Seeking Income? 3 Utilities Stocks Worth Consideration

Income investors commonly target the Utilities sector, as companies in the realm generate reliable and predictable demand thanks to their services being a necessity.

In addition, these stocks are generally considered defensive by nature, making them an attractive option for investors seeking an income stream during uncertainty.

Further, the sector has a favorable outlook, with the Zacks Utilities sector currently ranked number one out of all 16 Zacks sectors.

According to studies, 50% of a stock's price movement can be attributed to its group, making it clear why it’s critical for investors to target stocks in areas seeing their outlooks shift positively.

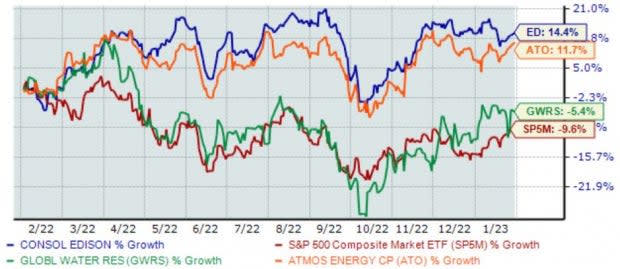

Three stocks from the Zacks Utilities sector – Global Water Resources GWRS, Atmos Energy ATO, and Consolidated Edison ED – could all be considerations for investors seeking a reliable income stream.

Below is a chart illustrating the performance of all three over the last year, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a closer look at each one.

Consolidated Edison

Consolidated Edison is a diversified utility holding company with subsidiaries engaged in both regulated and unregulated businesses. Currently, the company carries a favorable Zacks Rank #2 (Buy).

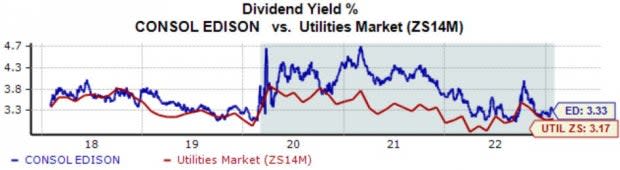

ED’s annual dividend yield presently stands tall at 3.3%, modestly above the Zacks Utilities sector average. Displaying its shareholder-friendly nature, the company has increased its payout six times over the last five years.

Image Source: Zacks Investment Research

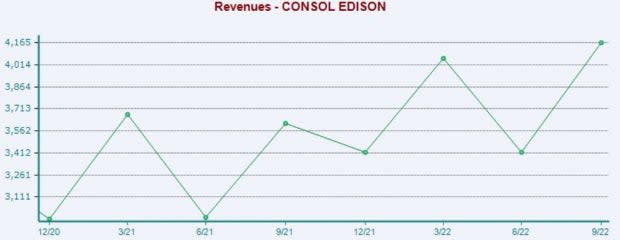

Further, the company has posted strong quarterly results as of late, exceeding earnings and revenue estimates in back-to-back quarters. In its latest release, Consolidated Edison surpassed the Zacks Consensus EPS Estimate by nearly 11% and posted a 12% revenue surprise.

Image Source: Zacks Investment Research

Global Water Resources

Global Water Resources is a water resource management company that owns and operates regulated water, wastewater, and recycled water utilities. The company sports a Zacks Rank #2 (Buy).

Global Water Resources’ annual dividend currently yields roughly 2.1%, below the Zacks sector average by a fair margin.

Still, the company has been dedicated to increasingly rewarding its shareholders, upping its payout eight times just over the last five years.

Image Source: Zacks Investment Research

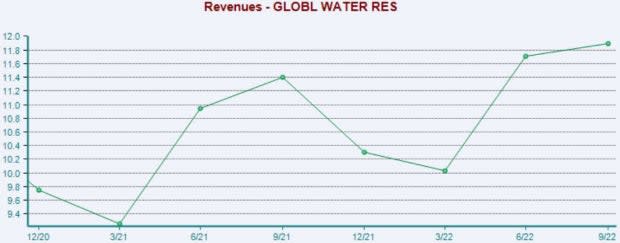

It’s impossible to ignore the company’s quarterly performance; Global Water Resources has exceeded the Zacks Consensus EPS Estimate in four consecutive quarters, with the average surprise being 180%.

Top-line results have also consistently come in better than expected, with GWRS penciling in four consecutive revenue beats.

Image Source: Zacks Investment Research

Atmos Energy

Atmos Energy and its subsidiaries are engaged in regulated natural gas distribution and storage businesses. Analysts have upped their earnings estimates across nearly all timeframes, helping land the stock into a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Atmos Energy rewards its shareholders via its annual dividend that currently yields 2.6% paired with a sustainable payout ratio sitting at 48% of its earnings.

While the yield is lower than the Zacks sector average, the company’s 9% five-year annualized dividend growth rate helps to bridge the gap in a big way.

Image Source: Zacks Investment Research

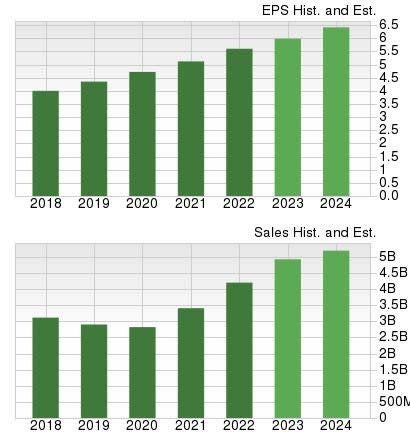

And to top it off, ATO carries a favorable growth profile, with earnings forecasted to climb 7% in its current fiscal year (FY23) and a further 7.2% in FY24.

The projected earnings growth comes on top of forecasted revenue upticks of 20% and 6% in FY23 and FY24, respectively.

Image Source: Zacks Investment Research

Bottom Line

Utilities stocks are common targets among income investors, as these companies’ services provide an advantageous ability to generate revenue in the face of many economic situations.

In addition, their defensive nature can provide a nice shield against volatility, something that all investors seek.

All three stocks above – Global Water Resources GWRS, Atmos Energy ATO, and Consolidated Edison ED – could be considerations for those seeking a reliable income stream paired with a defensive approach.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Consolidated Edison Inc (ED) : Free Stock Analysis Report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

Global Water Resources, Inc. (GWRS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance