SEHK Growth Stocks With High Insider Ownership And 24% Return On Equity

Amidst a backdrop of global market fluctuations and modest gains in the Hong Kong Hang Seng Index, investors continue to seek stable and potentially lucrative opportunities. Focusing on growth companies with high insider ownership can offer valuable insights, as these attributes may signal strong confidence in the company’s future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.2% | 104.1% |

Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

Fenbi (SEHK:2469) | 32.7% | 43% |

Adicon Holdings (SEHK:9860) | 22.4% | 28.3% |

Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 73.4% |

DPC Dash (SEHK:1405) | 38.2% | 90.2% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

Ocumension Therapeutics (SEHK:1477) | 23.1% | 93.7% |

Beijing Airdoc Technology (SEHK:2251) | 28.7% | 83.9% |

Let's explore several standout options from the results in the screener.

Kuaishou Technology

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kuaishou Technology, operating primarily in the People's Republic of China, is an investment holding company that offers live streaming and online marketing services with a market capitalization of approximately HK$207.26 billion.

Operations: The company generates revenue primarily from domestic operations, totaling CN¥114.72 billion, and a smaller portion from overseas activities, amounting to CN¥2.94 billion.

Insider Ownership: 19.2%

Return On Equity Forecast: 24% (2027 estimate)

Kuaishou Technology, a growth-oriented firm with high insider ownership in Hong Kong, is trading at 52.1% below its estimated fair value, making it an attractive buy compared to its peers. The company recently became profitable and is expected to grow earnings by 22.5% annually, outpacing the Hong Kong market's average. Despite no recent insider buying or selling data, the stock is well-positioned for appreciation with analysts predicting a 61.2% price increase based on current projections. Additionally, Kuaishou's recent showcase of advanced AI technologies indicates robust potential for future revenue streams and market influence.

BYD

Simply Wall St Growth Rating: ★★★★☆☆

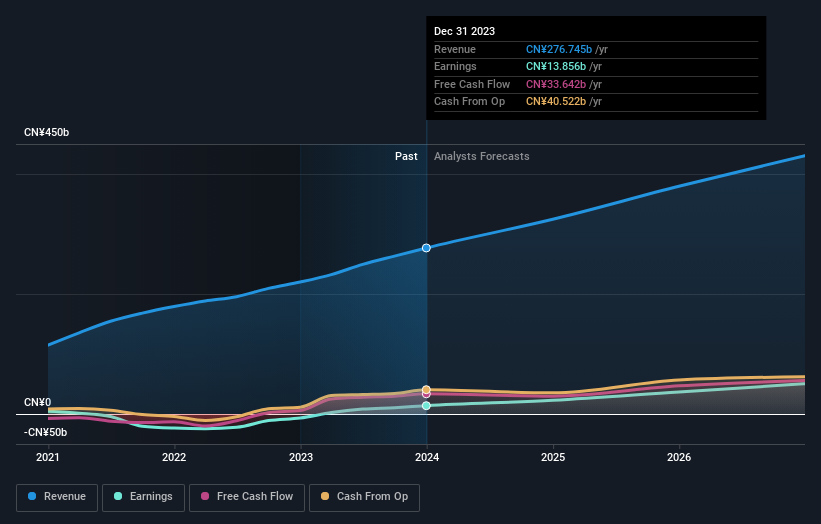

Overview: BYD Company Limited operates in the automobile and battery sectors across China, including Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$748.36 billion.

Operations: The company's revenue is derived from its automobile and battery sectors across various regions including China, Hong Kong, Macau, Taiwan, and internationally.

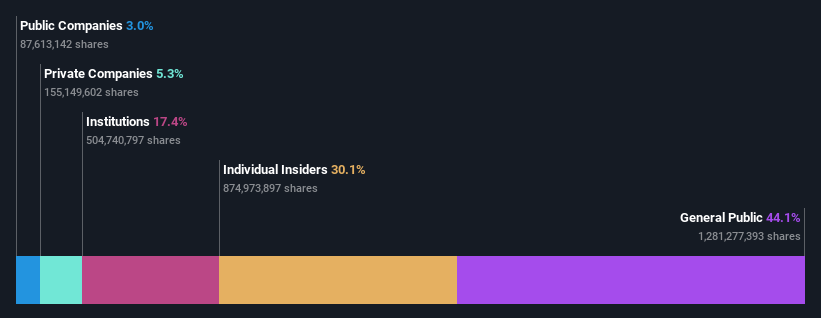

Insider Ownership: 30.1%

Return On Equity Forecast: 22% (2027 estimate)

BYD Company Limited, a significant entity in Hong Kong's growth company sphere with high insider ownership, is currently undervalued by 49.4%, presenting a potential investment opportunity. The firm has demonstrated robust year-over-year earnings growth of 52.7% and anticipates further annual earnings growth of 14.89%, outpacing the local market forecast of 11.3%. Despite lacking recent insider trading data, BYD's strategic expansions and product innovations, such as the launch of BYD SHARK in Mexico, underscore its growth trajectory and commitment to maintaining a competitive edge in the electric vehicle sector.

Meituan

Simply Wall St Growth Rating: ★★★★★☆

Overview: Meituan is a technology retail company based in the People's Republic of China, with a market capitalization of approximately HK$704.36 billion.

Operations: The company generates revenue primarily through technology retail operations in China.

Insider Ownership: 11.5%

Return On Equity Forecast: 21% (2027 estimate)

Meituan, a key player in Hong Kong's high insider ownership growth companies, reported a substantial earnings increase of 568.2% over the past year with Q1 2024 sales rising to CNY 73.28 billion from CNY 58.62 billion year-over-year. The company's earnings are expected to grow by 31.22% annually, significantly outpacing the Hong Kong market forecast of 11.3%. Recently, Meituan announced a HK$2 billion share buyback program, underscoring its strong financial position and commitment to shareholder value despite some concerns over substantial insider selling in the past three months.

Take a closer look at Meituan's potential here in our earnings growth report.

Our valuation report unveils the possibility Meituan's shares may be trading at a premium.

Where To Now?

Click through to start exploring the rest of the 51 Fast Growing SEHK Companies With High Insider Ownership now.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1024 SEHK:1211 and SEHK:3690.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com