SEHK Growth Stocks With High Insider Ownership And 15% Revenue Growth

As global markets navigate through varied performances, with tech sectors showing resilience amidst broader challenges, the Hong Kong market has experienced notable fluctuations. In this context, growth companies with high insider ownership in Hong Kong present a unique appeal, potentially offering stability and confidence due to significant skin in the game from those who know these companies best.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

New Horizon Health (SEHK:6606) | 16.6% | 61% |

Meitu (SEHK:1357) | 38% | 33.7% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.5% | 79.3% |

Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

Zhejiang Leapmotor Technology (SEHK:9863) | 14.2% | 73.8% |

Beijing Airdoc Technology (SEHK:2251) | 27.2% | 83.9% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 15.7% | 100.1% |

Ocumension Therapeutics (SEHK:1477) | 17.7% | 93.7% |

Underneath we present a selection of stocks filtered out by our screen.

BYD

Simply Wall St Growth Rating: ★★★★☆☆

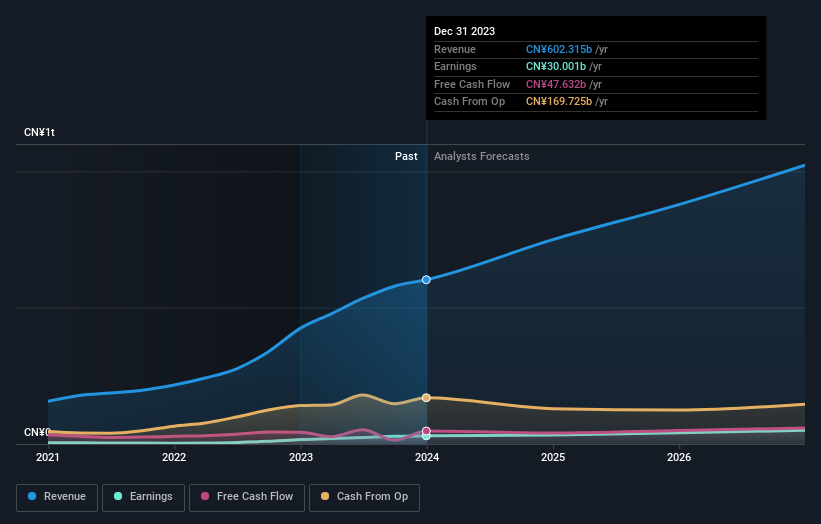

Overview: BYD Company Limited operates in the automobile and battery sectors across China, including Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$685.03 billion.

Operations: The company generates revenue primarily from its automobile and battery sectors across various regions, including mainland China and international markets.

Insider Ownership: 30.1%

Revenue Growth Forecast: 14.5% p.a.

BYD, a prominent growth company in Hong Kong with high insider ownership, is poised for steady expansion. Its earnings are expected to grow by 14.4% annually, outpacing the Hong Kong market's 11.9%. Additionally, BYD's revenue growth forecast at 14.5% yearly also exceeds the local market average of 7.8%. Despite trading at a significant discount to its fair value (33.4% below), challenges remain as this growth rate does not reach the high threshold of 20%. Recent strategic moves include launching BYD SHARK in Mexico and robust sales performance with significant year-over-year increases in monthly and annual sales volumes, indicating strong operational momentum and market acceptance.

Unlock comprehensive insights into our analysis of BYD stock in this growth report.

Upon reviewing our latest valuation report, BYD's share price might be too optimistic.

Dongyue Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dongyue Group Limited operates as an investment holding company that produces and distributes polymers, organic silicone, refrigerants, and other chemical products primarily in the People's Republic of China and globally, with a market capitalization of approximately HK$16.63 billion.

Operations: Dongyue Group's revenue is generated from polymers (CN¥4.55 billion), refrigerants (CN¥5.48 billion), organic silicone (CN¥4.86 billion), and dichloromethane, PVC, and liquid alkali (CN¥1.21 billion).

Insider Ownership: 15.4%

Revenue Growth Forecast: 15.4% p.a.

Dongyue Group, a company with high insider ownership in Hong Kong, is navigating a challenging phase with its net profit margin significantly reduced from the previous year. Despite this downturn, earnings are expected to grow at 35.73% annually, outperforming the Hong Kong market forecast of 11.9%. Revenue growth projections also surpass local market expectations at 15.4% annually. However, recent executive changes and a substantial drop in annual net income highlight potential governance and operational risks that could impact future performance.

Click to explore a detailed breakdown of our findings in Dongyue Group's earnings growth report.

Our valuation report here indicates Dongyue Group may be overvalued.

Alibaba Health Information Technology

Simply Wall St Growth Rating: ★★★★☆☆

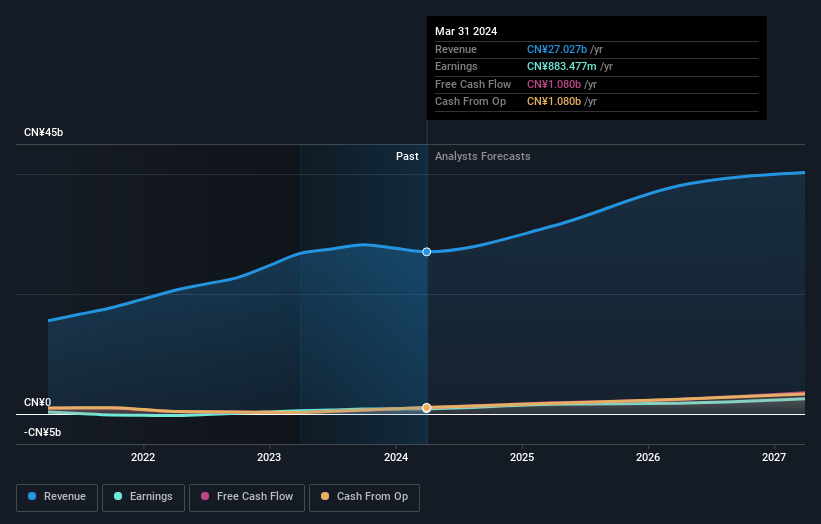

Overview: Alibaba Health Information Technology Limited operates in Mainland China and Hong Kong, focusing on pharmaceutical direct sales, e-commerce platforms, and healthcare digital services with a market capitalization of HK$57.73 billion.

Operations: The company generates CN¥27.03 billion from its distribution and development of pharmaceutical and healthcare business.

Insider Ownership: 24.2%

Revenue Growth Forecast: 12.2% p.a.

Alibaba Health Information Technology, despite not being top-tier in high insider ownership growth companies in Hong Kong, reported a year-over-year increase in sales to CNY 27.03 billion and net income to CNY 883.48 million. The company's earnings are projected to grow by 23.1% annually, surpassing the Hong Kong market's average. Recent agreements with Taobao China Companies for software services underscore its strategic initiatives, although concerns about shareholder dilution and low forecasted return on equity at 13.5% suggest mixed financial health.

Key Takeaways

Navigate through the entire inventory of 53 Fast Growing SEHK Companies With High Insider Ownership here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:189 and SEHK:241.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance