SEHK Favorite Dividend Stocks

Xingda International Holdings is one of our top dividend-paying companies that can help boost the investment income in your portfolio. These stocks are a safe way to create wealth as their stable and constant yields generally hedge against economic uncertainty and deliver downside protection. A sizeable part of portfolio returns can be produced by dividend stocks due to their contribution to compounding returns in the long run. Here are other similar dividend stocks that could be valuable additions to your current holdings.

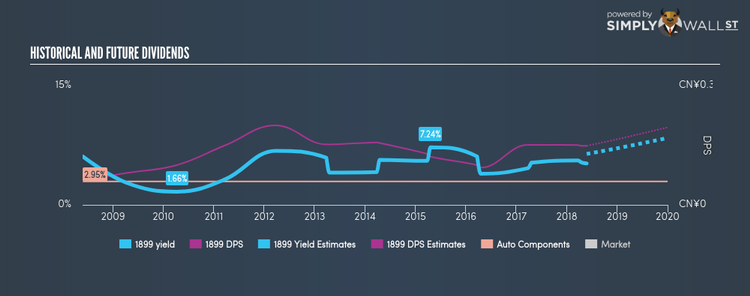

Xingda International Holdings Limited (SEHK:1899)

Xingda International Holdings Limited, an investment holding company, engages in the manufacture and trading of radial tire cords, steel cords, bead wires, and other wires. The company size now stands at 6959 people and with the company’s market cap sitting at HKD HK$4.23B, it falls under the mid-cap group.

1899 has a large dividend yield of 5.22% and the company currently pays out 62.26% of its profits as dividends , with the expected payout in three years being 66.10%. Despite there being some hiccups, dividends per share have increased during the past 10 years. Interested in Xingda International Holdings? Find out more here.

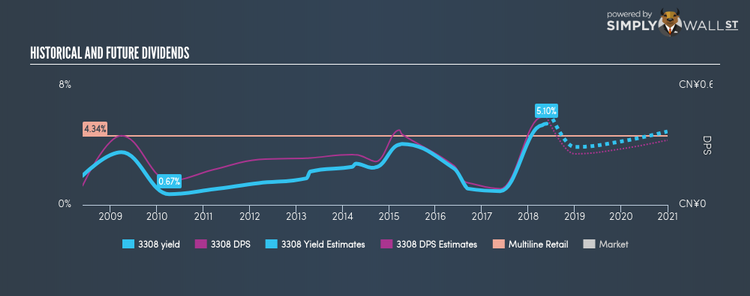

Golden Eagle Retail Group Limited (SEHK:3308)

Golden Eagle Retail Group Limited, an investment holding company, develops and operates lifestyle center and stylish department store chain in the People’s Republic of China. Formed in 1995, and now led by CEO Hung Wang, the company size now stands at 4,620 people and with the company’s market cap sitting at HKD HK$14.51B, it falls under the large-cap stocks category.

3308 has a sumptuous dividend yield of 5.10% and is currently distributing 47.17% of profits to shareholders . While there’s been some level of instability in the yield, 3308 has overall increased DPS over a 10 year period from CN¥0.097 to CN¥0.44. Continue research on Golden Eagle Retail Group here.

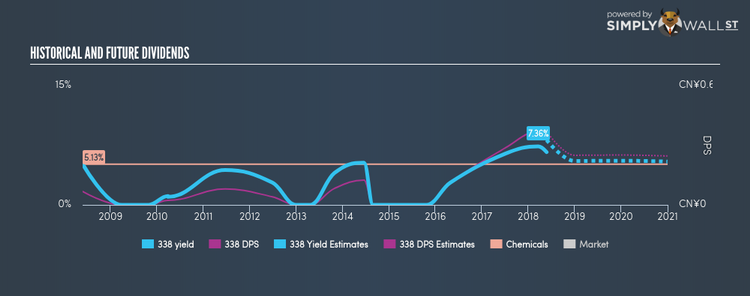

Sinopec Shanghai Petrochemical Company Limited (SEHK:338)

Sinopec Shanghai Petrochemical Company Limited, together with its subsidiaries, manufactures and sells petrochemical products in the People’s Republic of China. Founded in 1972, and run by CEO Haijun Wu , the company now has 11,088 employees and has a market cap of HKD HK$72.98B, putting it in the large-cap group.

338 has an alluring dividend yield of 6.64% and distributes 54.19% of its earnings to shareholders as dividends . While there’s been some fluctuation in the yield over the last 10 years, the dividends per share have increased in this time. The company has a lower PE ratio than the HK Chemicals industry, which interested investors would be happy to see. The company’s PE is currently 8.2 while the industry is sitting higher at 9.9. Dig deeper into Sinopec Shanghai Petrochemical here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance