Segment Strength, Buyouts to Aid Ingersoll (IR) Amid Cost Woes

Ingersoll Rand Inc. IR is a specialist in providing mission-critical flow creation and industrial technologies. It is based in Davidson, NC, and has a $22.8-billion market capitalization.

The company belongs to the Zacks Manufacturing - General Industrial industry, which, in turn, comes under the ambit of the Zacks Industrial Products sector. The industry comes in the top 22% (with the rank of 56) of more than 250 Zacks industries. The company presently carries a Zacks Rank #2 (Buy).

In the past three months, Ingersoll’s shares have gained 13.7% against the industry’s decline of 3.4%.

Image Source: Zacks Investment Research

There are a number of factors that are influencing the company’s prospects. A brief discussion on important factors and earnings estimates is given below:

Financial Performance and Projections: The company’s results for second-quarter 2021 were impressive, with earnings beating the Zacks Consensus Estimate by 15% and sales expanding 7.49%. On a year-over-year basis, its earnings increased 58.6% from the year-ago quarter on the back of revenue strength and margin generation.

In the quarters ahead, Ingersoll is poised to gain from its solid product offerings, focus on innovation and strengthening aftermarket business. Its focus on boosting the e-commerce business, expanding IoT and digital capabilities, and cost-saving actions are also likely to be advantageous. Savings from cost actions were $115 million in 2020 and are predicted to be $100 million in 2021.

For 2021, the company anticipates revenue growth in the mid-teens on a year-over-year basis as compared with the low-double-digit growth stated previously.

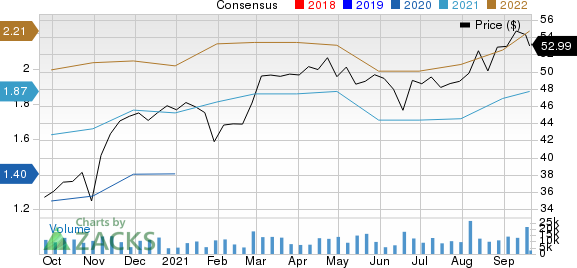

In the past 60 days, the Zacks Consensus Estimate for Ingersoll’s earnings per share has increased 8.7% to $1.87 for 2021 and 9.4% to $2.21 for 2022. The consensus estimate for the third quarter was 49 cents per share, up 11.4% from the 60-day-ago figure.

Ingersoll Rand Inc. Price and Consensus

Ingersoll Rand Inc. price-consensus-chart | Ingersoll Rand Inc. Quote

Segmental Strength: The company operates through two business segments — Industrial Technologies & Services, and Precision & Science Technologies. The Industrial Technologies & Services segment is engaged in making products, including power tools, air compressors, vacuum pumps, and couplers. The Precision & Science Technologies segment is engaged in manufacturing liquid and gas pumps, doing and metering pumps, and others.

In second-quarter 2021, revenues of the Industrial Technologies & Services segment increased 26.3% year over year, while that of Precision & Science Technologies grew 18.3%.

For 2021, the company anticipates organic sales for the Industrial Technologies & Services and Precision & Science Technologies segments to grow in low-double digits. Earlier, the company anticipated segmental growth in the high-single digits.

Inorganic Moves & Shareholders’ Rewards: Ingersoll engages in inorganic actions, both acquisitions and divestments, to strengthen its existing portfolio. The company added Albin Pump SAS to its portfolio in September 2020, and it acquired Tuthill Vacuum and Blower Systems in February 2021, and Maximus in August 2021. It also acquired Seepex GmbH in September. For 2021, the company anticipates buyouts/mergers to generate revenues of $60 million.

Ingersoll is active in disposing of its non-core or non-profitable businesses. In April 2021, it divested the High Pressure Solutions segment and sold the Specialty Vehicle Technologies Segment in June.

Regarding shareholders’ rewards, Ingersoll will initiate the payment of a quarterly dividend to shareholders from the fourth quarter of 2021. The initial dividend rate is fixed at 2 cents per share. Along with the approval for dividends in September, the company received the authorization for a $750-million share-buyback program.

Cost Woes: In second-quarter 2021, Ingersoll’s cost of sales expanded 6.9% year over year and its selling, general and administrative expenses increased 27.8%. In the quarters ahead, the impacts of one-time and discretionary costs, inflation in material and logistics costs, and growth investments might be concerning.

International Operations & Industry Peers: Ingersoll carries out its operations internationally, with exposure in markets of the Middle East, the Asia Pacific, Africa, the Americas, Europe and India. International diversification has exposed the company to geopolitical issues, unfavorable movements in foreign currencies, local competitive pressure and macroeconomic challenges.

Three other top-ranked companies in the same industry are EnPro Industries, Inc. NPO, Nordson Corporation NDSN and Kadant Inc. KAI. All companies presently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, earnings estimates for the companies have improved for the current year. Further, positive earnings surprise for the last reported quarter was 25.81% for EnPro, 14.15% for Nordson and 33.11% for Kadant.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Nordson Corporation (NDSN) : Free Stock Analysis Report

Kadant Inc (KAI) : Free Stock Analysis Report

EnPro Industries (NPO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance