SEHK Growth Companies With High Insider Ownership And A Minimum 15% Earnings Increase

Amidst a backdrop of global economic shifts, the Hong Kong market has shown resilience with a modest increase in the Hang Seng Index during a holiday-shortened week. This environment underscores the potential value of growth companies with high insider ownership, particularly those demonstrating robust earnings growth, as they may be better positioned to navigate and capitalize on current market conditions.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.2% | 104.1% |

Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

Fenbi (SEHK:2469) | 32.7% | 43% |

Adicon Holdings (SEHK:9860) | 22.4% | 28.3% |

Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 73.4% |

DPC Dash (SEHK:1405) | 38.2% | 90.2% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

Ocumension Therapeutics (SEHK:1477) | 23.1% | 93.7% |

Beijing Airdoc Technology (SEHK:2251) | 28.7% | 83.9% |

Let's explore several standout options from the results in the screener.

ESR Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ESR Group Limited operates in logistics real estate development, leasing, and management across regions including Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, and Europe with a market capitalization of HK$47.27 billion.

Operations: The company's revenue is generated primarily from fund management at HK$774.64 million and new economy development at HK$105.48 million.

Insider Ownership: 13.1%

Earnings Growth Forecast: 26.5% p.a.

ESR Group, a key player in the logistics and warehousing sector, is experiencing significant transformations. Despite lower profit margins this year compared to last and challenges in covering interest payments with earnings, ESR's revenue and earnings are expected to outpace the Hong Kong market with forecasts of 9.6% and 26.47% annual growth respectively. Recent events include a potential privatization proposal valued between HK$7 billion to HK$8 billion, suggesting strong investor interest despite some financial strains.

Click here to discover the nuances of ESR Group with our detailed analytical future growth report.

The valuation report we've compiled suggests that ESR Group's current price could be inflated.

Meituan

Simply Wall St Growth Rating: ★★★★★☆

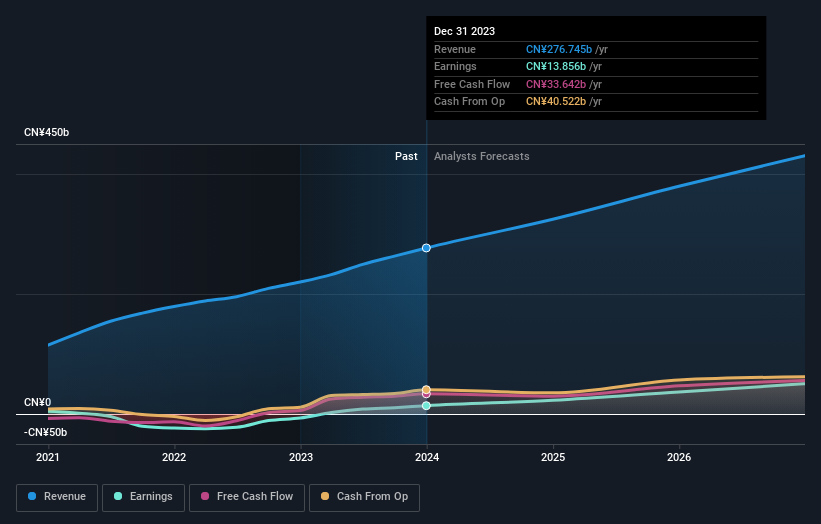

Overview: Meituan is a technology retail company based in the People's Republic of China, with a market capitalization of approximately HK$718.98 billion.

Operations: The company generates its revenue from various technology retail activities across China.

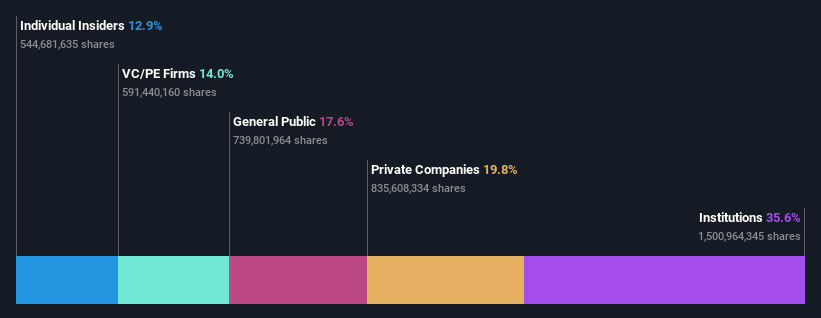

Insider Ownership: 11.4%

Earnings Growth Forecast: 31.2% p.a.

Meituan has demonstrated robust growth, with earnings soaring by 568.2% over the past year and expected to increase by 31.22% annually. Despite trading at 66.4% below its estimated fair value, insider activities show mixed signals; significant selling occurred in the past three months, contrasting a recent share buyback plan of up to US$2 billion initiated on June 11, 2024. This suggests a strategic approach to bolster shareholder value amidst fluctuating market conditions and high insider ownership stakes.

Get an in-depth perspective on Meituan's performance by reading our analyst estimates report here.

Our expertly prepared valuation report Meituan implies its share price may be too high.

Techtronic Industries

Simply Wall St Growth Rating: ★★★★☆☆

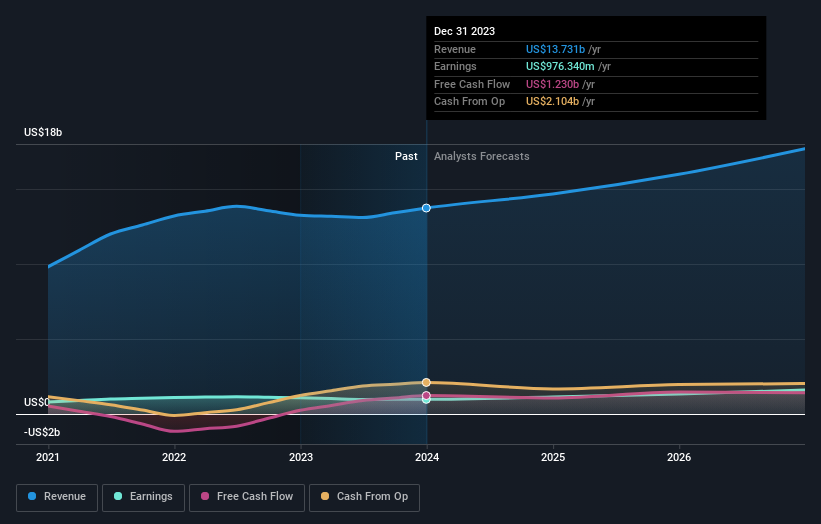

Overview: Techtronic Industries Company Limited, with a market capitalization of approximately HK$160.33 billion, operates globally in designing, manufacturing, and marketing power tools, outdoor power equipment, and floorcare and cleaning products primarily in North America and Europe.

Operations: Techtronic Industries' revenue is primarily generated from its Power Equipment segment, which earned $12.79 billion, and the Floorcare & Cleaning products segment, contributing $0.97 billion.

Insider Ownership: 25.4%

Earnings Growth Forecast: 15.2% p.a.

Techtronic Industries, known for its robust growth in Hong Kong, has recently shown promising financial trends with earnings forecasted to grow by 15.2% annually, outpacing the local market's 11.3%. Despite trading slightly below its estimated fair value, insider activities have been bullish with more shares bought than sold over the past three months. However, following CEO Joseph Galli Jr.'s resignation and a new share repurchase program initiated on May 21, 2024, there are changes at the helm and in strategy that could influence future performance.

Turning Ideas Into Actions

Click this link to deep-dive into the 54 companies within our Fast Growing SEHK Companies With High Insider Ownership screener.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1821 SEHK:3690 and SEHK:669.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com