is approaching $1 trillion a year, no small sum when welfare consumes $3 trillion and defence spending about $850bn. Annual tax income is around $5 trillion, so the Biden administration is spending more than it generates in tax by a scary degree.

The federal debt is up by $1.6 trillion in the five months since April to take the total to $33 trillion and towards the new limit approved by Congress in the spring.

The government is unlikely to stop spending in 2024, a presidential election year, so at some stage the Fed may have to put a halt to rate rises to stop interest bills throttling America’s finances and its economy. Some gold bugs even argue that the US central bank may have to resort once more to quantitative easing (QE) and start buying US “Treasuries” – government bonds – again to fund the deficit, especially if the economy slows down and tax revenues come under further pressure.

Anyone who has faith in the Fed and the US economy will be entirely unmoved by such talk and likely to view gold as an inert, useless lump. Those of this world view can just skip to the next column. But anyone who is even a little concerned by America’s fiscal situation might at least like to bear gold in mind as a potential insurance policy if anything does come unravelled on the other side of the Atlantic.

A surge in Chinese gold buying also catches this column’s eye. The Chinese authorities even imposed temporary curbs on imports as the renminbi weakened and the metal’s price there surged to a premium to that on offer in the West.

As Beijing adjusts to a period of lower growth and less speculation in both its stock and housing markets, some economists now suggest that Chinese savers view gold as a better option than housing in their search for financial security.

This concept may seem alien to many in the West, but such scepticism may help to explain why Shanta’s market value of about £110m represents a discount to the $165m (£135m) of net assets on its balance sheet.

Such a discount to book value will hopefully provide investors with some protection, should they need it. For the moment, however, Shanta is on track to increase production by more than 40pc in 2023 to around 94,000 ounces and build on 2022’s 18pc advance. New Luika’s AISC is expected to be $1,200-$1,300 an ounce and Singida’s around $1,300-$1,400, so gold prices north of $1,900 are a boon.

No wonder last week’s first-half results reported a 70pc year-on-year jump in sales and a move into profit, while positive free cash flow reduced the already modest net debt position. A sixth consecutive dividend payment for a half-year also speaks of management’s confidence in its Tanzanian assets, while exploration work in west Kenya could yet add a little gold dust to the investment case.

Nevertheless, small mining companies are not suitable for everyone, not least because things can and do go wrong.

The gold price can be volatile, for a start, while Shanta Gold aims to bounce back after missing production targets in 2022. In addition, the Aim-quoted concern is looking for a new chief executive after Eric Zurrin’s decision to step down in 2023 after a six-year spell in charge. The identity of his successor is eagerly awaited.

Shanta still has a chance to really shine.

Questor says: hold

Ticker: SHG

Share price at close: 10.5p

Questor on Twitter

Readers who used to follow us @DTquestor may be wondering what has happened to the account. It still exists but its name has changed to @TeleQuestor. If you go there instead, you should find that you are already following us and we will aim to tweet each column from there. Apologies for any confusion.

Russ Mould is investment director at AJ Bell, the stockbroker

Read the latest Questor column on telegraph.co.uk every Monday, Tuesday, Wednesday, Thursday and Friday from 6am

Read Questor’s rules of investment before you follow our tips

Yahoo Finance

Yahoo Finance